As part of CGAP’s Agent Networks at the Last Mile initiative, we explored the role of gender in developing rural agent networks in Bihar State, India, through the State Government’s Bank Sakhi Program. CGAP partnered with the Rural Livelihood Mission (Jeevika) to perform field research to better understand the business, impact and outcomes of women agents of the Bank Sakhi program.

We found that . However, we also saw that the business performance of most Bank Sakhis is worse than their male counterparts. The majority of Bank Sakhis struggle with operational issues that have limited their expansion thus far. In this blog, we suggest actions that can resolve these operational constraints so that the benefits Banks Sakhis bring can spread further among India’s rural poor.

Meet the Bank Sakhis: India’s women bank agents

In 2016, the Government of India’s National Rural Livelihood Missions, in partnership with the World Bank, launched The Bank Sakhi program to train women members of Self-Help Groups (SHGs) to become banking agents. The program has the dual objective of promoting digital financial services in rural areas by expanding agent networks and aiding in the digitalization of financial transactions between SHGs and their members, thereby improving formal financial access for a vast population of rural women. It also seeks to empower women working as agents by providing them with economic opportunities.

The initiative has trained over 100,000 women since the launch of the program, who are now actively working for various banks in more than 20 states. The initiative has effectively created a successful public-private initiative that empowers women and includes them in the formal economy, which involves public-sector banks and private-sector agent network managers.

Bank Sakhis serve the most vulnerable despite many obstacles

Various gender norms constrain how Bank Sakhis operate and hinder their likelihood of becoming “successful” from a business standpoint, even when they generate great benefits to their communities and for themselves, as described below.

