Iberdrola has raised €400 million through an innovative green bond linked to the company’s share price performance. This bond, maturing in five years with a 1.5% coupon, offers investors the opportunity to benefit from potential share price appreciation, without diluting existing shareholder equity.

The unique bond structure includes a call option based on Iberdrola’s share price in the last three months before maturity, ensuring that investors only receive the difference in price appreciation, without impacting current shareholders. To hedge against potential risks, Iberdrola also purchased a matching hedging option, which helps mitigate the financial risk if the share price exceeds a predefined threshold.

This approach provides Iberdrola with cost benefits compared to traditional financing, as the company stated, “By purchasing a hedging option, Iberdrola eliminates the risk and obtains a cost advantage over traditional financing.”

The issuance was supported by leading global banks including JP Morgan, Natixis, Mizuho, and Morgan Stanley. This follows Iberdrola’s ongoing innovation in the structured bond market, building on previous similar issuances, such as the €450 million green bond in 2022 and a €500 million bond in 2015, with additional increases over time.

Iberdrola continues to set a precedent for creative financial solutions that align with sustainable growth goals while minimizing risks and dilution for shareholders.

Sources: Iberdrola | Excerpts from esg.com

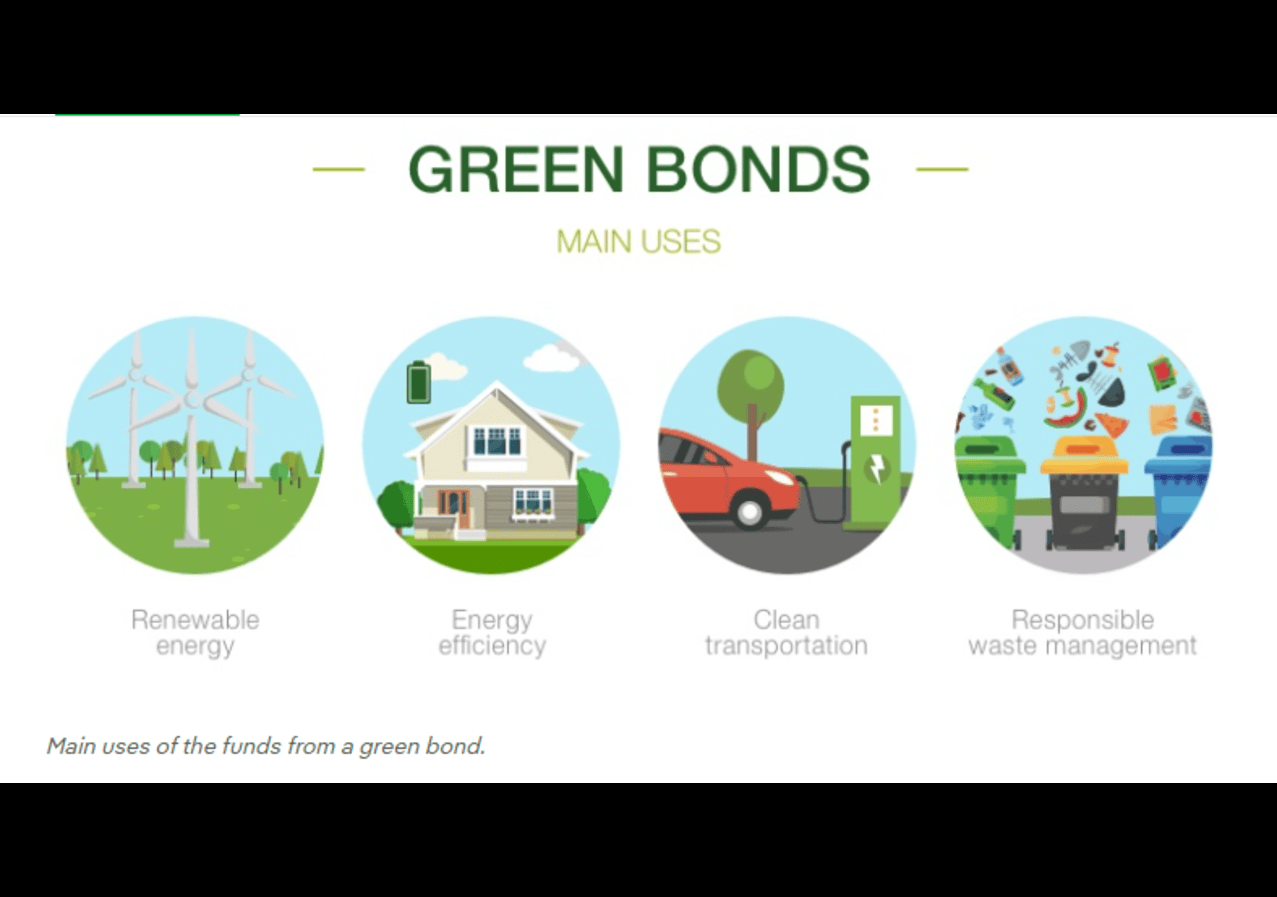

Green-bonds-usage-Image-by-Iberdrola.