ReGenEarth, a UK sustainability venture emerging from Stephen Lansdown’s Earth Capital, has launched a £100 million Green Bond Programme to fund the rollout of carbon-negative biochar technology. Partnering with circular economy energy firm RER, the initiative will integrate biochar production into existing anaerobic digestion and biomass sites nationwide.

The three-year, asset-backed bonds—issued by RER Capital PLC—offer a 12.5% annual return and mature in 2030. Proceeds will support scalable carbon removal via pyrolysis, converting waste into biochar that sequesters carbon for centuries while enhancing soil health and agricultural yields.

“This is climate-positive investing with strong returns,” said ReGenEarth CEO Mickey Rooney. “We’re turning waste into climate wealth.”

The bond aligns with ICMA Green Bond Principles and is supported by partnerships with BeZero (carbon credit verification), Onnu (project development), and Brunel University (biochar innovation and SeaCure CO₂ research). The June 10 launch at London’s Institute of Engineering & Technology emphasized the bond’s role in advancing carbon markets and circular economy practices.

For investors seeking high-yield, sustainable alternatives beyond traditional wind and solar, the ReGenEarth bond offers access to the growing voluntary carbon credit sector and clean-tech infrastructure.

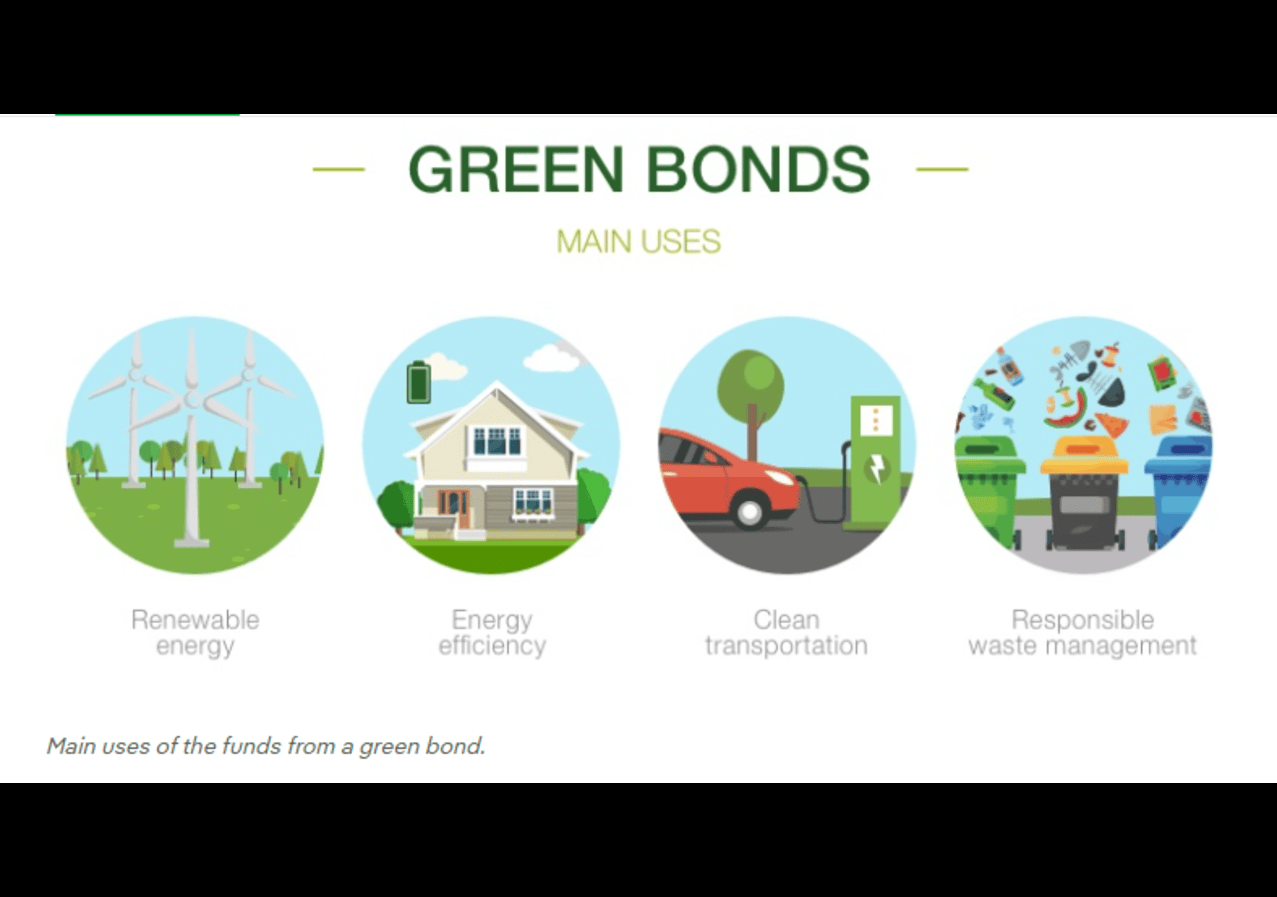

Green-bonds-usage-Image-by-Iberdrola.