Reading Time: 14 minutes

EU CBAM and ETS

This paper has been prepared by ESG PRO as an organization with a team of experts in sustainability and carbon footprint reporting, as well as corporate governance. The aim of the paper is to introduce the general public to the ways in which EU’s new sustainability and environmental frameworks intertwine with the transport industry, as well as the effect they may have for the EU aspiring Western Balkan countries.

What is the Carbon Border Adjustment Mechanism (CBAM), its entanglement with the EU Emission Trading System (ETS) and its eventual effect on the transport sector in the Western Balkans

The Western Balkans (Serbia, North Macedonia, Albania) have been plagued by economic fragmentation caused by inefficient bureaucracy, such as trucks spending 28 million hours waiting at borders every year – a burden that costs 1% of the region’s GDP(1).

The Open Balkan initiative was a step taken by the Balkan countries to mimic the EU’s Schengen zone and improve trade and movement between the countries(2).

However, Serbia is often projected to join the EU by 2030, and Albania and North Macedonia have opened accession negotiations with the EU in July 2022, thus the region should consider integrating their systems within the frameworks of the developing mechanisms of the European Union as soon as possible. This is especially important if they want to stay competitive in the EU market where carbon emissions are strictly restricted and regulated.

One of the most important upcoming EU mechanisms for carbon emission control that the Western Balkans need to have in mind when drafting their future policies and economic plans, is the Carbon Border Adjustment Mechanism.

On 13 December 2022, the Council of the European Union and the European Parliament reached a political agreement on the implementation of The Carbon Border Adjustment Mechanism (CBAM). The CBAM has been designed by the European Union legislators in compliance with the World Trade Organization, as a mechanism towards achieving the goals of EU Fit for 55 in line with the ambitions and targets the European Green Deal. Its main objective is to be an instrument for closing the carbon leakages and to prevent the possibilities of avoiding carbon taxes through the import of emission-intensive goods from non-EU and non-EFTA countries through the EU Emissions Trading System (EST)(3-4).

CBAM will initially cover some of the most carbon-intensive sectors at risk of carbon leakage, more specifically:

- Iron and steel (including downstream products such as nuts and bolts),

- Cement,

- Fertilizers,

- Aluminium,

- Electricity and hydrogen (which was recently added because it is mainly produced with coal in non-EU countries). The European Parliament also made it clear that it intended to include all goods and sectors (e.g. mineral oil products, lime, glass, ceramics, paper, etc.) covered by the (ETS) by 2030 as well as plastics and chemicals by 2026.

At this point, finished or semi-finished goods like automobiles could also be included. Additionally, “under certain circumstances” the carbon content of an imported good will also include indirect emissions (those brought on by the production of the energy used in the manufacturing process) (which are still to be clarified)(5-6).

With a transitional period linked with the phase-out of free allowances under the ETS, CBAM will become effective on October 1, 2023. The Mechanism’s full implementation is currently anticipated to begin on January 1st, 2027.

Businesses that wish to import products made outside of the EU into the EU will be required to buy certificates that reflect the quantity of emissions produced during the production of those goods. The average weekly price of ETS auctions will be used by the European Commission to determine the price of the CBAM certificates. As a result of this, the CBAM certificates will be linked to the ETM.

In addition to keeping the system manageable for the administrative authorities, this will ensure that the price of CBAM certificates is as close as possible to the price of ETS allowances. There are no limits on the number of CBAM certificates an importer may purchase to avoid imposing restrictions on trade.

To ensure that they consistently reflect the growth of the ETS price, CBAM certificates are neither tradable nor bankable, because any divergence could result in price discrepancies that could be so wide that they could weaken the incentives for decarbonization between domestic and imported goods.

After the date of purchase, certificates remain valid for two years. The sole “transaction” that is permitted on CBAM certificates is repurchasing. Up to one-third of the total certificates bought the previous year may be sold again by an importer to the appropriate authority. As a result, importers should still have some flexibility and be able to reduce their costs without jeopardizing appropriate pricing.

