|

Getting your Trinity Audio player ready...

|

There are many ways to build long-term wealth without an actual J-O-B. Having enough income-producing assets working in your favor can make it possible to “live rich” – or at least get by – without ever having to clock in for an employer again.

It’s why you see all kinds of wealthy people retiring early without having to change their lifestyles. These people have income-producing assets spinning off profits or dividends, and they use those funds to pay for their bills and lifestyle.

When it comes to income-producing assets, more is always better! In fact, having multiple income sources is the best way to feel secure when you’re relying on alternative income sources to leave your 9 to 5.

What Are Income-Producing Assets?

But what are income-producing assets, anyways? While the definition can be somewhat vague, they are assets that generate reliable income or cash flow over time.

Income-producing assets help you earn money while you sleep, and we all know what Warren Buffet had to say about that:

“If you don’t find a way to make money while you sleep, you will work until you die.” – Warren Buffet

If you want to avoid working until you die, you must have some income-producing assets working on your behalf. Let’s review some of the best ones to consider for your portfolio and how they work.

#1: Dividend Paying Stocks

Dividend stocks are one of the easiest income-generating assets to get into because you can start with small sums of money. What separates dividend stocks from other types is the fact that they pay out dividends, or recurring income, to their investors.

Dividend stocks are also issued by the most profitable companies, so they are seen as less risky. A wide range of stocks from various sectors, along with ETFs and mutual funds, can all offer dividends, making it possible to craft a dividend stock portfolio that suitds your needs and goals.

Conversely, expense ratios for dividend mutual funds and ETFs can be higher than for non-dividend options. With that in mind, you’ll want to do plenty of research and compare ongoing expenses carefully before you dive in.

If you’re looking for a place to invest in dividend stocks, I recommend you check out Robinhood since it lets you invest with no fees or commissions, or M1 Finance, which lets you invest in fractional shares of dividend stocks.

#2: Real Estate Crowdfunding

Real estate crowdfunding is another option to consider if you want an income-producing asset with a low barrier to entry. With crowdfunding, you are pooling your money with other investors, and the company overseeing the plan invests that money into different types of real estate.

Fundrise, one of the most popular real estate crowdfunding platforms, allows you to get started with as little as $10. Your investment is placed into commercial and residential real estate developments. From there, you can secure a regular return on your funds based on the rental income produced by the underlying real estate investments in your portfolio.

While Fundrise hasn’t been around forever, they do have solid gains to report so far. For example, Fundrise clients achieved an average return of 7.31% in 2020, 22.99% in 2021, and 5.52% during the first half of 2022.

#3: Rental Properties

If crowdfunding real estate isn’t for you, consider becoming a landlord. This strategy can work with both commercial and residential real estate, although the barrier to entry is much higher than real estate crowdfunding.

In most cases, you’ll need a minimum of 20% down to purchase an investment property – to buy a rental property worth $300,000, you would need a minimum of $60,000 in cash just to get started.

Many people leverage a strategy known as house hacking to get around real estate’s high barrier to entry.

Here’s how it works.

You purchase a multi-unit property and live in one of the units while renting the others out. This way, you can qualify for more traditional mortgage products with lower down payment requirements. Buyers can even use a first-time homebuyer program like the FHA loan to purchase properties with up to four units and as little as 3.5% down.

Whichever way you go, rental properties are an ideal income-producing asset as they generate regular monthly income. Just remember that being a landlord isn’t for everyone – there will always be bumps in the road if you manage your properties yourself.

#4: Digital Real Estate

Another income producing asset comes in the form of digital real estate. Funny enough, you are currently occupying space on my own piece of digital real estate – this website.

You are on my lawn right now, and that’s okay with me! Why? Because I earn commissions when you click on affiliate links and buy stuff, and from the display ads you see on the page. Good Financial Cents has been around for over a decade, and I have used it to earn millions of dollars blogging along the way.

In addition to websites like mine that earn income through traffic and affiliate sales, other types of digital real estate include:

- Assets held in the metaverse

- Authority websites that focus on a specific niche

- eCommerce stores that sell physical products

- Digital products such as courses and printables

- Domain names bought and sold for profit

- Email lists that are built and sold for profit

- Membership groups that require a monthly or annual fee

While getting started in digital real estate isn’t a cakewalk, it’s not rocket science, either. The following guide can help you build your own website from start to finish, so make sure to check it out:

Also, check out my Make 1k Blogging course, which is free and pretty cool if I say so myself. The goal of this course is to help you get a website set up so you can earn your first $1,000 online.