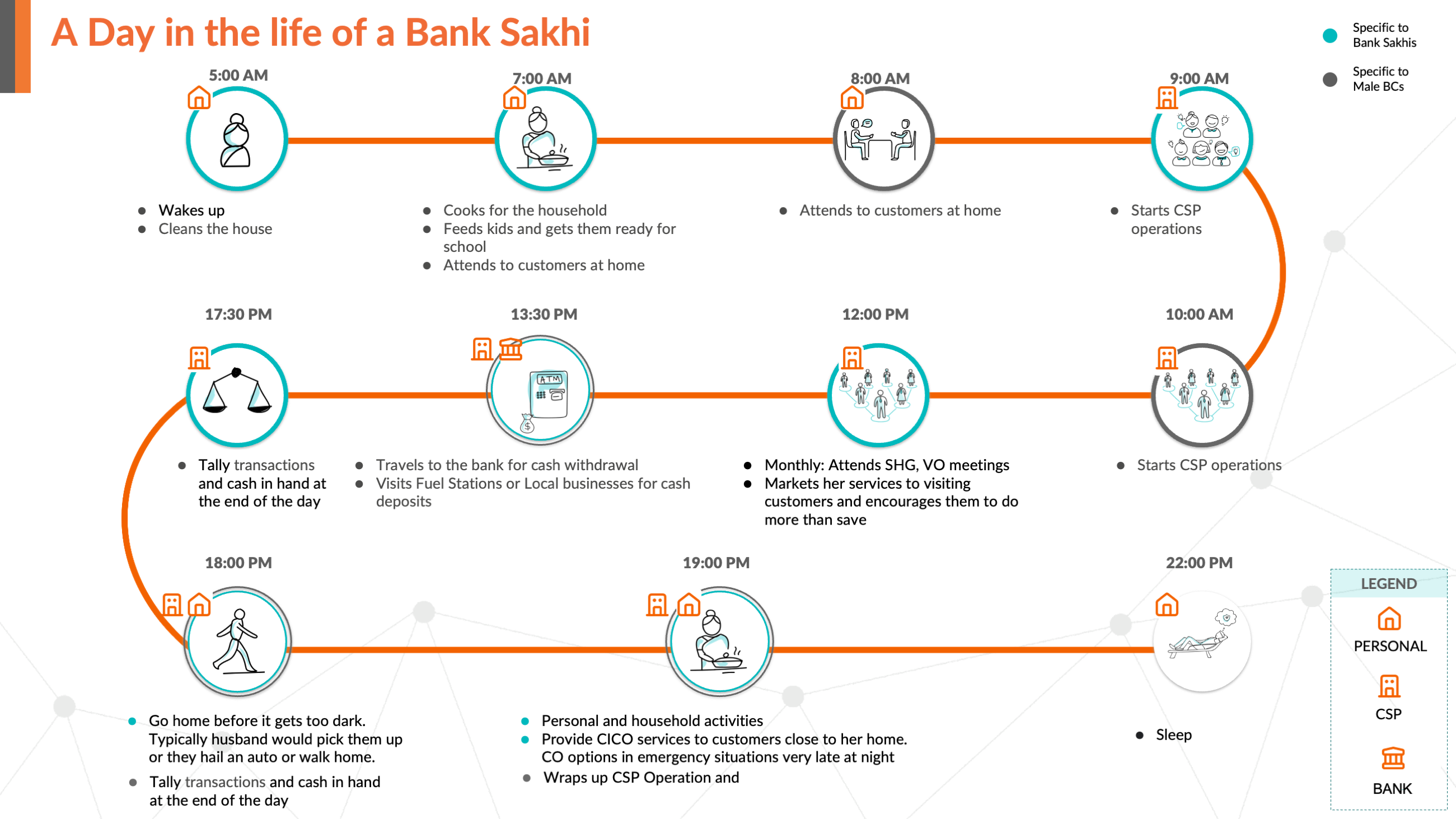

Bank Sakhis, most of whom come from vulnerable sections of society, face two main constraints. First, there is an expectation that they must primarily fulfill their household responsibilities in addition to being an agent, which means that they are extremely time constrained and work long days, unlike their male counterparts. On average, they work 3-4 more hours per day across their multiple responsibilities, but male agents perform twice as many transactions as Bank Sakhi agents on a daily basis. Second, Bank Sakhis often face mobility and security issues, resulting in a need for support from male relatives to carry out certain agent activities like accompanying them to deposit cash at a branch. As a result, women can only become agents if they have the support of their relatives — in fact, only 3% work without their household’s involvement — making the Bank Sakhis a family business.

Bank Sakhis tend to be located in more remote rural areas where population density is lower. Although they do not necessarily serve more women customers compared with traditional agents, they are more likely to serve students, the elderly, and people with disabilities — the most vulnerable and challenging segments to reach from a financial inclusion perspective. This represents a significant social benefit that does not get quantified in traditional business performance indicators.

(on average, it takes them 41 months to do so). They tend to spend more time educating and advising their customers based on their needs, resulting in more customer empowerment and financial literacy. Some 62% of rural customers prefer to interact with Bank Sakhis when compared to traditional agents. Furthermore, 83% of Bank Sakhis provide door-to-door services (only 33% of traditional agents offer this service), and most work after normal business hours. This is especially beneficial for customers that also face mobility constraints, or for other women who need to juggle time between different responsibilities — in fact, 83% of customers value highly the proximity of Bank Sakhis.

We also find that Bank Sakhis’ self-esteem and confidence have significantly increased as they’ve become valuable and reputable members of their households and communities. Over 90% of Bank Sakhis have experienced an improvement in their interactions with the community and 22% have seen an increase in their agency on household expenses. They have also inspired other women to become more independent and comfortable using financial services. From a household perspective, Bank Sakhis spend their income on expenses that positively increase the well-being of their children; they report seeing a noticeable improvement in the quality of food, education, and access to medical care.

I get to serve my community, becoming a Bank Sakhi has enabled me to help people who are helpless, old or extremely poor. This is the part of the job that makes me feel proud about myself!

Nikita Kumari, UBI, FINO

CGAP’s work supporting Bank Sakhis viability

So, how can we improve the business viability of Bank Sakhis such that their networks keep expanding service coverage in a more cost-effective manner? Based on success factors observed in the best performing Bank Sakhis, CGAP and The World Bank convened industry stakeholders to ideate potential solutions that could further increase the Banks Sakhis’ business viability, thereby increasing the number of women willing to become agents.

Improving liquidity management

At present, 42% of Bank Sakhis need support with liquidity to provide a better service. These agents have a high concentration of cash-out transactions, resulting in the need to travel to bank branches multiple times a week, which increases their transportation costs and time spent outside work. A potential solution would be for Bank Sakhis to digitize neighboring self-help group (SHG) transactions, which are mainly cash-in operations. This would reduce the frequency of bank visits, lower costs for the agents, and increase their amount of transactions. However, SHG-member level payments are not routed through Bank Sakhis for various reasons such as inter-bank transfer fees and low transaction value limits.

CGAP, along with financial service providers (FSPs) and the government, are exploring the possibility of reducing or subsidizing the interbank fees and lifting the cap for transactions made by SHGs so Bank Sakhis can balance their cash-in and cash-out operations and improve their liquidity management.

Allowing Bank Sakhis to offer high-demand services to increase their revenue

Our research shows that Bank Sakhis who provide high-demand services like account opening, passbook printing, or servicing SHG accounts, have the potential to double their income. However, only a minority of Bank Sakhis offer these services due to technical integration constraints between banking systems. CGAP is working with partner FSPs to implement solutions that allow bank agents to print statements for customers of other banks, allowing them to better serve all their clients and increase their daily activities.

Stay tuned!

CGAP continues to collaborate with The World Bank, State Governments and partner FSPs to expand gender-focused financial inclusion programs. We will be sharing the results of the solutions being explored so that other initiatives seeking greater participation of women agents can learn from the experience.

CGAP would like to acknowledge the support and contribution that the Bihar Rural Livelihoods Promotion Society, Jeevika, made to facilitate the field research and enhance our understanding of the Bank Sakhi program in Bihar. In particular, we thank Jiban Jha for his leadership, and Kajal Kumari and Shilpi Srivastava for enabling a wide range of field interactions across multiple geographies. CGAP would also like to express gratitude to our World Bank India colleagues, Alreena Pinto and Shantanu Kumar for their extensive support in peer-reviewing the research design and questionnaires and helping us interpret the findings to produce meaningful insights.

Resources

Study to Assess the Role and Impact of Women Self-Help Groups as Banking Agents in Bihar

This research explores the role of gender in developing rural agent networks in Bihar State, India, through the State Government’s Bank Sakhi Program. CGAP partnered with the Rural Livelihood Mission (Jeevika) to perform field research to better understand the business, impact, and outcomes of women agents of this program.