However, the proposal includes three ways in which a business can be exempt from implementing the CBAM, and are the following:

- The CBAM does not apply when trading with entities from non-EU markets that participate in the ETS and countries with carbon markets linked with the EU ETS.

- An importer will be entitled to request a decrease in the number of CBAM certificates to be surrendered corresponding to the carbon price already paid in other authorities.

- Electricity imports from a third country will be exempt from the application of the CBAM, provided the country’s electricity market is integrated with the EU’s internal market for electricity through market coupling and it has not been possible to find a technical solution for the application of CBAM(7).

A transitional phase will be in effect for three years after the CBAM Regulation goes into effect (between 2023 and 2025)(8). CBAM will be applied during this period without imposing any financial obligations (no purchasing of certificates will be required). The goal is to have the mechanism roll out smoothly while minimizing the danger of negative effects on the market.

The actual embedded emissions in products imported during the transitional period, including direct and indirect emissions as well as any foreign carbon price paid, must be reported by importers on a quarterly basis. Only in 2026 importers will become legally obligated to begin paying for CBAM certificates.

- Determine who oversees the application of CBAM inside the organization.

- Check the country of origin and CN-codes of the products imported into the EU to see if they are covered by the CBAM Regulation.

- Establish a procedure for gathering information on embedded emissions. Make sure you locate who in the supply chain possesses this data. Who is going to contact the suppliers? To lessen the fiscal impact, evaluate the gathered data to re-evaluate your supply chain structure, sourcing strategy, production, etc.

- Re-evaluate the structure of future imports into the EU, considering the costs associated with customs duties and CBAM as well as the administrative work necessary to fully comply with all applicable rules, including those relating to reporting requirements and information confidentiality(9).

However, it is worth mentioning that because of the gradual expansion of the sectors covered by the ETS and CBAM, the European Parliament had concerns that the economically weaker states and citizens would be seriously hurt by the carbon taxes imposed by the mechanisms. Therefore, the current consensus in the EU is that 50% of the income from every new sector added to the ETS and CBAM would be allocated to the newly introduced Social Climate Fund.

The fund shall support small business and vulnerable households to manage with the rise of prices in certain sectors covered by the expanded ETS, such as fuel prices and the construction sector. The fund would start operation in 2026 and is set up to run until 2032 for now(10).

This is something that Western Balkan countries should have into consideration. Educating the appropriate government bodies on how to apply for the abovementioned funds is of upmost importance so that a fluent transition into the EU trading system would be possible. Also, it is especially important for every country to locate what people and/or legal entities would be affected by the implementation of emission trading systems, as to avoid severe social consequences caused by disparity in fuel prices, and construction materials/living spaces price and rent caused by said implementations.

For emissions that are not currently priced across the entire EU, a separate emission trading system will be implemented, conveniently named the EU ETS II. In addition to emissions from the building sector, fuel usage in road traffic, the EU ETS II will include emissions, from as of now, undefined sectors.

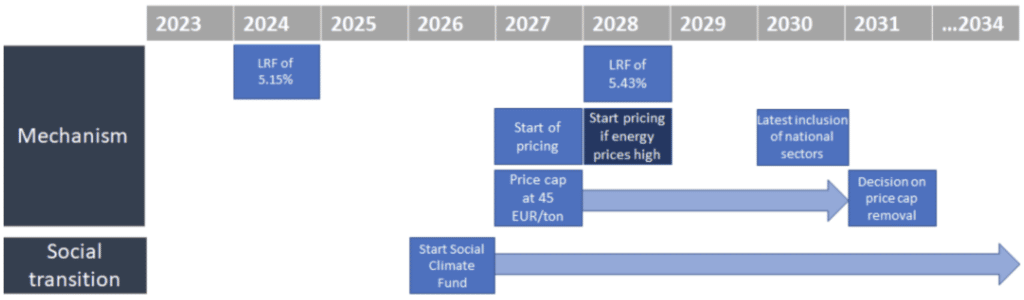

However, the EU ETS II will not be implemented until at least 2027, and it might even be delayed until 2028 due to high energy prices later this decade. Not all the details have been sorted out yet, especially since member states are permitted to exempt fuel suppliers from the EU ETS II in the event of a national carbon price scheme exists with a price level that is equal to or higher than the EU system (see Table 1 for the EU ETS II timeline).

