A session of the National Assembly to discuss the Finance (Supplementary) Bill, 2023, generally known as the mini-budget, was adjourned on Friday without a vote on the crucial tax amendments necessary for reviving a stalled International Monetary Fund (IMF) programme and averting the threat of default.

The session will now resume on Monday at 5pm.

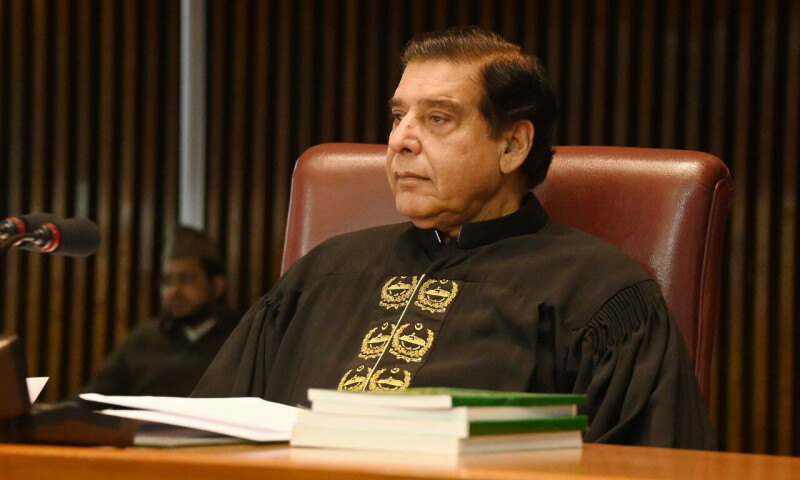

Speaker Raja Pervaiz Ashraf chaired the session, during which lawmakers criticised the government for increasing the burden on the poor by hiking taxes.

Finance Minister Ishaq Dar had presented the bill in both houses of parliament on Wednesday as the government rushed to fulfil the IMF’s conditions for the release of a desperately needed bailout.

The finance bill outlines tax measures to raise an additional Rs55 billion in the next four and half months to meet the last prior actions agreed upon with the IMF.

During the session today, PPP’s Qadir Khan Mandokhail urged the government to decrease the burden on the poor and instead hike taxes on luxury cars and houses.

Meanwhile, MQM-P’s Salahuddin criticised Dar for being “non-serious” about the difficult conditions the country was facing. “If we are allied with you today, it is only to prevent default and lift the country out of the economic crisis.

“The rupee has depreciated; petrol, electricity and gas were already expensive. These bombs had already been dropped on the public. And then our finance minister dropped another bomb on Feb 15.”

MNA Saira Bano from Grand Democratic Alliance also lashed out at the government for the increase in taxes, saying that it was impossible for common people to meet their essential needs due to inflation.

PTI MNA Mohammad Afzal Khan Dhandla emphasised the need to focus on agriculture and population control. He called for strengthening public transport and reducing car imports.

Finance bill

Two measures — raising the federal excise duty (FED) on cigarettes and increasing the general sales tax (GST) rate from 17 per cent to 18pc — have already been implemented through statutory regulatory orders (SROs). The Federal Board of Revenue (FBR) expects to generate Rs115bn from these two measures.

The finance bill proposes the following:

- GST to be increased from 17pc to 18pc; GST on luxury items to increase to 25pc

- On first class and business class air tickets, federal excise duty of 20pc of the airfare or Rs50,000, whichever is higher

- 10pc withholding adjustable advance tax on the bills of wedding halls

- Increase in FED on cigarettes, and aerated and sugary drinks

- Increase in FED on cement from Rs1.5 to Rs2 per kg

- Benazir Income Support Programme budget increased to Rs400bn from Rs360bn

The finance bill also proposes increasing GST from 17pc to 25pc on 33 categories of goods covering 860 tariff lines — including high-end mobile phones, imported food, decoration items, and other luxury goods. However, this raise will be notified through another notification.

Through the finance bill, the excise duty on cement has been raised from Rs1.5 to Rs2 per kilogram, a measure estimated to fetch another Rs6bn.

The excise duty on carbonated/aerated drinks has been raised to 20pc from 13pc to raise an additional Rs10bn for the government.

A new excise tax of 10pc was proposed on non-aerated drinks like juices — mango, orange, etc. — to raise an additional tax of Rs4bn.

The increase in excise duty on business-, first- and club-class air tickets will raise an additional Rs10bn for the government. A tax rate of 20pc (or Rs50,000, whichever is higher) has been proposed on the value of air tickets.

The government has also proposed a 10pc withholding tax on functions and gatherings held in marriage halls, marquees, hotels, restaurants, commercial lawns, clubs, community places, or other places. The FBR expects to raise Rs1bn to Rs2bn from this tax.

These measures proposed through the finance bill are in addition to earlier steps agreed upon with the IMF, including increasing electricity and gas rates and allowing a free-floating exchange rate.

To offset the inflationary impact of the budget, the government proposed that handouts under the BISP welfare scheme to be increased to a total of Rs400bn from Rs360bn.

The IMF has given a deadline of March 1 for the implementation of all these measures. However, the bulk of tax measures worth Rs115bn was already implemented from Feb 14 through SROs.