Investing in a guaranteed interest account is a great way to secure your money, as there is very little risk. Guaranteed interest accounts provide reliable, consistent returns and can be used for short-term savings or to supplement other investments in your portfolio. Here are 8 of the best guaranteed interest investments available today.

Investing in a guaranteed interest account is a great way to secure your money, as there is very little risk. Guaranteed interest accounts provide reliable, consistent returns and can be used for short-term savings or to supplement other investments in your portfolio.

But with so many options available, it can be hard to decide which type of account is right for you.

This article will provide an overview of the different types of guaranteed interest accounts, their advantages, and tips for choosing the best option.

What Does Guaranteed Return Mean?

When an investment is described as having a “guaranteed return,” the investor is promised a specific interest rate on their money. The issuing institution offers the guarantee, like a bank, credit union, or government agency.

However, a guaranteed rate doesn’t mean that the investment carries no risk or that the return will be higher than other investment options. Some guaranteed return investments, such as CDs and bonds, may be considered low-risk, but they still carry some risk.

Guaranteed returns are intended to give investors a sense of security and predictability regarding their investment.

Tired of the stock market’s ups and downs? Guaranteed interest accounts offer a stable rate of return.

Even with the guarantee, the return on the investment may be lower than other investment options. Some guaranteed return investments, such as annuities, may have high fees and expenses that can eat away returns.

How Does A Guaranteed Interest Account Work?

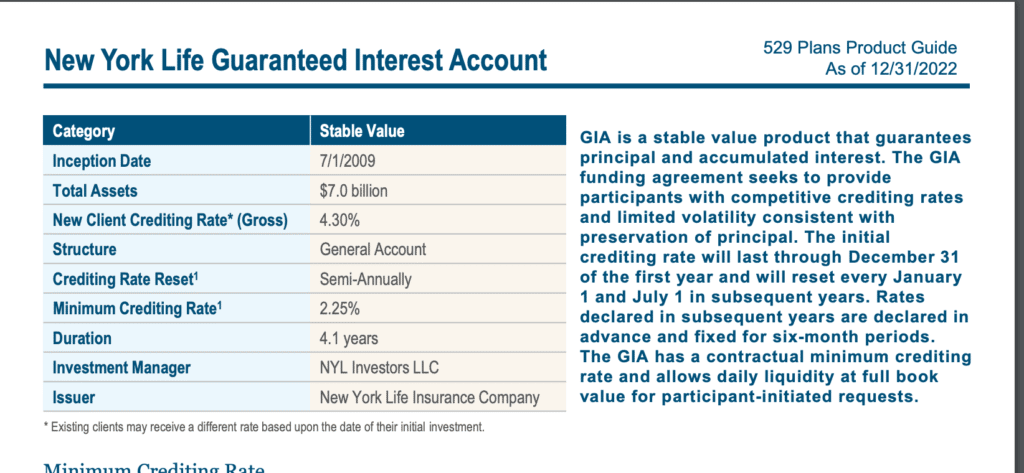

A Guaranteed Interest Account (GIA) is a type of savings or investment account that offers a guaranteed interest rate. In other words, the rate will remain the same for a specified period, usually one year or longer. Examples include Certificates of Deposit (CDs), High-Interest Savings Accounts, etc.

Most banks and credit unions offer guaranteed interest accounts.

Lower Rates of Return

Because the return is guaranteed, GIA interest rates are typically lower than other investment options, such as stocks, mutual funds, or exchange-traded funds (ETFs). However, they are also a safer option.

There May be Early Withdrawal Penalties

Some guaranteed interest accounts, like CDs, may charge a penalty if you redeem your investment before maturity. The penalties will vary depending on the institution and the specific GIA product.

GIA Annuity Accounts

Some GIA’s are also annuity contracts and will have a specific maturity date. This means that the money is locked in for a certain number of years, after which you can withdraw your principal investment and interest earned.

It’s important to compare the interest rates and terms of different GIAs and to carefully consider the penalties for early withdrawal before opening an account.

Let’s take a look at eight different investments that feature a guaranteed rate of return.

What Are The Best Investments With Guaranteed Returns?

1. Bank-Brokered CDs

Bank-brokered CDs, also known as brokered CDs, are offered by banks with a guaranteed rate of return for a specific period. These CDs are typically sold through a broker or financial advisor rather than directly from the bank.

They are considered a low-risk investment option, as the principal investment is FDIC-insured up to $250,000 per depositor, per institution, in case of bank failure.

In addition, the interest rate on a bank-brokered CD is guaranteed for the term of the CD, which means that even if interest rates fall, the rate on your CD will not change. This can provide a sense of security for anyone concerned about market fluctuations and who wants to ensure a steady return on their investment.

However, it’s important to note that bank-brokered CDs typically have penalties for early withdrawal, meaning you will lose some or all of the interest if you withdraw the money before the term of the account is up.

2. High Yield Savings Accounts

High-yield savings accounts offer a higher interest rate than traditional savings accounts. They are considered a low-risk investment option, as the principal investment is FDIC insured. Many of the best high-interest savings accounts belong to online-only banks, like Discover and Ally.

The interest rate on most high-yield savings accounts is can be subject to change as there is no locking-in period or fixed term, as with a CD.

One of the main benefits of a high-yield savings account is liquidity. Because your money is never locked-in, you always have easy access to your funds and can withdraw money at any time without penalty. Some institutions have a minimum balance requirement; If the balance falls below, the rate may decrease, or the account may be closed.

