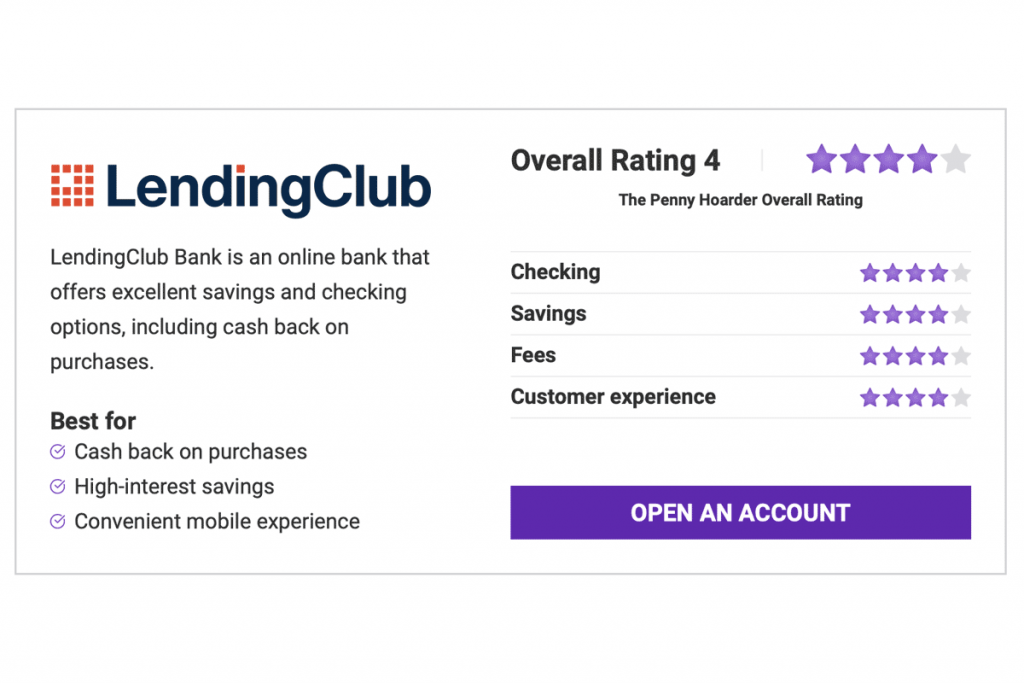

LendingClub is one of the more interesting online banks we’ve reviewed lately. First up — it is an online bank, which means no physical branches, though that’s not necessarily unusual anymore. What makes LendingClub Bank unique is that it’s the first proper mix of fintech and online banking.

LendingClub Bank actually started life as Radius Bank in 1987 and transitioned to online-only banking in 2012, closing its brick-and-mortar locations. LendingClub is also a fintech — financial technology — company that offers personal loans online. In 2020, LendingClub acquired Radius and renamed it LendingClub Bank. This acquisition marked the first time a fintech company had purchased a U.S. bank, and the promise was that LendingClub Bank would be able to offer the best of both worlds.

Today, LendingClub Bank offers an array of competitive online banking accounts and services, including a very compelling checking account option.

Is LendingClub Bank right for you? Read on to find out.

LendingClub Bank Checking Accounts

LendingClub offers one of our favorite checking accounts right now: Rewards Checking. Unfortunately, if you don’t qualify for it, you don’t have many other options.

LendingClub Rewards Checking

Best for Earning Cash Back

Key Features

- No monthly fees or ATM fees

- Ability to earn interest on checking account

- 1.00% cash back on debit card purchases

The LendingClub Bank Rewards Checking account is a unique checking account that enables you to earn both interest and cash back on purchases — provided you meet certain balance requirements.

LendingClub Rewards Checking

APY

0.10% APY on balances between $2,500 and $99,999.99 and 0.15% APY on balances $100,000 and up.

Monthly fees

None

ATM access

37,000 ATMs with no charges

Minimum starting balance

$25

More Information About LendingClub Checking

The LendingClub Bank Rewards Checking account offers account holders a fee-free checking experience with a $25 minimum starting balance and no monthly minimum balance requirement. The account earns a reasonable interest rate of between 0.10% and 0.15% (depending on balance), which is a nice bonus that many checking accounts don’t offer.

Even more interesting is the cash back available on this account — as long as you maintain an average balance of $2,500 or more each month, or receive at least that much in direct deposits each month, you can earn 1.00% cash back on your debit card purchases. While maintaining a $2,500 average balance may be a stretch for some, the direct deposit criteria is much more achievable and makes this a compelling checking account option.

LendingClub Bank Savings Accounts

LendingClub Bank’s single savings account option offers a very competitive interest rate, provided you meet the minimum balance requirement of $2,500. Below that, it’s less interesting.

LendingClub High-Yield Savings

Best for Fee-Free Savings

Key Features

- Up to 3.60% APY

- No-fee ATM access

- Low-starting balance

The LendingClub High-Yield Savings account combines an extremely competitive interest rate with no monthly fee and a low starting balance. The result is a savings account that’s really hard to fault.

