|

Getting your Trinity Audio player ready...

|

If you have $15,000 stashed away, you’ll want to put that money to work. If you don’t, inflation can quickly eat away at your nest egg. Plus, the current rise in interest rates has made it worthwhile to have some money in savings accounts again.

But where should you invest your $15,000? That depends on when you’ll need the money, whether you want it to grow for a few years, a few decades, or longer. In the meantime, you’ll want to consider how much risk you’re willing to take to get a reasonable return.

16 Ways to Invest $15,000 in 2023

To help you figure out how to invest $15k, I compiled a list of 16 of the best options. Keep reading to find out where I think $15,000 should be invested in early 2023 and how you can get started today.

1. High-Yield Savings Accounts

If you have $15,000 to invest but plan to use the cash in the next few years, a high-yield savings account could be the way to go. The best high-yield savings accounts are FDIC-insured, so you are protected up to $250,000 per depositor per account. Plus, saving account yields are much higher than in the last few years, particularly when looking at the top online banks.

Take the high-yield savings account from UFB Direct, for example. This account offers 3.83% APY on savings, with no minimum deposit requirements or hidden fees. It comes with a complimentary ATM card you can use to access cash when you need to, and you earn the same exceptional yield whether you put your entire $15,000 nest egg in this account or only part of it.

2. Auto-Pilot Investing

You can invest $15,000 over a period of time by automating your investment contributions. You can utilize this strategy with Acorns, a savings app which lets you “round up” all your purchases and invest the difference with no added work on your part.

Acorns will automatically invest your money into diversified portfolios of ETFs built and managed by professionals. The highly-rated Acorns app makes it easy to watch your money grow over time.

Interestingly, Acorns even makes it possible to invest your spare change and other money into a Bitcoin ETF. This means your investments can grow over time along with the value of Bitcoin, which seems to be the most relevant and long-lasting crypto investment available today.

Acorns also cost just $3 or $5 per month, depending on the features you want your account to have. You can learn more about Acorns and how it works in my Acorns app review.

3. Invest in Fractional Shares

Investing in fractional shares is another smart move, particularly if you have $15,000 tucked away but want to buy stocks. After all, fractional shares essentially let you buy pieces of popular stock without buying an entire share if you don’t want to. Your slice of each stock will grow commensurate with the stock’s value, just as if you owned a full share or several shares.

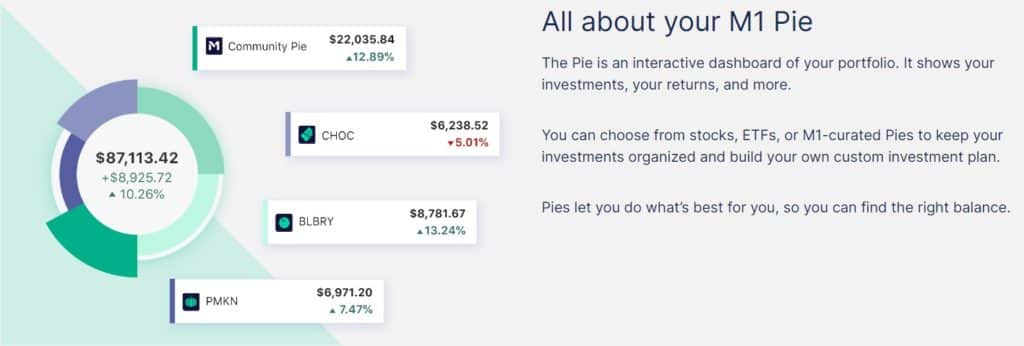

M1 Finance is one of the best platforms for investing in fractional shares, mostly because it lets you invest using its intuitive app, and investing transactions are commission-free.

With M1 Finance, you invest in “pies” that are made up of different stocks and ETFs, including fractional shares. You also get the chance to build your own pie or choose from expert pies crafted by experts with different goals in mind.

My M1 Finance review explains more about this investing app and how it works, so read it before you start.

The best part about real estate crowdfunding is that you don’t have to deal with renters or the grunt work of being a landlord.