3. Fixed Annuities

Fixed annuities are offered by insurance companies with a guaranteed rate of return for a specific period. They are considered a low-risk investment option as they are typically backed by the full faith and credit of the insurance company issuing the annuity. Additionally, the interest rate on a fixed annuity is guaranteed for the annuity’s term, which means that even if interest rates fall, the rate on your annuity will not change.

This can provide security for those concerned about market fluctuations who want to ensure a steady return on their investment.

When you invest in a fixed annuity, you make a lump sum payment or series of payments, and in return, you receive a guaranteed stream of income for a certain period, usually, after you retire. The income may be guaranteed for a certain number of years or life.

Annuities are designed for long-term savings and provide a secure retirement income.

Unfortunately, fixed annuities may have restrictions such as early withdrawal penalties, and most have high fees and expenses that can eat away at the return.

4. Fixed-Indexed Annuities

Fixed indexed annuities (FIAs) are a type of annuity contract offered by insurance companies that offer a guaranteed rate of return for a specific period, with the potential for additional returns based on the performance of a stock market index such as the S&P 500.

They are considered a low-risk investment option as the principal investment is typically guaranteed by the insurance company, and the interest rate credited to the contract is also guaranteed, meaning that even if the stock market index performs poorly, the investor will not lose any of their principal investment.

They offer the same tax advantages as traditional annuities and can be used as a retirement savings vehicle.

Note that the interest rate credited to the contract is based on the underlying index’s performance and may not increase over time. Like traditional annuities, fixed-index annuities tend to be expensive and can charge high fees.

5. Deferred Annuities

Deferred annuities are yet another annuity contract offered by insurance companies. They allow the investor to make contributions to the annuity over a certain period, often many years, before starting to receive the guaranteed income payments. The income payments are typically received after the annuitant reaches a specific age, such as retirement age, and are guaranteed for a defined number of years or the remainder of the annuitant’s lifetime.

Deferred annuities may be a good option for those looking for a guaranteed rate of return and a secure retirement income, but be mindful of penalties and fees.

6. Treasury Inflation-Protected Securities

Treasury Inflation-Protected Securities (TIPS) are a type of government bond offered by the U.S. Department of Treasury. They are among the best low-risk investments and offer a guaranteed rate of return with the added benefit of protection against inflation.

The principal and interest on TIPS are adjusted for inflation, meaning that the value of the bond increases with the rate of inflation, protecting the investor’s purchasing power. The interest rates on TIPS are fixed and paid every six months, and the bond matures in 5, 10, or 30 years.

TIPS are considered a low-risk investment option as they are issued and backed by the U.S. government.

They may be a good option for those looking for a guaranteed rate of return and protection against inflation, and they can be a good addition to a diversified portfolio.

However, it’s important to note that the interest rate paid on TIPS is lower than other bonds, and the principal portion may be subject to taxes.

7. Treasury Bonds

Treasury bonds, also known as T-bonds, are a type of debt security issued by the U.S. Department of Treasury. They are considered to be a low-risk investment option as they are issued by the U.S. government and are backed by the full faith and credit of the United States.

The interest rate on Treasury bonds is guaranteed for the bond’s term, typically 10 or 30 years and the interest is paid to the bondholder every six months. The face value of the bond is returned to the bondholder when the bond matures.

Treasury bonds can be a good option for anyone with a low-risk profile who wants a guaranteed rate of return. They can provide a steady income stream and be a good addition to a diversified portfolio.

Additionally, the interest earned on Treasury bonds is exempt from state and local income taxes.

8. Whole Life Insurance

Whole life insurance is a type of permanent life insurance policy that provides a guaranteed death benefit to the policyholder’s beneficiaries in the event of their death, as well as cash value accumulation over time.

The cash value component of the policy grows at a guaranteed rate, and the policyholder can accumulate savings and borrow against the cash value of the policy.

Whole life insurance is an option for those looking for a guaranteed return on their investment and those who want to provide financial protection for their loved ones in the event of their death.

Unfortunately, whole life insurance policies have higher premium costs than term life insurance policies, and the policy’s cash value component is not guaranteed to cover the death benefit.

Can Guaranteed Return Investments Lose Value?

Guaranteed return investments, such as savings accounts, CDs, and annuities, are considered safety investments mainly because of the principal guarantee, not to mention the guaranteed rates of return.

However, these investments carry something known as ‘inflation risk.’ Because the rates of return are so low, there is a risk that you will lose purchasing power on your investment if the returns can’t keep up with inflation.

This has been an issue in 2022, as inflation has soared to highs not seen in decades. It’s for this reason that long-term investments should almost always be invested in the stock market in the form of ETFs, mutual funds, or individual stocks.

The Bottom Line on Investments that Offer Guaranteed Interest

Guaranteed interest investments can be a great way to invest your money over the short to mid-term. These investments are designed with the safety of the principal in mind and can offer financial stability.

But with so many options, it’s important to research, compare products and select an investment that fits your risk tolerance level and goals.

FAQs on Guaranteed Interest Accounts

Guaranteed interest accounts work by allowing depositors to earn a fixed interest rate on their deposits over a certain period. The rate of interest is guaranteed and will not change, regardless of the stock market’s performance or other economic conditions.

It’s important to shop around and compare interest rates and other product features from multiple banks and credit unions. It’s also important to consider the depositor’s insurance coverage and the bank’s credit rating.

The most common investments offering a guaranteed rate of return include high-interest savings accounts, certificates of deposit, T-Bills, and government and corporate bonds.

The primary benefit of an annuity is that it provides a reliable income stream during retirement. However, annuities are expensive investments with high fees, and you may not get the full benefit if you pass away too early.