LendingClub High-Yield Savings

APY

3.60% APY on all balances

Monthly fees

None

ATM access

37,000 ATMs with no charges

Minimum starting balance

$100

More Information About LendingClub Savings

The LendingClub High-Yield Savings account is frankly fantastic. The balance does not matter, you will earn an excellent 3.60% APY, and you only need a minimum deposit of $100 to get started. On top of that, you get a free ATM card with no fees, so your funds are easily accessible.

Previously, the only real issue we spotted was that accounts with balances below $2,500 earned a much lower interest rate. That has since changed, with LendingClub’s High-Yield Savings Account now providing the same interest rate no matter the balance. That said, the more money you have saved, the more interest you earn, so here’s some smart savings strategies that will help you get that balance up in no time.

Other LendingClub Bank Offerings

LendingClub’s other offerings are fairly standard. There’s a CD option with a wide range of term lengths, as well as the expected array of personal loans. Most interesting are the personal finance options available through partnerships with other institutions.

Certificates of Deposit (CDs)

LendingClub Bank offers an array of CDs for longer-term investments. Terms run the gamut from 6 months to five years and offer interest rates of between 3.25% to 4.10% APY depending on the term.

LendingClub CD Account

Best for Medium-Term Savings

Key Features

- Moderate minimum balance

- Great interest rates

- Choice of term lengths

The LendingClub CDs all offer different interest rates, depending on the term.The balance does not affect the rates as well, however the different CD accounts require a moderate minimum deposit amount of $2,500 all across the board.

LendingClub CD Account

APY

: 3.25% for 6 months, 4.00% for 1 year, 4.05% for 18 months, and 4.10% for 2, 3, and 5 year CDs

Monthly fees

None

Minimum starting balance

$2,500

More Information About LendingClub CDs

CDs differ from standard savings accounts in a couple of ways:

- A CD locks your funds into the account for the length of the term.

- There is almost always a penalty for withdrawing funds early.

- The interest rate on a CD account is fixed for the length of the term.

For these reasons, they don’t necessarily make the best general-purpose savings accounts. They’re better-suited to situations where you know your money will have time to mature and earn.

The LendingClub CD options are decent, though we think they’d be best as an additional savings account if you’re already using LendingClub Bank, rather than as a standalone product.

Personal Loans

LendingClub also offers personal loans — in fact, that’s how the company got its name. LendingClub offers loans up to $40,000 for credit card consolidation, balance transfers, debt consolidation, and more. The rates are fixed, and funding can be available in just a few days. Additionally, they now provide small business loans between $5,000 and $500,000 thanks to partnering with Accion Opportunity Fund.

If you’re already using LendingClub Bank and need to take out a personal loan, it may make sense to keep things under one roof. At any rate, it certainly doesn’t hurt to have the option.

Mobile Banking

The mobile experience is important with any bank, but for online banks it can make or break the experience. We’re happy to report that LendingClub Bank’s suite of apps is outstanding.

The standard mobile app is easy to use and offers all the features you’d expect, including:

- Check deposits.

- Available balances.

- Transaction history and search.

- Fund transfers.

There are also features available to help you better manage your finances, set a budget, and keep track of trends in your income or spending. Finally, the LendingClub Marketplace is a tool built into the app that helps customers find financial products from LendingClub partners, including life insurance, student loan refinancing, and more.

LendingClub Bank Review: The Pros and Cons

Wondering if LendingClub Bank is right for you? Our list of pros and cons could help you decide.

Pros

- Earn cash back with the Rewards Checking account — 1.00% on all debit card purchases, provided you meet the minimum balance requirement.

- Highly competitive interest rate on the High-Yield Savings account (with a reasonable minimum balance).

- No monthly fees on any accounts.

- No ATM fees at in-network ATMs, and ATM fee rebates for any out-of-network fees incurred, which helps offset the lack of branches.

- Excellent mobile app and 24/7 online access.

Cons

- No physical branch locations, like most online banks.

- CDs have a moderately high minimum balance to open ($2500 across the board).

- No IRAs or other savings options beyond the High-Yield Savings and CD accounts.

- The High-Yield Savings account is less attractive if your minimum balance dips below $2,500.

Frequently Asked Questions (FAQs) About LendingClub Bank

Have questions about LendingClub Bank? We have answers.

Is LendingClub Legitimate?

Absolutely! LendingClub has built a solid reputation for its online personal loan products. The company has reasonable requirements for new accounts and loan applications, and is transparent with fees and other charges. In our searching, we couldn’t find anything that threw up any red flags. Additionally, LendingClub Bank was originally Radius Bank, which was a regulated, brick and mortar bank.

Is LendingClub FDIC Insured?

Yes, LendingClub is an FDIC insured online bank. That means that any money you deposit with LendingClub is insured for up to $250,000 per depositor. This is important in the event that the bank fails for any reason, as it prevents the money in your checking or savings account from disappearing due to no fault of your own.

What is the History of LendingClub Bank?

LendingClub Bank started life as Radius Bank in 1987 and transitioned to online-only banking in 2012, closing its brick-and-mortar locations. LendingClub is also a fintech — financial technology — company that offers personal loans online. In 2020, LendingClub acquired Radius and renamed it LendingClub Bank. This acquisition marked the first time a fintech company had purchased a U.S. bank.

Penny Hoarder contributor Dave Schafer has been writing professionally for nearly a decade, covering topics ranging from personal finance to software and consumer tech. Freelancer Dennis Lynch contributed to this report.