4. Real Estate Crowdfunding

Another smart way to grow $15,000 involves investing in real estate without being a landlord. This option makes sense since it would be difficult to buy a physical property with just $15,000 to put down, especially considering closing costs and other fees.

My favorite real estate crowdfunding platform is Fundrise, and this account is perfect for investing anywhere from $10 to $15,000. Essentially, you can invest in an eREIT (real estate investment trust) with commercial and residential real estate holdings. Your account not only makes money off the rental returns on Fundrise properties, but the value of your shares can grow as the company sells properties, too.

The best part about real estate crowdfunding is that you don’t have to deal with renters or the grunt work of being a landlord. You just invest your money and wait for a solid return (although returns are never guaranteed.)

That said, Fundrise has done well so far. Investors in the platform earned an average yield of 22.99% in 2021, and those invested in 2022 earned an average yield of 5.40% as of the third quarter of 2022. You can read more about this company and how it works in my Fundrise review.

In the meantime, you can also check out another real estate crowdfunding platform called Realty Mogul, which works similarly. The main difference between Fundrise and Realty Mogul is that Realty Mogul requires you to be an accredited investor, whereas Fundrise does not in most cases.

5. Open a Brokerage Account

Next up, you can always consider opening a brokerage account with your $15,000. You can do this with nearly any online brokerage platform, from major players like Vanguard and Fidelity to investing apps like M1 Finance and Robinhood.

Opening a brokerage account lets you invest for the future outside of a retirement account, allowing you to access your money by selling shares at any time without waiting until age 59 ½.

You can use your brokerage account to invest in index funds that track an index like the S&P 500, or you could get started investing in dividend stocks. You can also use a brokerage fund to buy individual stocks, bonds, ETFs, etc. The choice is up to you.

My guide on the best online brokerage accounts can help you get started, but make sure you compare accounts based on their minimum balance requirements and fees.

6. Hire a Robo-Advisor

Maybe you want to invest in the stock market but are unsure how to get started or where to place your investments. In that case, hiring a robo-advisor could be your best move.

Robo-advisors use computer algorithms and statistics to determine the best ways to invest money, eliminating the need for a human advisor. Robo-advisors also tend to cost less than regular advisors, meaning you get to keep more of your gains over time.

Betterment is the robo-advisor I normally recommend for several reasons. Betterment makes it easy to invest automatically, and they ask you questions to assess your risk tolerance and get a better handle on your goals.

My Betterment investing review explains how the platform works. One standout feature is the price – Betterment fees start at just 0.25% on investment accounts. This compares very favorably to the 1% or more that most financial advisors charge.

7. Open a Roth IRA

If you’re looking for a way to save part of your $15,000 for retirement, consider opening a Roth IRA. This type of retirement account is only available to individuals whose incomes fall under certain thresholds, yet it lets you save money for retirement on an after-tax basis. In other words, you benefit from tax-free growth and tax-free distributions once you reach retirement age.

Another Roth IRA secret is that you can withdraw your contributions (but not earnings) anytime without penalty. This means you can take out the money you put into your account before age 59 ½ without paying income taxes on your withdrawals.

You can open a Roth IRA through platforms like M1 Finance and Robinhood or a robo-advisor like Betterment or Wealthfront.

8. Invest in Crypto

Investing in crypto may seem risky, given how things have been going over the last year. For example, a recent report from CNBC revealed that crypto values peaked in November 2021, and investors have lost $2 trillion in crypto-related wealth since that massive run-up.

Some cryptocurrencies like Bitcoin and Ethereum seem to have hit their bottom. At the very least, they may be getting close, and some currencies are bound to survive the crypto sell-off and stand the test of time.

If you want to invest part of your $15,000 in crypto to see where it goes, you can use an array of platforms to get started. Options include crypto investment platforms like Coinbase and investing apps like Robinhood and M1 Finance.

Related: How to Buy Bitcoin SAFELY and Make Money in 2022

9. Pay Off High-Interest Debt

If you have high-interest debt and you also have $15,000, using your nest egg to pay off your debt can be an incredibly smart move. This is especially true since credit card interest rates have surged, and the average rate is now over 19%.

