|

Getting your Trinity Audio player ready...

|

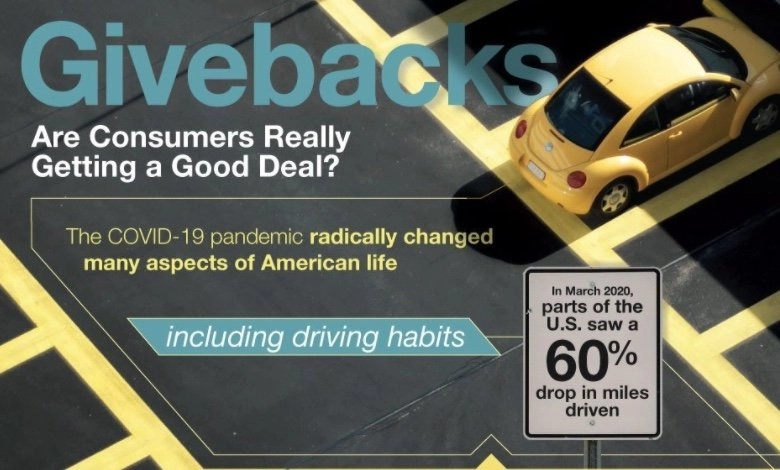

What is the impact of COVID-19 and autonomous driving on auto insurance pricing? The COVID-19 pandemic has drastically affected many aspects of American life. Since March 2020, various parts of the United States saw a 60% drop in miles driven. Less driving has led to fewer low-speed accidents and incidents of aggressive acceleration. This begs the question: does less driving mean lower insurance?

Factors That May Affect Your Car Insurance Premium

In response to the decrease in driving mileage, some of America’s biggest insurers have begun to refund auto insurance premiums. While partial refunds have been made, a reduction in driving mileage can’t translate to an equal refund percentage. Variation in severity of accidents, unpredictable changes in driving habits, and increased repair costs due to supply chain disruptions are just a few of the variables that keep auto insurers from offering complete refunds. Additionally, less driving could mean more insurance claims; less traffic leads to an increase in speeding, which may lead to increased claims, more severe accidents, and higher cost claims.

Insurance providers have to understand risk pools when determining the cost of car insurance. Low-risk pools include experienced drivers who don’t have tickets on their record. High-risk drivers may include teenagers or drivers with a history of moving violations. Higher-risk drivers pay higher premiums than their lower-risk counterparts. Driving less can reduce your risk profile, providing an opportunity for savings.

Managing Transition to Autonomous Vehicles

The shift to autonomous vehicles will affect how auto insurance operates. 94% of car accidents occur because of human error. Reducing this error through autonomous vehicle use may lead to fewer insurance claims, lower premiums, and a liability shift. In the event of a crash, liability will shift from the driver to the vehicle, the driver behavior and claim history will be irrelevant, and new calculations for determining risk will be created.

Liability concerns can pose a problem for the current auto insurance systems. The simplest solution may be no fault or split fault personal auto insurance. Rather than personal auto insurance, autonomous vehicle manufacturers may start offering their insurance options. Manufacturers would then be able to compute the exact probability of accidents, offer lower insurance premiums, and decrease premiums with each new release or upgrade. Whatever the details, the adoption of autonomous vehicles will reduce the risk profile of many drivers.