Table 1. EU ETS II Implementation Timeline. Source: energypost.eu

For emissions that are not currently priced across the entire EU, a separate emission trading system will be implemented, conveniently named the EU ETS II. In addition to emissions from the building sector, fuel usage in road traffic, the EU ETS II will include emissions, from as of now, undefined sectors.

However, the EU ETS II will not be implemented until at least 2027, and it might even be delayed until 2028 due to high energy prices later this decade. Not all the details have been sorted out yet, especially since member states are permitted to exempt fuel suppliers from the EU ETS II in the event of a national carbon price scheme exists with a price level that is equal to or higher than the EU system (see Table 1 for the EU ETS II timeline).

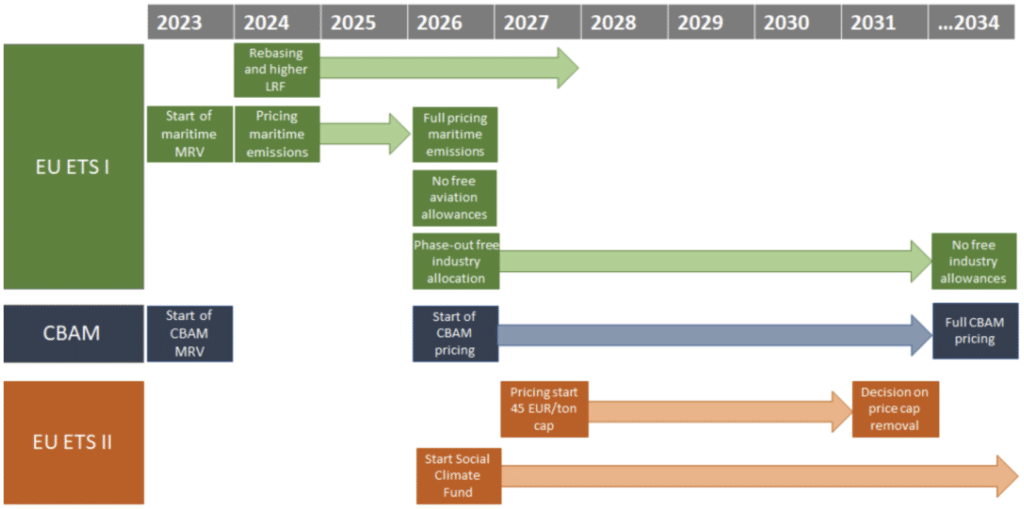

The pricing of imports through CBAM, the addition of new sectors and phased-out free allowances, as well as the introduction of the new EU ETS II for sectors that currently have no pricing scheme at all, will make the EU emission trading space more complex. An overview of the full timeline for the most significant changes’ implementation is shown in Table 2(11).