Paying off debt may not feel as satisfying as investing, but it should. After all, when you pay down high-interest debt, you’re essentially getting a “return” that lines up with the interest rate you’re paying.

For example, paying off $15,000 in credit card debt at 19% APR is like getting a 19% return on your money. Plus, paying off debt frees up cash flow you can invest over time.

10. Invest in Art and Collectibles

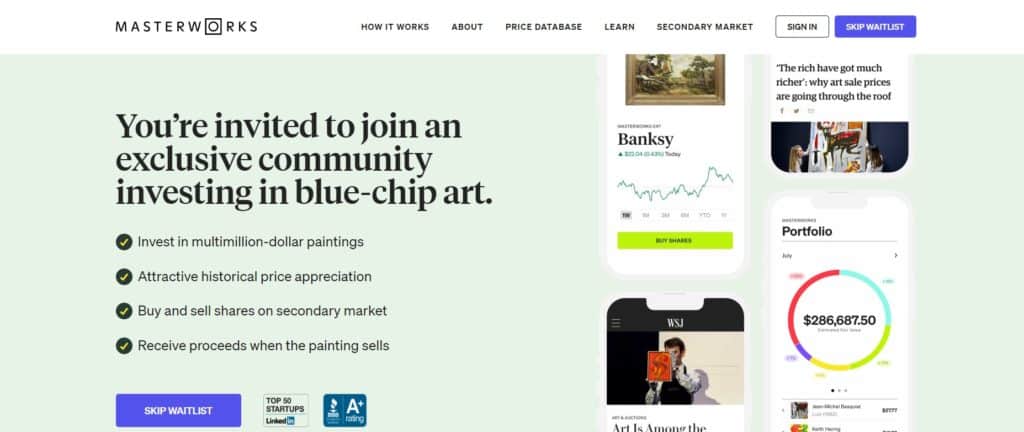

Did you know? You can invest $15,000 in famous works of art or even digital art. For example, you can invest in non-fungible tokens (NFTs), digital works of art that can grow in value over time.

I also like Masterworks, a crowdfunding platform for major works of art. Masterworks lets you invest in fractional shares of famous pieces of art that can be worth millions of dollars, and you make money as the art increases in value and is ultimately sold at a higher price.

Check out my Masterworks review to learn more about this company and how you can get started.

11. Certificates of Deposit (CDs)

Certificates of deposit (CDs) are a low-risk way to grow $15,000. This type of investment is similar to a high-yield savings account because your money is FDIC-insured in amounts up to $250,000 per deposit, per account. The difference is that you actually “lock in” your savings in a certificate of deposit (CD) for a set time.

SaveBetter is a great platform for CDs because they offer competitive yields and plenty of terms to choose from. The SaveBetter website is just a savings account and CD comparison platform, so you can use it to shop across many different banks in one place.

At the moment, SaveBetter offers fixed-term CDs with yields over 5%, and they even offer no-penalty CDs that let you access your money when you need it penalty-free.

12. Series I Savings Bonds

Next up, consider stashing part of your $15,000 into Series I Savings bonds. These bonds are government-backed, so your savings are guaranteed to grow at an agreed-upon rate. However, individuals can only invest up to $10,000 in electronic I bonds annually. Plus, you cannot access the money for at least 12 months, and you’ll pay a penalty of three months of interest if you cash in your Series I Savings bond within five years.

All this being said, Series I Savings bonds have some solid returns. The current rate is set at 6.89%, and it lasts through April 30, 2023. After that, the rate readjusts based on market conditions every six months.

13. Start a Business

A nest egg of $15,000 might also be enough to start a business, although you’ll want to be careful with the money and make sure you’re investing in something that can work for the long term. For example, you may be able to buy equipment you can use to start a service business. Of course, there are plenty of other home-based business ideas you could start with that much money in industries like catering, landscape design, tax preparation, herb farming, and more.

