As the U.S. braces for the implementation of new tariffs under the Trump administration, major tech companies Nvidia and AMD are accelerating their production and shipping efforts to avoid the impact of these tariffs, which could lead to significant price increases for next-generation graphics cards. These tariffs, expected to take effect on January 20, could raise the prices of high-end GPUs by as much as 40%.

The new tariffs, ranging from 10% to 20% on most imported goods, and a steep 60% tariff on imports from China, are part of former President Trump’s strategy to incentivize U.S. manufacturing. However, the tariffs are expected to create higher costs for consumers on a range of electronics, including laptops, smartphones, desktop PCs, monitors, and TVs—all of which rely heavily on Chinese manufacturing.

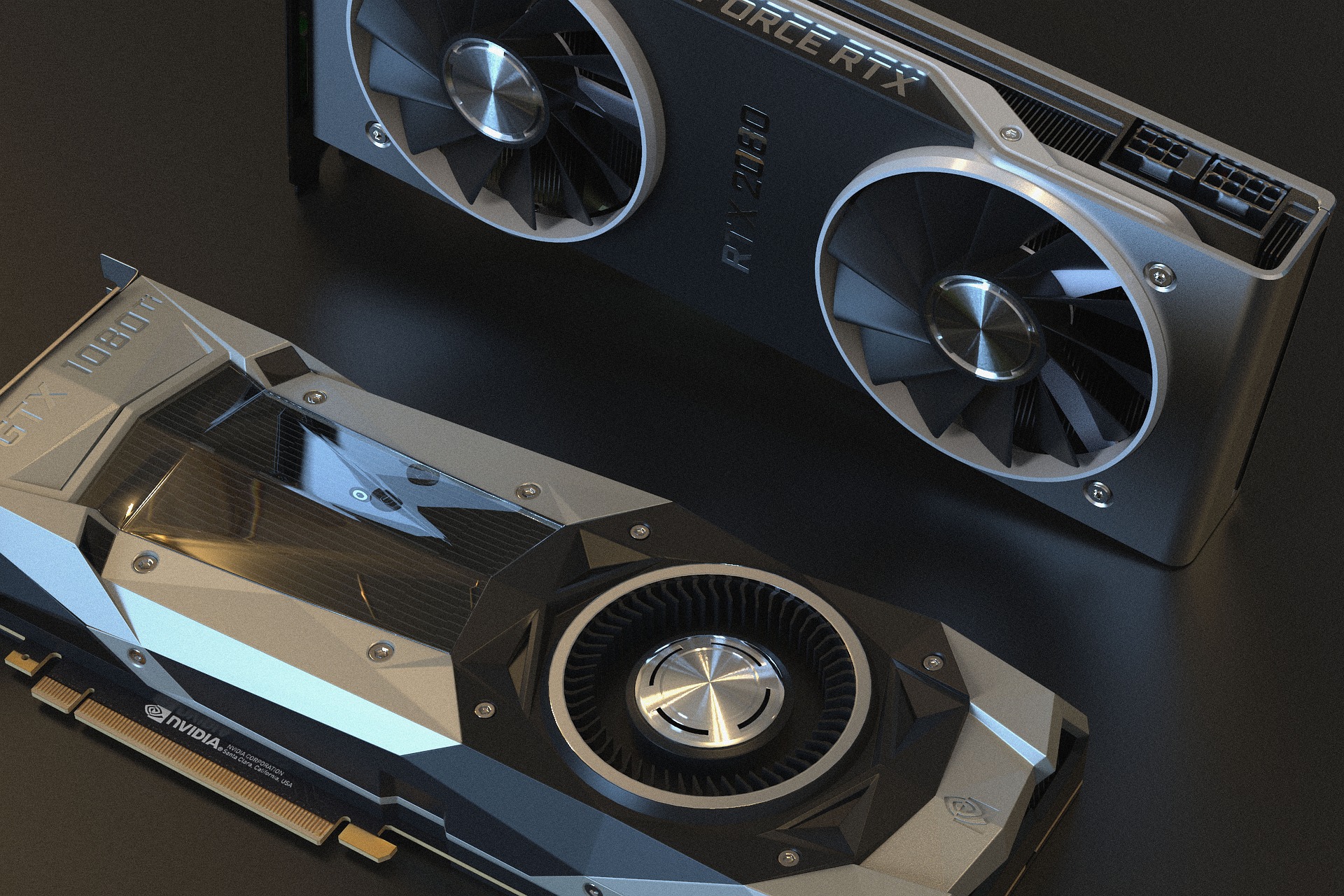

For Nvidia and AMD, this situation is particularly concerning. While both companies rely on semiconductor manufacturing partners like TSMC and Samsung for their GPU chips, much of the assembly work—including critical components such as cooling systems, printed circuit boards (PCBs), and packaging—is handled by manufacturers in China, such as Foxconn and BYD. Additionally, the assembly of graphics cards is often carried out by third-party companies such as Asus, MSI, Gigabyte, and Zotac, many of which also operate in China.

In anticipation of the tariffs, Nvidia and AMD are rushing to stockpile graphics cards in U.S. warehouses before the deadline. The companies are hoping to ship their products before the tariffs come into effect, as a price hike could significantly impact demand. Nvidia, for instance, is preparing to unveil its RTX 5000 series at the Consumer Electronics Show (CES) in early January, while AMD is set to debut its Radeon 9000 series.

If the tariffs take effect as expected, the cost of these next-generation graphics cards could rise dramatically. For example, if the Nvidia RTX 5090, which is expected to launch with a price tag of $1,799, were to face a 40% tariff increase, the price could surge to over $2,500. This price increase would likely have a noticeable impact on consumer demand, as gamers and professionals may be less inclined to pay such a high premium for the latest GPUs.

Despite these efforts to stockpile inventory, both Nvidia and AMD will eventually need to adjust prices to account for the increased costs brought on by the tariffs. As the U.S. government’s trade policies continue to evolve, the effects of these tariffs on the tech industry—especially the consumer electronics sector—remain to be fully seen.

While these price hikes are inevitable, they raise broader concerns about the long-term impact of such trade policies on consumer access to technology and the broader tech supply chain. The challenge for Nvidia, AMD, and other companies in the sector will be balancing the cost of manufacturing with consumer demand, all while navigating the complexities of an increasingly unpredictable global market.

This ongoing situation underscores the shifting dynamics of global trade and its direct impact on consumers, particularly in markets like gaming and professional computing, where high-performance graphics cards are critical. As the January deadline approaches, all eyes will be on how companies like Nvidia and AMD navigate these new tariffs and their potential to reshape pricing in the electronics market.