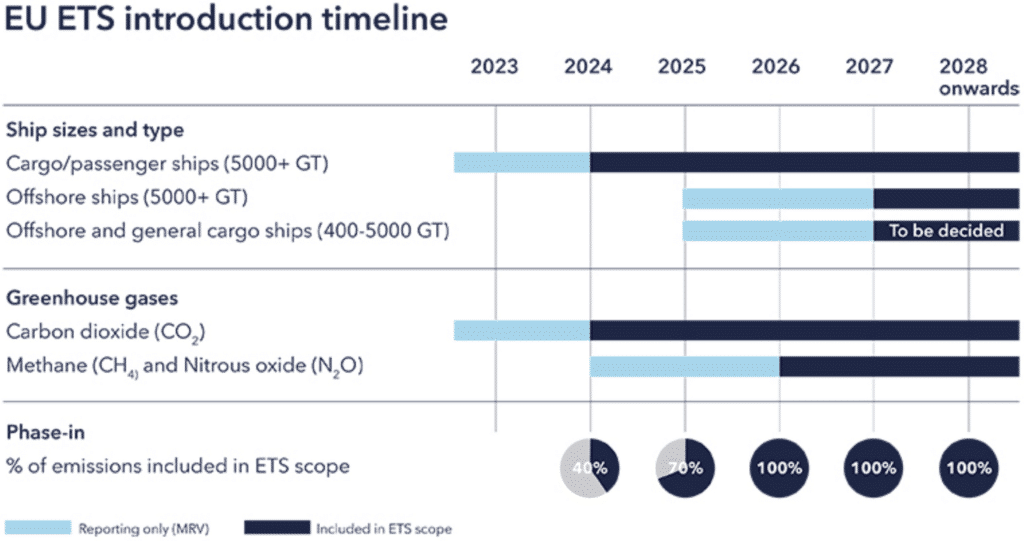

Maritime transport – During the three-year phase-in period, the percentage of taxable emissions shall be increasing from 40% in 2024 to 70% in 2025 and 100% in 2026. From 2024, it would apply to cargo and passenger ships over 5,000gt, and starting in 2027, it would apply to offshore ships over 5,000gt. The EU ETS would initially only cover CO2 emissions but, starting in 2026, it would also cover methane and nitrous oxide emissions. Offshore ship and general cargo ships between 400 and 5,000gt will also be required to report emissions and may be included in the EU ETS at a later stage. Currently the EU ETS applies to all 100% of emissions on trips and port calls inside the EU/EEA and 50% of emissions on trips into or out of the EU/EEA.

To avoid evasive behaviour, container ships stopping in transhipment ports outside the EU/EEA but less than 300nm from an EU/EEA port, need to include 50% of the emissions for the voyage to that port as well, rather than only the short leg from the transhipment port. A list of transhipment ports will be provided by the EU. Shipping companies will need to hold enough EU allowances to cover the GHG (greenhouse gas) emissions from ships under their control and turn these allowances in to the authorities each year if their ships are travelling to or from ports in the EU or EEA.

Under the EU MRV regulation, these businesses are required to monitor, report, and verify the GHG emissions on an annual basis, and this data is used to calculate the allowances they must give up. For shipping companies, the cost of buying allowances under the EU ETS can be a sizable expense, and this is likely to have an impact on the pricing and other terms of contractual agreements between parties across the value chain, including charterers and cargo owners.

To manage significant tax cashflows across the value chain, it will be necessary for all parties to have a shared and reliable basis of emissions performance data for voyage verification(12).

Overall, operations, costs, and contractual agreements in the maritime transport industry will be impacted by the EU ETS. Shipping companies must be diligent and take steps to cut emissions, including improving operational efficiency, making investments in low-carbon technologies, and switching to alternative fuels in order to stay competitive on the transport and logistics market.

Road transport – The introduction of ETS II will undoubtedly come as a big blow to the road transport and logistics industry. Paying a carbon tax won’t be the only fee the industry will have to pay, as the oil companies will have to pay for carbon allowances raising fuel prices by the margin of the allowances that have been paid to produce fossil fuels, affecting both road transport companies, as well as EU citizens.

For further information on the impacts of expanding the ETS to the road transport read more on the EU study – Possible extension of the EU Emissions Trading System (ETS) to cover emissions from the use of fossil fuels in particular in the road transport and the buildings sector.

Aviation transport – In Europe, direct emissions from aviation accounted for almost 4% of total CO2 emissions in 2017(13). In an attempt to mitigate this the EU is covering the aviation industry within the framework of the ETS, as well in the CBAM. These frameworks shall be applied to each flight that depart from or arrive in an aerodrome situated in the territory of a Member State(14).