#5: Online Savings Vehicles

Online savings vehicles, like high-yield savings or money market accounts, give you decent returns in exchange for the safety of the principal. You could even lump certificates of deposit (CDs) into this category. They offer a fixed interest rate and FDIC insurance, which protects your deposit up to $250,000.

None of these options will help you earn a ton of passive income, but they are a great place to stash your money while you decide on other strategies. Online savings vehicles are also suitable for emergency funds, and for when you have a specific savings goal, like a vacation or major purchase.

Not sure which online savings vehicle to try? Some of the best options include UFB Direct, SoFi Money, and CIT Bank.

With an online bank account from SoFi, for example, you can earn 2.00% APY on your savings with no account fees. You can earn a $300 sign-up bonus when you open an account and set up qualifying direct deposits.

#6: Traditional Stock Market Investing

If you want to invest in the ultimate income producing asset, traditional stocks should be part of your portfolio. I’m talking about regular stocks that don’t necessarily pay dividends, or even mutual funds, index funds, or ETFs.

Investing in the stock market can help you gain a steady income that you can use to fund your lifestyle or even retire. Plus, the returns are superior to other investment vehicles over the long term.

For example, the S&P 500 (one of the major stock market indexes) offered an average return of 8.91% during the 20 years leading up to the beginning of 2022. If you look at returns over 30 years instead, the average increases to 9.89%.

While you can select your own individual stocks, investing in index funds is one of the easiest (and lower risk) ways to get started. Index funds allow you properly diversify your portfolio by investing in all of the major companies that fall within an index across various industry sectors.

Examples of popular index funds include the Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX), Vanguard 500 Index Fund Admiral Shares (VFIAX), Schwab S&P 500 Index Fund (SWPPX), and Fidelity U.S. Sustainability Index Fund (FITLX).

While you can invest in individual stocks, mutual funds, or index funds by opening an account with the best online brokerage firms, you can also lean on a robo-advisor for help.

For example, a robo-advisor like Betterment can help you craft a portfolio of stocks that can help you reach your goals. Heck, they will even help you define your goals.

Betterment also lets you start investing with as little as $10, so you don’t need much cash to open an account.

#7: Farmland Investments with FarmTogether

Perhaps you have heard that investor mogul Bill Gates has been busy buying up farmland across the country. In July of 2022, he purchased 2,100 acres of Farmland in North Dakota, on top of the 270,000 acres of farmland he already owns across dozens of states.

Something is unsettling about one of the world’s richest people buying up farmland to build more wealth, but I digress. Buying farmland is evidently a smart long-term investment since farmers pay rent to use the land. Not only that, but farms bring in millions of dollars in government subsidies, and landowners can get a piece of the pie.

The good news is that regular people can invest in farmland, too. A website called FarmTogether proved this opportunity via sole ownership options, farmland crowdfunding opportunities, or funds that use farmland as the underlying asset.

With farmland crowdfunding, the minimum investment starts at just $15,000, and the typical holding period lasts five to 12 years. You can also opt to invest in FarmTogether’s Sustainable Farmland Fund, which requires a minimum investment of $100,000 and comes with a target net annualized return of 8% to 10% and a net annual target distribution of 4% to 6%.

Just be aware that you may have to be an accredited investor to start with FarmTogether.

#8: Digital Products

Did you know? You can invest in digital products that earn passive income over time, though you’ll typically have to create your own digital product to earn a substantial return here.

This includes eBooks and courses, but you can also create printable products that users buy and print at home.

When it comes to eBooks, writing is the hardest part. Once that’s finished, you can market and sell your eBook online using software programs like CreateSpace. eBooks are one of the strategies people use to make money on Amazon.com.

Online courses can also spin off passive income if you automate the sales process. My own course – The Passive $1K Formula™ – is a good example.

I created the Passive $1K Formula™ to help people learn how to earn passive income entirely from home and on their own terms. However, I also earn passive income with each course I sell.

See how that works?

When coming up with an idea for your online course, consider your areas of expertise or what you’re passionate about. Maybe you love to bake cookies and pies, or perhaps you want to teach other people about investing in crypto.

Whatever you want to teach others about, you can create your own course on a platform like Teachable and watch the money roll in from there.

#9: Renting Your Car

For most people, a car is nothing more than a depreciating asset. You make a huge monthly payment every month, and your car only decreases in value as time passes.

