TOKYO, Oct. 23, 2025 — Global data center developer STACK Infrastructure has closed a ¥39.7 billion ($260 million) green financing package to advance the expansion of its flagship 36-megawatt TKY01 campus in Inzai, Greater Tokyo. The financing was fully underwritten by Natixis Corporate & Investment Banking and Société Générale, which also acted as green loan coordinators.

Project Scope

The TKY01 campus, located on a 5.7-acre site, is being developed in phases:

- First 18MW scheduled for delivery in 2026

- Second 18MW to follow in 2027

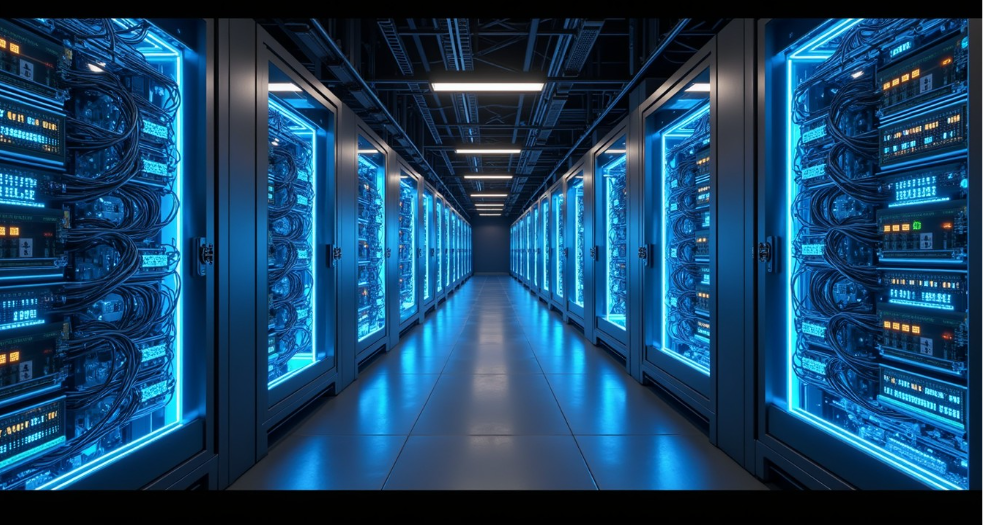

The facility is designed with AI-ready infrastructure, advanced resiliency, and energy-efficient systems, aligning with Japan’s push to expand sustainable digital capacity.

Strategic Significance

Japan is one of the largest and most competitive data center markets in Asia-Pacific, with Inzai emerging as a hub for hyperscale operators. STACK’s expansion is expected to bolster capacity for cloud providers, AI workloads, and enterprise clients, while reinforcing Tokyo’s position as a regional digital infrastructure leader.

Financing and Sustainability

The financing structure qualifies as a green loan, reflecting STACK’s commitment to sustainable development. Proceeds will be used to integrate energy-efficient technologies and ensure compliance with international green finance standards.

Industry Context

The deal highlights two converging trends:

- Rising demand for hyperscale and AI-ready data centers across Asia

- Growing reliance on sustainable finance to fund large-scale digital infrastructure projects

STACK executives said the financing demonstrates strong institutional confidence in the long-term growth of the APAC data center market.

Summary: STACK Infrastructure has secured $260 million in green financing to expand its 36MW Tokyo data center campus, with phased delivery beginning in 2026. The project, backed by Natixis CIB and Société Générale, reflects both the rapid growth of Asia’s digital economy and the increasing role of sustainable finance in powering next-generation infrastructure.

References: