Reports this week that Goldman Sachs was gearing up to lay off 400 employees may have underestimated the breadth of the coming cuts. By a factor of 10.

Managers across the bank have been asked to identify low performers for a cull that could cut loose as many as 4,000 employees — or up to 8% of its staff, Semafor reported Friday, citing people familiar with the matter.

The cuts are likely to come in January, according to CNBC. That would put it ahead of a conference for Goldman shareholders, where management is expected to lay out the bank’s performance targets.

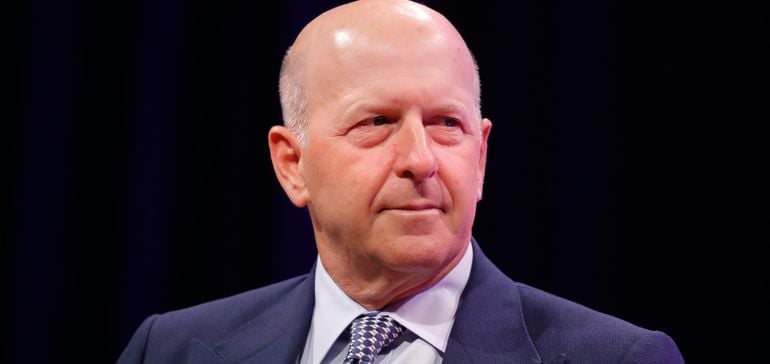

At this year’s strategic update in February, Goldman CEO David Solomon set out a medium-term goal of 14% to 16% return on equity. Through the first nine months of 2022, the bank has seen that figure hover around 12%, Bloomberg reported.

Goldman’s staff cuts are set to be deeper than the 5% the bank may see in a typical year. But 2022 is hardly a typical year. Analysts have estimated Goldman’s adjusted annual profit could drop 44%, according to Bloomberg. And investment banking fees have fallen 35% so far this year, Refinitiv data indicate.

That’s after 2021, when Goldman surpassed by September the amount of revenue it typically sees in a full year.

Goldman hasn’t used its annual performance review in a while. It de-emphasized staff cuts in 2020 as a result of the COVID-19 pandemic, and didn’t need them in 2021 because the bank was seeing so much deal activity.

Goldman’s headcount sat at 49,100 in September. That’s 14% higher than last year, and a 34% uptick since 2018.

But news in July that Goldman would reinstate the annual reviews was perhaps the first indicator that layoffs were a given.

Goldman revamped its performance review system in 2020. Under the new system, 25% of staff would be deemed “exceeds expectations”; 65% would be rated “fully meets expectations”; and 10% would receive “partially meets expectations.” That structure spurred rumors, at the time, that Goldman could consider a 10% layoff.

Along with underperformers, those at greatest risk of reduction are in Goldman’s much-maligned consumer-banking unit, Marcus. The consumer bank is being split, Goldman announced in an October restructuring, and the platform will stop offering personal loans, Bloomberg and the Financial Times reported this week. Many of the 400 cuts reported earlier centered around Marcus.

Solomon perhaps telegraphed staff-cut intentions last week at a conference. “We’ve set in motion certain expense mitigation plans, but it will take some time to realize the benefits,” he said, according to the Financial Times. “Ultimately, we will remain nimble and we will size the firm to reflect the opportunity set.”

A spokesperson for Goldman Sachs did not comment to Bloomberg or the Financial Times.

Goldman’s stock trades at roughly 1.2 times the value of its assets. By comparison, its closest rival, Morgan Stanley, trades at 1.6 times, Semafor reported.

Morgan Stanley, too, is laying off staff — about 1,600, the bank announced last week, less than half the number surfacing from Goldman.

“Many firms will have to go back to the drawing board and right-size their organizations, it’s not just Goldman,” Wall Street recruiter Mike Karp told CNBC. “Firms over-hired, and now they will have to over-fire, too.”

Layoffs aren’t the only expense mitigation tool Goldman might employ. The bank is considering shrinking the bonus pool for its investment bankers by at least 40% this year, the Financial Times reported Wednesday.

“I think we’re going to be worse than the Street,” a senior Goldman banker told the outlet, referring to Wall Street in general.

That tracks. JPMorgan Chase, Bank of America and Citi are each considering slashing their investment-banker bonus pools by 30%, Bloomberg reported this month.

Goldman’s 400 or so partners could see an even more severe pullback on bonuses. The bank’s bonus pool for senior employees is expected to shrink by as much as half, Semafor reported last week, citing people familiar with the matter.