In order to make sure that the industry helps achieve EU and global climate goals, on 6 December 2022 the EU Parliament and Council reached a provisional agreement on revising the ETS for aviation to tighten the rules for lowering carbon dioxide emissions from air travel. The updated ETS will include the ICAO’s globally agreed-upon market-based Carbon Offsetting and Reduction Scheme for International Aviation as a result of the new regulation (CORSIA). In case of a negative evaluation of CORSIA’s progress by 1 July 2026, the European Commission would be required to make a proposal to include in the scope of the EU ETS emissions of flights departing from an airport located in the European Economic Area (EEA) to a third country. By 2027, flights to foreign countries that do not implement CORSIA will be subject to the ETS.

The deal foresees a gradual end to the free allocations of allowances in the aviation sector by 2026, one year ahead of the timetable proposed by the European Commission. However, the EU agreed to reserve 20 million allowances, between 1 January 2024 and 31 December 2030, for commercial aircraft operators who increase their use of sustainable aviation fuels (SAF), including advanced biofuels, fuels from non-biological sources of renewable energy, and hydrogen from renewable energy sources.

In an unprecedented measure, beginning in 2025, airlines will be required to report the release of potential “non-CO2 impacts.”

This includes dangerous gases released from jet engines, such as nitrogen oxides, sulphur dioxide, and soot particles.

In 2028, a legislative proposal will be made to include these emissions in the EU ETS’s purview.

Other actions foreseen by the law include:

- The Innovation Fund will use the proceeds from the auction of 5 million aviation allowances to support modern technologies, including electrification;

- There will be a derogation for emissions occurring up until 2030 from flights between airports in the most remote parts of one EU country and airports in that same country, as well as flights between airports in the most remote parts of the same EU country;

- In order to increase transparency, aggregated annual emissions-related data will start to be provided in 2023 in a user-friendly format(15-16).

However, before the agreement can go into effect, it must receive formal approval from the European Council and Parliament.

Railway transport – After the implementation of all the environmental laws and mechanisms that have been discussed thus far, we can say that the railway transport may come out as an absolute winner.

However, this is not a given. It very much depends on the will and cooperation between the EU and EFTA countries to make railways a viable mean of transport.