If you’re unsure about starting a small business, you can invest in other people’s small businesses with a platform called Mainvest. This platform lets you invest in regular, everyday businesses with a starting balance as low as $100 and targets returns between 10% and 25%.

Mainvest lets you get started with no investor fees, so it’s affordable.

14. Invest in Digital Real Estate

Next up is digital real estate. You can invest in websites like the one you’re reading right now. You can take steps to start your own blog or ecommerce business, or buy existing an existing website using a platform called Flippa.com.

Other types of digital real estate you can invest in include:

- Affiliate websites built to earn passive income

- Assets and land sold in the metaverse

- Authority websites in a specific niche

- Digital products like courses and printables

- Email lists you can sell to others

- Mobile apps

- Paid membership groups

- YouTube channels

- Social media channels

Personally, I can say that my digital real estate investments have paid off significantly. I started Good Financial Cents more than a decade ago, and it has earned millions of dollars since those early days. From there, I added a YouTube channel that is also monetized, and I have sold a range of courses that have brought in big profits over the last decade.

If you’re wondering what it takes to get started as a blogger, you should check out my Make 1k Blogging course, which is free. True to the name, this course outlines exactly what you need to do to earn your first $1,000 online.

15. Invest in Farmland

Another way to invest $15,000 may sound unconventional, but it’s becoming increasingly popular. I’m talking about investing in farmland, but not going from town to town and buying up physical property.

With a platform called FarmTogether, anyone can invest in fractional shares of farmland that can earn real income over time. This platform aims for targeted net returns of 6% to 13% per year with a 2% to 9% targeted net cash yield. Not only does this platform make it easy to invest in farmland in a passive way that requires no work on your part, but it can also help you diversify your portfolio and include more types of investments outside of crypto, stocks, and bonds.

16. Open a Health Savings Account (HSA)

If you have a high-deductible health plan (HDHP), you can also invest in a Health Savings Account (HSA). An HSA lets you save for future healthcare expenses on a tax-advantaged basis, and contributions are tax-deductible in the year you contribute. In 2023, eligible individuals with an HDHP can contribute up to $3,850 to an HSA and families up to $7,750. People ages 50 and over with accounts can also contribute an additional $1,000 per year. This is what’s known as a “catch-up contribution.”

Note that only certain types of high-deductible health plans qualify for an HSA. Specifically, individuals need to have a minimum deductible of $1,500 in 2023, while families need a minimum deductible of $3,000. In the meantime, the total out-of-pocket amounts for health insurance plans are capped at $7,500 for individuals and $15,000 for families.

If you think you qualify and want to explore your HSA options, check out companies like HealthEquity and Lively. Both options let you invest your underlying HSA funds in the stock market, so your savings can grow over time.

As a side note, Lively HSAs are an especially good deal because they don’t have any regular account fees or hidden fees.

How to Invest 15k: Final Thoughts

The options outlined in this guide can work if you have $15,000 set aside and are ready to invest smartly. You could even spread your initial investment across several from the list to diversify your portfolio.

Whatever you do, make sure you read over the fine print of any new accounts you want to open and have a handle on the level of risk you’re willing to take on.

Also, never forget the golden rule of investing – that is, past results do not guarantee future returns. The investments on this list can help you grow $15,000 over time, but you can always lose money in the short term.

FAQ’s on Investing $15,000

If you are starting from scratch, then $15,000 is a good amount to start investing. You can start by investing in stocks, mutual funds, ETF’s and crowdfunding real estate. However, it’s important to remember that investing involves risk, so it’s important to do your research before investing any money.

Assuming you have $15,000 to invest in 2023, the best way to invest the money would be in a diversified mix of stocks, bonds and real estate. This will give you the best chance of seeing a positive return on your investment while minimizing your risk. You can either invest in individual stocks and bonds yourself, or you can use an online broker to do it for you. You can also choose a robo-advisor that will charge little to no fees.

If you choose to go the DIY route, there are a number of online resources (including Investopedia) that can help you get started. If you prefer to let a professional handle it (like Edward Jones, Merrill Lynch, etc) most brokerage firms will offer a variety of investment options, including stocks, bonds, and even mutual funds.