|

Getting your Trinity Audio player ready...

|

M1 Finance is a personal finance company that offers a variety of financial services, including investment management, portfolio analysis, and stock trading. The company is headquartered in Chicago, Illinois, and was founded in 2015.

If you read more about them in our M1 Finance review you’ll clearly see they are a top notch online broker that offers a wide array of investing and banking services and products to their clients.

But does that mean they are safe for you to invest your money?

We’re going to answer that question and whole lot more.

So, is M1 Finance secure?

The answer is yes. M1 Finance is a legitimate financial services company that is regulated by both FINRA and SIPC. Additionally, the company’s website states that it uses “industry-leading security protection” and is FDIC insured. Therefore, investors can rest assured that their money is safe with M1 Finance.

While M1 Finance is a safe and legitimate company, it’s important to remember that all investments come with risk. No investment is completely risk-free, so it’s important to do your own research before investing any money.

When did M1 Finance Start?

M1 Finance was founded in 2015 and is headquartered in Chicago, Illinois. They have grown quickly and now offer a variety of financial services, including investment management, portfolio analysis, and stock trading.

Currently, their AUM (assets under management) is over $6 billion with over 500,000 users (according to Wikipedia). While that’s certainly a large of assets for a relatively new firm, in comparison industry giant Fidelity currently has over $4.5 trillion in customer assets.

What Services does M1 Finance Offer?

M1 Finance offers a variety of financial services, including investment management, portfolio analysis, and stock trading. The company is FDIC insured and uses “industry-leading security protection.”

Investment Management: M1 Finance offers investment management services to help you grow your money. They offer a variety of features, including portfolio rebalancing, tax-loss harvesting, and automatic deposits.

Portfolio Analysis: M1 Finance’s portfolio analysis tools can help you understand your risk tolerance and invest accordingly. Their tools can also help you track your progress and see how your investments are performing.

Stock Trading: M1 Finance offers stock trading services so you can buy and sell stocks online. They offer a variety of features, including real-time quotes, charts, and analysis.

Is M1 Finance Free?

Yes, M1 Finance is free to use. There are no fees for opening an account, transferring money, or managing your portfolio. Additionally, there are no minimum balance requirements. You can start investing with as little or as much money as you want.

Hows does M1 Finance make money?

M1 Finance makes money by providing premium services to customers. These premium services include tax-loss harvesting and advanced analytics tools. They also make money through interest earned on cash balances in customer accounts, as well as from select securities transactions.

M1 Finance is a safe and legitimate financial services company that offers a variety of investment options, including individual stocks, ETFs, and mutual funds. The company has a strong history of providing quality services to its customers and has received numerous awards for its excellence.

What is SIPC?

The Securities Investor Protection Corporation (SIPC) is a nonprofit membership corporation that protects the customers of its members in the event of the failure of a member brokerage firm. It does this by providing funds to cover the missing securities and cash of customers up to certain limits.

Since its inception in over 50 years ago, the SIPC has helped recover over $141 billion in assets for over 770,000 investors. SIPC does not cover losses due to market fluctuations.

M1 Finance is a member of the SIPC (you can see their listing here) which means they have the same type of protection if you opened an account with another online broker.

This means if you opened an account with M1 Finance and the company went bankrupt, SIPC would step in to help return your money. However, if you lost money due to bad stock picks, SIPC would not cover those losses.

What is FINRA?

The Financial Industry Regulatory Authority (FINRA) is a self-regulatory organization that oversees the brokers and firms that conduct business in the securities industry in the United States. FINRA is responsible for ensuring that firms comply with federal securities laws and regulations.

FINRA regulates M1 Finance to protect investors from fraudulent or abusive practices. The main functions they regulate include:

- Licensing

- Discipline

- Marketing

- Trading practices

- Sales practices

FINRA also runs the Central Registration Depository (CRD), which is a database of information on brokers and firms.