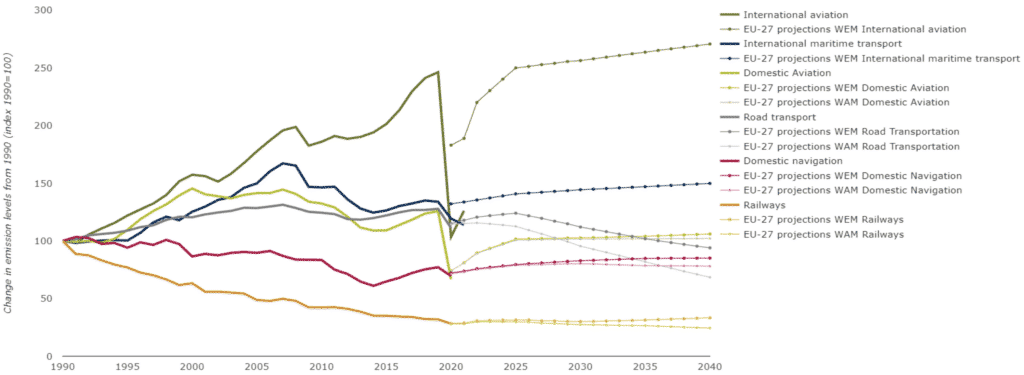

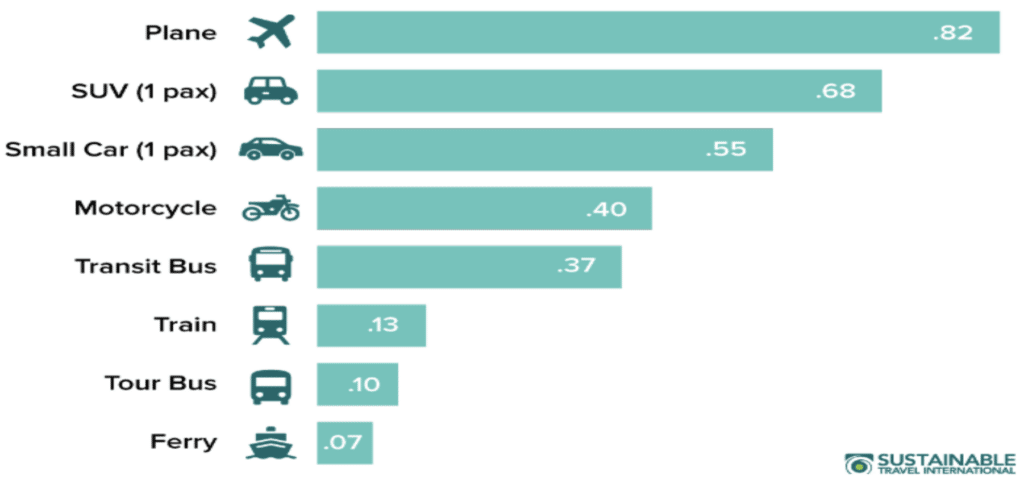

Since the 1990’s the railway has been the most environmentally friendly mean of transport when it comes to greenhouse gas emissions (see graph 1 and 2). So why isn’t the railway transport preferred for travel and transport of goods?

The fact that national rail firms do not make things simpler is the first problem. Many of them do not compete in various national markets, even though the EU urges them to. Long wait periods and disorganised travel schedules are a result from this. However, the EU Commission is trying to combat this by implement new railways packages to make the EU railway infrastructure more dynamic(17).

The second issue is that travellers have no Open ticket data. Potential passengers would have to navigate several different timetables, websites and ticketing systems, making it extremely cumbersome to book a train journey from one European country to another. However, there was an attempt from the European Parliament to open ticketing data, but unfortunately their decision was repealed from the Council of Ministers in December 2019. Furthermore only 51 of the 150 most popular short-haul flights in the EU have train alternatives that take less than six hours, according to a recent Greenpeace analysis. On the other hand, the competitors from the aviation business — international in nature — has, over time (and without EU regulation), opened ticket and route data allowing third-party companies like Skyscanner or Momondo to compare fares and sell tickets, creating a preference for people to travel by air rather than rail(18-19).

The last issue is the electrification of the railways. Even though most of EU railways are electrified, there is a difference between the electrification systems, making the transfer of trains from one system to another difficult(20-21).

The aim of the EU is to make the gauges between countries interoperable, and where possible for member states to replace their existing electricity gauges with standardised 25kV, 50Hz AC. One step towards this is the attempt of the EU for building a Single European Railway Area with the aim to: open the railway market to competition; increase the interoperability of national railway systems; define the framework for a single European railway area(22-23).

Another step towards making railways more interoperable is by introducing Digital Automatic Coupling which enables freight wagons to be coupled together automatically, without any manual human intervention, which is currently the standard procedure. The new connection method enables for goods trains to be longer and heavier, thus growing the capacity of the track(24).

The Western Balkans should make a deep analysis of the mechanisms and systems incorporated withing their trade networks and make an analysis for the best way to approach their incorporation into the EU frameworks.

First step that should be taken is assess the financial impacts implementation may have on the market and the overall economy, so a proper mitigation plan could be put in place before carrying out implementation.

The next stap would include analysing the specifics of the domestic market, so a proper way of implementation could be conducted, without harming the economic processes and causing bureaucratic jams in the country.

The last step would be to explore and find a way to apply and install new renewable energy sources in their economy in such a way that would make the means of transport less susceptible to EU carbon taxations.

- Miščević T. European Western Balkans [Internet]. [Place unknown]: European Western Balkans; 13.05.2021. Western Balkans Economic Integration – why is it needed?; 13.05.2021 [cited 15.02.2023]. Available from: https://europeanwesternbalkans.com/2021/05/13/western-balkans-economic-integration-why-is-it-needed/

- Ristic D. European Policy Center [Internet].[Place unknown]: European Policy Center; 13.09.2021. Open Balkan Initiative – less history more business; 13.09.2021 [cited 15.02.2023]. Available from: https://cep.org.rs/en/blog/open-balkan-initiative/

- European Comission [Internet]. [Place unknown]: European Comission;[date unknown] Carbon Border Adjustment Mechanism; date unknown [cited 15.02.2023] Available from: https://taxation-customs.ec.europa.eu/green-taxation-0/carbon-border-adjustment-mechanism_en

- European Comission. European Comission [Internet]. [Place unknown]: European Comission; [date unknown]. Carbon Border Adjustment Mechanism: Questions and Answers; date unknown [cited 15.02.2023]. Available from:

https://ec.europa.eu/commission/presscorner/detail/en/qanda_21_3661

- Monkelbaan J. World Economic Forum [Internet]. [Place unknown]: World Economic Forum; 19.12.2022. CBAM: What you need to know about the new EU decarbonization incentive 19.12.2022 [cited 15.02.2023]. Available from: https://www.weforum.org/agenda/2022/12/cbam-the-new-eu-decarbonization-incentive-and-what-you-need-to-know/

- European Comission. European Comission [Internet]. [Place unknown]: European Comission; [date unknown]. EU Emissions Trading System (EU ETS) [Date unknown] [cited 15.02.2023]. Available from: https://climate.ec.europa.eu/eu-action/eu-emissions-trading-system-eu-ets_en

- Ruggiero A. Carbon Market Watch [Internet]. [Place unknown]: Carbon Market Watch; 16.12.2022. A brief explanation of the Carbon Border Adjustment Mechanism (CBAM). 16.12.2022 [cited 15.02.2023]. Available from: https://carbonmarketwatch.org/ 2021/12/16/a-brief-explanation-of-the-cbam-proposal/#cbam-objective

- Mitsios S. Ernst & Young [Internet]. [Place unknown]: Ernst & Young; 25.01.2023. EU Carbon Border Adjustment Mechanism (CBAM) – Provisional Agreement. 25.01.2023 [cited 15.02.2023]. Available from: https://www.ey.com/en_gr/tax/tax-alerts/eu-carbon-border-adjustment-mechanism-cbam-provisional-agreement

- Deloitte. Deloitte [Internet]. [Place unknown]: Deloitte; [date unknown]. EU Carbon Border Adjustment Mechanism (CBAM) [date unknown]; [cited 15.02.2023]. Available from: https://www2.deloitte.com/nl/nl/pages/tax/articles/eu-carbon-border-adjustment-mechanism-cbam.html

- European Comission. European Comission [Internet]. [Place unknown]: European Comission; [date unknown]. Social Climate Fund; [Date unknown] [cited 15.02.2023]. Available from: https://climate.ec.europa.eu/eu-action/european-green-deal/delivering-european-green-deal/social-climate-fund_en

- Goss S. EnergyPost.eu [Internet]. [Place unknown]: EnergyPost.eu; 06.02.2022. Understanding the new EU ETS (Part 2): Buildings, Road Transport, Fuels. And how the revenues will be spent; 06.02.2022 [cited 15.02.2023]. Available from: https://energypost.eu/understanding-the-new-eu-ets-part-2-buildings-road-transport-fuels-and-how-the-revenues-will-be-spent/

- Det Norske Veritas. Det Norske Veritas [Internet]. [Place unknown]: Det Norske Veritas; [date unknown]. EU ETS – Emissions Trading System; [date unknown] [cited 15.02.2023]. Available from: https://www.dnv.com/maritime/insights/topics/eu-emissions-trading-system/index.html

- European Union Aviation Safety Agency, European Environment Agency, Eurocontrol. European Aviation Environmental Report 2019. www.easa.europa.eu [PDF document from the internet]. Cologne, Germany; 2019 [cited 15.02.2023] Available from: https://www.easa.europa.eu/eco/sites/default/files/2021-09/219473_EASA_EAER_2019_WEB_LOW-RES_190311.pdf (page 75)

