Also: Reader in high tax bracket asks about receiving OAS.

Article content

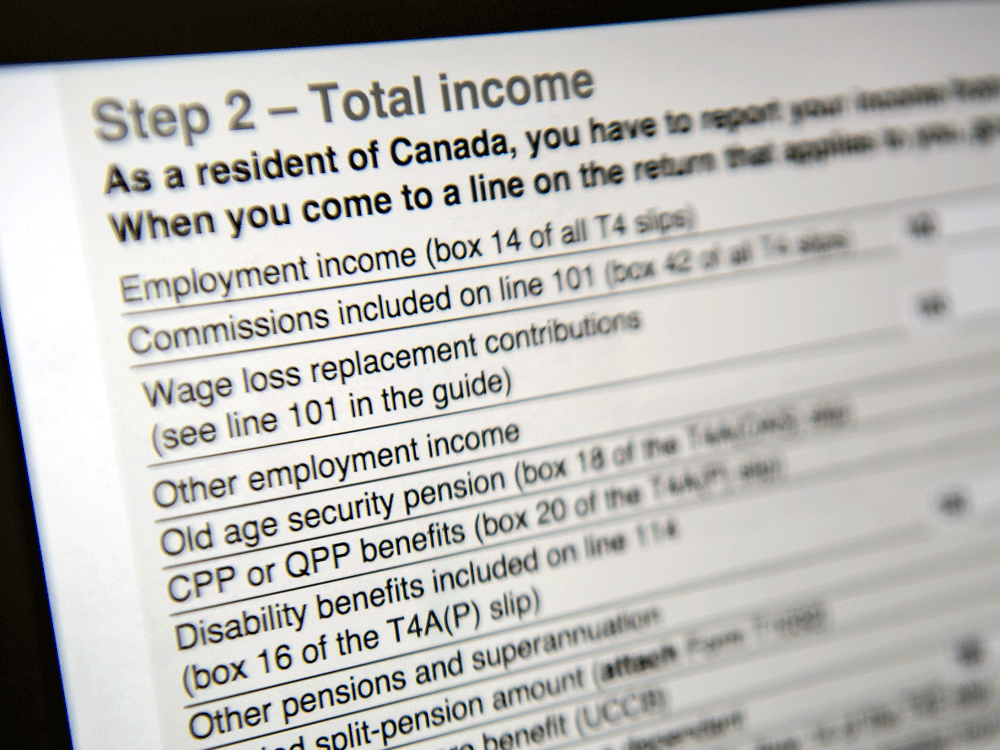

The merits of incorporating a side business and applying for Old Age Security (OAS) while in a high tax bracket were among the topics raised recently by readers. Here’s what they wanted to know.

Advertisement 2

Article content

Q: I am currently an employee with employment expenses, and some are reimbursed by the employer, such as car mileage. If mileage is reimbursed, can I still deduct car expenses and depreciation on my taxes?

Article content

Besides my job, I also do some consulting work on the side, revenues for which I report under “Other Income” on my personal taxes. Since the income generated is less than $30,000, I don’t charge any sales taxes and I report “0” every year when I fill in my sales taxes information (I have GST and TVQ numbers). Am I doing this right or I should start charging taxes to clients?

I don’t report any expenses related to this extra income. Some people are telling me that I should incorporate myself, that way I won’t pay any taxes on that extra revenue since the income generated is fairly small (I expect to be making $10,000 in 2023) and I would be able to deduct some expenses related to this work. Is it worth doing?

Advertisement 3

Article content

A: Peter Moraitis, partner with accounting firm BDO Canada LLP, doesn’t recommend incorporation in this case.

“It does not give a higher expense deduction compared to a personal business, and likely costs more to administer. And corporations are taxed on their first dollar of profit.”

Reporting the consulting work as “Other Income” may invite scrutiny from the tax departments, Moraitis cautioned, since it meets the definition of business income, and as such carries Quebec Pension Plan and Quebec Parental Insurance Plan obligations. Not charging tax on the consulting income also could have consequences.

“Anyone who is registered for sales tax must charge it on their invoices, even if their annual sales are less than the $30,000 threshold,” Moraitis said.

Advertisement 4

Article content

With regard to the car expenses, Moraitis said you cannot deduct them if you receive a non-taxable allowance from the employer, such as for mileage. You could deduct them, in proportion to the business usage, if the employer allowance is included on your T4 as taxable income.

“The employer should have issued federal form T2200 plus the Quebec equivalent indicating use of the employer’s own car was a condition of employment, without which no expenses can be deducted,” Moraitis said.

Q: I’m 74 and never applied for OAS (Old Age Security) because I believed it would simply be clawed back (my income being over the threshold). Is there any advantage to applying for it even if it will be clawed back?

A: Probably not, unless you have a spouse age 60 to 64 whose annual income is below $28,080, which would make them eligible for the “survivor allowance” in the event of your passing. Unlike the Quebec Pension Plan, OAS does not have a death benefit.

Advertisement 5

Article content

But do keep an eye on the OAS thresholds. They change annually, and this year they’re significantly higher than in 2022. In 2023, OAS starts to get clawed back at a rate of 15 cents for every dollar exceeding net income of $86,912 and is completely eliminated at income ranging from $141,917 to $147,418 (depending on whether you’re younger or older than 75 and whether you started the pension at 65 or later).

Maybe some year the thresholds will catch up to your income and you’ll get to keep some (taxable) money from OAS.

The Montreal Gazette invites reader questions on tax, investment and personal finance matters. If you have a query, please send it by email to Paul Delean at [email protected]

-

Delean: RRSPs not always best option for those with modest incomes

-

Delean: Annuities become more attractive as interest rates rise

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation