As a financial planner, I get a lot of concerned questions from my clients regarding their investments.

One recently asked me:

What exactly happens if the brokerage firm I’m custodied with goes out of business?

This is a great question because many people don’t know their investments have protection in the first place, or they’re misinformed about what the protection actually covers.

Keep reading and I’ll help you understand what coverage your investments get from the SIPC, or Securities Investor Protection Corporation. You’ll find out exactly what the SIPC does (and does not do) for investors.

What is the Securities Investor Protection Corporation (SIPC)?

The SIPC is a nonprofit corporation created by Congress in 1970. Their job is to return securities—like stocks and bonds, as well as cash—up to a certain amount, to investors when their brokerage firm closes and owes them money.

As of March 2023, the SIPC says they’ve helped an estimated 773,000 investors recover over $141.8 billion in lost assets.

Not all investments are eligible for SIPC protection. These include investments like commodity futures and fixed annuity contracts which are not registered with the Securities and Exchange Commission (SEC).

The SIPC Is Not Like the FDIC

The SIPC is often compared to the FDIC (Federal Deposit Insurance Corporation) bank insurance—but they’re not related in any way. The SIPC helps investors when their money is stolen or put at risk if their brokerage goes out of business—but they don’t insure invested funds. In other words, the SIPC doesn’t bail investors out of bad investments.

Unlike FDIC, which is a government agency, SIPC is funded by member firms.

And currently, SIPC has only $3.9 billion in assets vs. $128.2 billion for FDIC (as of March 2023). Seems like this wouldn’t go very far if the holdings of a couple of big brokerages just up and disappeared.

But SIPC’s doesn’t have to be this big.

Broker/Dealers function differently from banks. Banks are in the business of investing your deposits – lending out your savings to other customers, who might renege on those loans. Brokerages only have to hold your securities, nothing else.

Even with the Lehman Brother’s incident, for example, the SIPC already issued a statement saying all the assets under the brokerage umbrella will be taken care of. It never hurts to double check to make sure your firm is covered under SIPC.

Who Offers SIPC Protection?

The SIPC is funded by member brokers and you’ve probably seen the SIPC logo on brokerage websites and literature. To find out if your brokerage firm is an SIPC member visit sipc.org and search the member database.

Or you can call the SIPC Membership Department at (202) 372-8300.

What The SIPC Doesn’t Cover

The SIPC will not cover every loss. It does have restrictions. Those include:

- SIPC limits coverage to SEC-registered securities. So foreign currency, precious metals and commodity futures contracts aren’t protected.

- Bad timing. SIPC will replace your shares, not dollar values. So if you own 500 shares of General Electric worth $15,000 and your brokerage firm fails, SIPC will replace your 500 shares, but only at the current value.

- Some outstanding margin loans. If your broker fails while you have a margin loan outstanding, SIPC will try to transfer the debt and collateral to another broker. But if no other firm takes on the loan, you’ll be on the hook to pay it off to your broker or ultimately to its creditors

Keep this in mind, as you’ll want to act as quickly as possible should something happen to you.

How to File an SIPC Claim

So, what happens if your money disappears from an SIPC member broker?

You’ll typically receive an SIPC claim form from the court-appointed trustee who’s in charge of liquidating the firm’s assets. By the way, there are strict time limits for filing claims, so be sure to adhere to any deadlines you receive.

If your broker is in trouble it’s possible your account could be transferred to another brokerage firm before you even know there’s a problem.

In the event of a transfer, it’s still recommended you file an SIPC claim form. This can protect your rights in the event of reporting errors which could occur during the transfer of your money.

How SIPC Claims are Paid

The goal of the SIPC is to replace the actual securities you lost. Since they have to purchase those securities in the open market, your investments may have increased or decreased in value by the time the SIPC returns them to you.

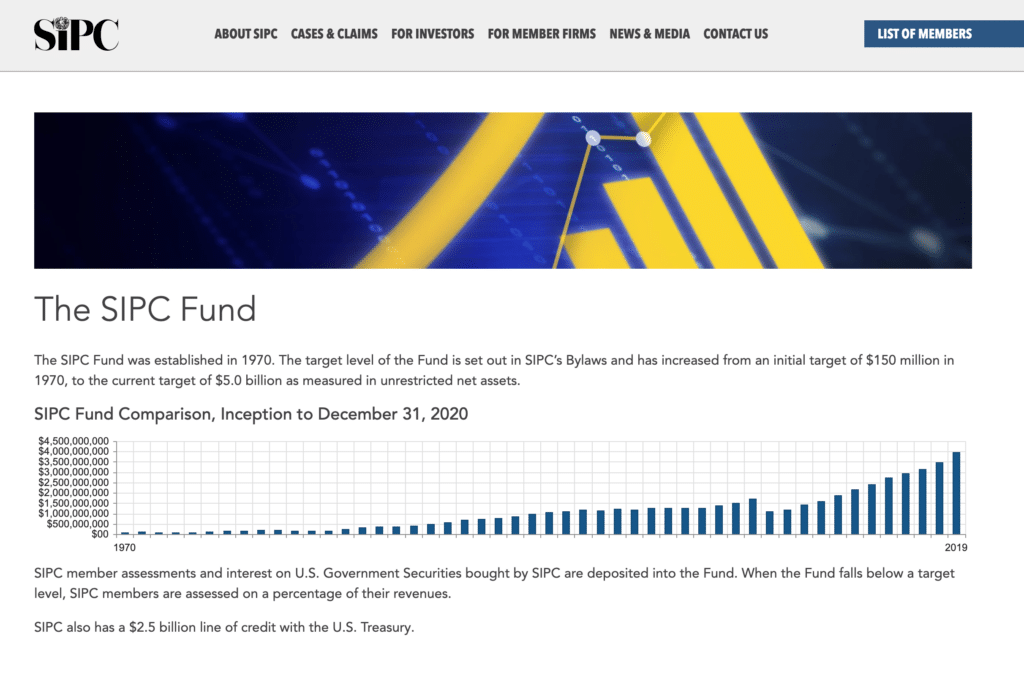

If there isn’t enough money in liquidated customer brokerage accounts to satisfy all claims, the SIPC has a huge reserve fund that kicks in to make up the difference.

SIPC Maximum Coverage

The maximum amount that the SIPC will pay out of reserve per customer is $500,000. This includes a $250,000 maximum for cash claims.

Once a claim is received, most customers can expect to get their funds back within one to three months. If fraud is involved and the firm’s financial records are deemed to be inaccurate, it may take longer to sort out the bad books.

Steps to File a Claim with SIPC

If your brokerage firm fails and you believe you are entitled to compensation, you can file a claim with the SIPC. Here are the steps to file a claim with the SIPC:

| Step | File a Claim with SIPC |

|---|---|

| 1 | Contact your brokerage firm to inquire about the status of your account and whether they have any plans to reimburse you. |

| 2 | Download and complete a SIPC claim form from the SIPC website. The claim form will require you to provide information about your account, the securities you held, and the value of your investments. |

| 3 | Submit supporting documents, such as account statements, transaction confirmations, and any other relevant documentation that supports your claim. |

| 4 | Wait for the SIPC to review your claim. The SIPC will determine whether you are eligible for reimbursement. If the SIPC determines that you are eligible, they will work with your brokerage firm to transfer your account to another brokerage firm or issue payment for the value of your investments up to the SIPC insurance limits. |

Excess of SIPC Coverage

There are some strict limits on how much coverage SIPC provides. Because the SIPC coverage is capped at $500,000, a lot of the larger brokerage firms have “excess of SIPC” insurance. These insurance plans will pay for any client losses are above what they would receive in a liquidation proceeding, which includes the payments from SIPC.

These insurance plans only pay out when the distributions from a brokerage firm’s liquation are not high enough to pay for a client’s claim.

Claims for Excess of SIPC insurance claims are EXTREMELY rare. In fact, there are only been 2 times when the excess of SIPC insurance policies has been invoked.

How to Stay Safe from Investment Fraud

It’s good to know that the SIPC has returned investments to 99% of the investors eligible for its protection.

But, of course, I’d prefer you never get into a situation where you need SIPC protection! Here are several resources where you can learn how to stay safe from shady brokers and investment fraud:

FAQs – SIPC: How it Protects Investors

SIPC provides insurance protection to investors in the event that their brokerage firm fails. If your brokerage firm fails and you believe you are entitled to compensation, you can file a claim with the SIPC.

SIPC insurance covers the loss of cash and securities held by a customer at a financially troubled brokerage firm. The insurance provides coverage up to $500,000 for securities and cash in a customer’s account, including up to $250,000 in cash.

SIPC insurance covers most types of securities, including stocks, bonds, mutual funds, and other securities that are registered with the Securities and Exchange Commission (SEC).

No, investors do not need to pay for SIPC insurance. The insurance is funded by SIPC member firms, which are brokerage firms that are registered with the SEC and are required to be SIPC members.

If you’re concerned about failing markets it’s not a great idea to keep more than $500,000 in a single brokerage account if you want to ensure that your assets are fully covered by SIPC insurance in the event of a brokerage firm failure.

SIPC provides insurance protection up to $500,000 per customer for cash and securities held in a brokerage account. This means that if your brokerage firm fails, you may not be fully compensated for any losses that exceed $500,000.

However, it is possible to increase your coverage beyond the SIPC insurance limits by using multiple brokerage firms or opening accounts at different types of financial institutions, such as banks or credit unions.

SIPC and FDIC are both independent agencies that provide insurance protection to customers of financial institutions, but they have different mandates and cover different types of assets.

SIPC provides insurance protection to customers of brokerage firms in the event of a broker-dealer’s failure. SIPC insurance provides coverage up to $500,000 per customer for cash and securities held in a brokerage account.

FDIC, on the other hand, provides insurance protection to customers of banks and savings associations in the event of a bank’s failure. FDIC insurance provides coverage up to $250,000 per depositor for deposits held in a bank or savings association.

While both SIPC and FDIC provide important protections to customers of financial institutions, they have different insurance limits and cover different types of assets.