- European Parliament, European Council. Official Journal of the European Union [Internet]. [Strasbourg, France]: European Parliement; 19.11.2008. Directive 2008/101/Ec Of The European Parliament And Of The Council of 19 November 2008 amending Directive 2003/87/EC so as to include aviation activities in the scheme for greenhouse gas emission allowance trading within the Community; 19.11.2008 [cited 15.02.2023]. Available from: https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:32008L0101&from=EN#d1e32-17-1

- European Parliament. European Parliament [Internet]. [Place unknown]: European Parliament; 22.07.2022. Fit for 55: deal on more ambitious emissions reduction for aviation; 22.07.2022 [cited 15.02.2023]. Available from:

- Goulding Carroll S. Euractiv.com [Internet]. [Place unknown]: Euractiv.com; 07.12.2022. Lawmakers agree to restrict EU carbon tax to flights within Europe; 07.12.2022 [cited 15.02.2023]. Available from: https://www.euractiv.com/ section/aviation/news/lawmakers-agree-to-restrict-eu-carbon-tax-to-flights-within-europe/

- European Council. European Council [Internet]. [Place unknown]: European Council; 01.09.2017. The 4th railway package: measures to improve Europe’s railways; 01.09.2017 [cited 15.02.2023]. Available from:

https://www.consilium.europa.eu/en/policies/4th-railway-package/

- Greenpeace. Get on track: Train Alternatives to short-haul flights in Europe. www.greenpeace.org [PDF document from the internet]. Brussels, Belgium; 2021 [cited 15.02.2023]. Available from: https://www.greenpeace.org/static/planet4-eu-unit-stateless/2021/10/135ec803-getontrack-gp-briefing-en-final.pdf pg. 4

- Melchior S, Brillaud L, Rico M. InvestigateEurope.eu [Internet]. [Place unknown]: InvestigateEurope.eu; 19.11.2021. European governments are holding back on railway passenger rights; 19.11.2021 [cited 15.02.2023]. Available from: https://www.investigate-europe.eu/en/2021/european-governments-are-holding-back-on-railway-passenger-rights/

- Statista research department. Statista [Internet]. [Place unknown]: Statista; 13.12.2022. Share of the rail network which was electrified in Europe in 2020, by country; 13.12.2022 [cited 15.02.2023]. Available from: https://www.statista.com/statistics/451522/share-of-the-rail-network-which-is-electrified-in-europe/

- Cassat A, Bourquin V: MAGLEV – Worldwide Status and Technical Review. www.researchgate.net [PDF document from the internet]. Lausanne, Switzerland; 2011 [cited 15.02.2023]. Aveliable from:

https://www.researchgate.net/publication/236993225_MAGLEV_-_Worldwide_Status_and_Technical_Review pg.10

- European Council. European Council [Internet]. [Place unknown]: European Council; [date unknown]. Building the single European railway area; [date unknown] [cited 15.02.2023]. Available from: https://www.consilium.europa.eu/en/policies/single-eu-railway-area/

- Schengen Visa News. Schengen Visa News [Internet]. [Place unknown]: Schengen Visa News; 12.08.2021. EU Reveals Plans for a Single European Railway Area to Connect the Block & Reach Carbon Emission Goal by 2050; 12.08.2021 [cited 15.02.2023]. Available from: https://www.schengenvisainfo.com/news/eu-reveals-plans-for-a-single-european-railway-area-to-connect-the-block-reach-carbon-emission-goal-by-2050/

- Van Gompel M. RailTech.com [Internet]. [Place unknown]: RailTech.com; 19.01.2022. Freight train with Digital Automatic Coupling starts test run in Europe; 19.01.2022 [cited 15.02.2023]. Available from: https://www.railtech.com/digitalisation/2022/01/19/freight-train-with-digital-automatic-coupling-starts-test-run-in-europe/

The post EU CBAM and ETS appeared first on ESG PRO Ltd..