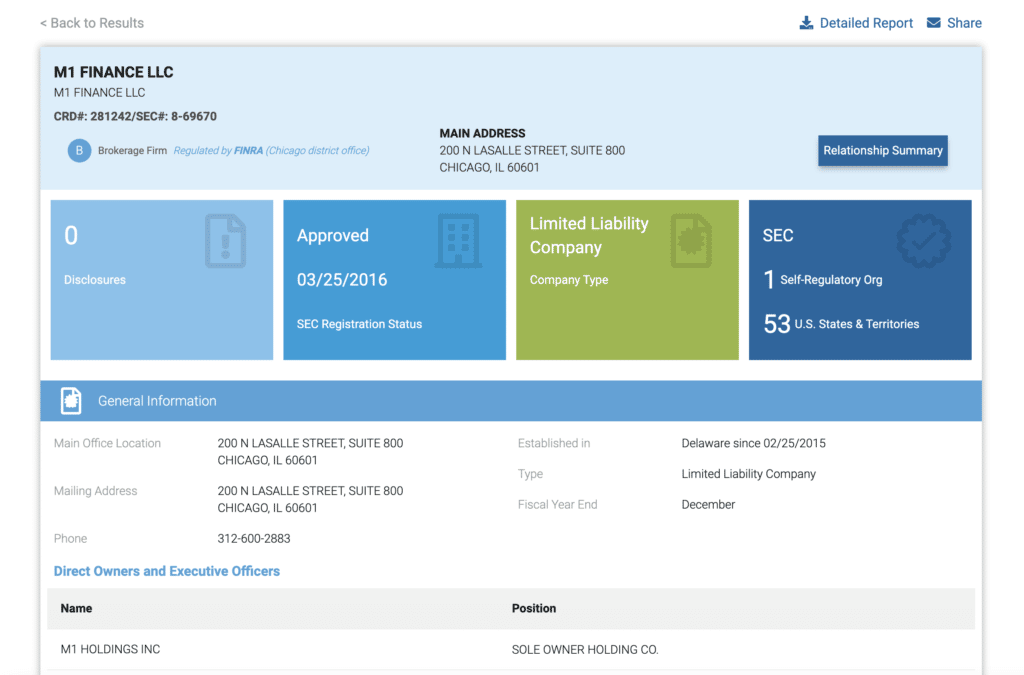

You can review M1 Finance’s information on Finra.org through their BrokerCheck database. Below is a screenshot of their FINRA listing:

A quick glance and you’ll find both their CRD#: 281242 and SEC#: 8-69670 since M1 Finance is also regulated by the SEC since they are currently registered in 53 states and U.S. territories.

You’ll see their LLC was approved in Delaware 02/25/2015 and their SEC registration status was approved 03/25/2016.

FDIC Coverage

The Federal Deposit Insurance Corporation (FDIC) is an independent agency of the US government that provides deposit insurance for banks and credit unions. FDIC coverage protects depositors up to $250,000 per account in the event of a bank failure.

There are times confusion of what FDIC covers and what they don’t. Below is a table that shows what type of investments FDIC is responsible for and what falls out of their jurisdiction.

| DOES COVER | DOES NOT COVER |

| Checking accounts | Stocks |

| Negotiable Order of Withdrawal (NOW) accounts |

Bonds |

| Savings accounts | Mutual Funds |

| Money market deposit accounts | Exchanged Traded Funds |

| CDs | Life Insurance Policies |

| Cashier’s checks | Annuities |

| Money orders | Municipal Securities |

| U.S. Treasury Bills |

How Does FDIC Coverage work?

Here’s an example of how FDIC would work in the event of a bank closure:

| Case Study: I have $100,000 in a personal checking account and $200,000 in a business checking account both at the same bank. How does FDIC insurance protect me? |

If the bank you have your accounts with is FDIC-insured, then your personal and business checking accounts would be covered up to $250,000 each, for a total of $500,000 in coverage. This means that if the bank were to fail, the FDIC would reimburse you up to $250,000 for your personal checking account and up to $250,000 for your business checking account, for a total of $500,000 in coverage.

It’s important to note that FDIC insurance covers depositors’ accounts up to at least $250,000 per depositor per insured bank, so you would need to make sure that the bank you have your accounts with is FDIC-insured in order to be eligible for FDIC insurance coverage.

Now that we understand how FDIC coverage works, let’s see how this affects M1 Finance investors.

Does M1 Finance Carry FDIC Coverage?

First, you must understand M1 Finance is NOT a bank. They currently use Lincoln Savings Bank for all their banking products (M1 Checking). Lincoln Savings Bank is a member of the FDIC so that means you’ll get the same FDIC insurance as you would with any other bank.

You can read more about M1 Finance and their FDIC coverage here.

What Type of Security Protection Does M1 Finance Use?

M1 Finance uses a few different types of security protection. One type is SSL, which is a secure socket layer. This encrypts the data that is sent between your computer and M1’s servers. This ensures that your information is safe and secure.

Another type of security protection that M1 Finance uses is two-factor authentication (2FA). This requires you to input a unique code, in addition to your username and password, in order to log in to your account. This code is usually sent to your phone via text message or an app.

This helps to keep your account secure, as someone would need both your login information and your phone in order to access your account.

Bottom Line – Is M1 Finance Legitimate?

Yes, M1 Finance is a legitimate financial services company. You don’t get to over $6 billion in investable assets and 500,000 total customers running a shady operation.

Another item I look at to see if an investment company passes the “sniff test” is to see if they have any “Disclosures” posted against them. A reportable disclosure could be information about certain criminal, civil, or customer complaints involving any of M1 Finance brokers. This could also include certain types of employment termination disclosures and bankruptcy discharges.

At this time M1 Finance has no such disclosure to report which means they have a clean track record.

As always be sure to do your own research in choosing the best investment platform for your needs.

FAQ’s on M1 Finance

The company’s website states that it uses “industry-leading security protection.” Their data is protected with a military-grade 4096-bit encryption. They also offer two-factor authentication (2FA) which provides even more security on your personal information.

Yes, M1 Finance is a member of the Securities Investor Protection Corporation (SIPC).

M1 Finance may not be the best option for investors who want to trade frequently. The company doesn’t offer a platform that allows traders to buy and sell individual stocks.