You can turn your car into an income producing asset if you’re willing to share it from time to time. With a website called Turo, you can rent your car out and bring in income for each rental day you can book.

How much can you earn with Turo? That depends on how nice your car is and where you live. A Tesla can easily fetch $100 to $200 per day on the platform, and a Jeep can bring in anywhere from $80 to $150 per day.

#10: Renting Out Your Own Home

You can rent out your home, a room in your home, or outdoor space on your property through Airbnb.com. You can even rent out your mobile home through this platform, provided you have some land to place it on.

Renting out your space can generate plenty of passive income, but some work is involved. For example, you’ll have to do everything that’s expected from a host, from helping resolve issues to cleaning up your place in between guests.

#11: Mineral Rights

Mineral rights are an interesting income-generating asset. Interestingly, you don’t have to own the land to earn cash flow from mineral rights. You just have to purchase the mineral rights themselves.

When you own mineral rights for a property, you are entitled to payments when minerals such as oil, silver, or natural gas are mined from underneath a plot of land.

While mineral rights are harder to get into than other income producing assets, you can browse available mineral rights on websites such as U.S. Mineral Exchange.

#12: Short-Term Vacation Rentals

Short-term vacation rentals are yet another real estate-based income source if you’re willing to work. If you don’t already own a vacation home, make sure you choose properties suitable for vacationers – in tourist destinations, areas ideal for camping or glamping, or properties near desirable urban centers.

One downside of short-term vacation rentals is that, like other types of rental real estate, you’ll need to put down 20% upfront. Real estate prices are incredibly high right now as well, so it might be difficult to find a property with a good return on investment.

Of course, owning short-term rentals is not passive at all. You have to manage reservations for your property, clean between renters, and deal with any issues that pop up. You can hire people to manage these aspects of your short-term vacation rental business for you, but doing so will eat away at your financial returns over time.

#13: Annuities

When you buy an annuity, you’re either making payments or putting down a lump sum of cash. From there, you’ll receive a regular payout for a specific duration of time or the rest of your life.

Annuities are a good example of income producing assets, but they come with their share of risks. For example, annuities tend to be expensive, and exorbitant surrender charges can apply if you need to give up your annuity to get your money back. Annuities also come with tax implications that apply if you have to withdraw money before the age of 59 ½.

You’ll need to research the different types of annuities as well, which can include fixed annuities, fixed-indexed annuities, variable annuities, deferred income annuities, and more.

#14: Owning Your Own Business

Owning your own business is another way to produce income now and later on. For example, a small business you own will produce income while operating it, yet you may also be able to sell your business for a profit later on.

Your small business could be almost anything, but here are some examples:

- A freelance writing or content marketing business

- A small community-based gym

- Carpet cleaning business

- Yoga Studio

- House cleaning business

- Laptop repair business

Ultimately, the small business idea that works for you will depend on your skills, your expertise, and what you’re most passionate about. Just remember that building a business is not passive at all! This income producing asset is probably one of the hardest to build among all the options on this list.

#15: Investing in Small Businesses

Maybe you want to invest in small businesses without building one of your own. In that case, you can become an angel investor who invests in start-up companies with big income potential. You can also invest in various small businesses through a platform called Mainvest.

Mainvest is intriguing since you can get started with as little as $100. They allow you to invest in many small businesses across America, and they vet companies ahead of time.

Investors who start with Mainvest can also secure returns between 10% and 25% with no investor fees. That said, Mainvest was only founded in 2018, so they haven’t been around long enough to know how sustainable their investment options are.

#16: Art Investing

Artwork can be an income-producing asset, and you don’t have to visit galleries or come up with the resources to buy individual pieces. A platform called Masterworks lets you purchase fractional shares of art from famous artists and up-and-coming artists few have ever heard of. Think of it like crowdfunded art investing. And because it’s crowdfunded, you can get started with as little as a few hundred dollars.

According to Masterworks, returns have been exceptional since the company’s founding in 2018. Masterworks says their investors have seen 26.8% in net annualized realized returns since then.

The platform lets you buy and sell your shares on their secondary market. You also receive returns as the art you invest in sells. According to Masterworks, this can take three to ten years, so it’s not as liquid as some other passive income options.

#17: Bonds

Bonds can also provide an ongoing stream of passive income, but you’ll need to do the proper research to know what types of bonds to invest in. One good option for recurring income is bond ETFs, which are commonly used by investors to balance their portfolios.

Popular bond ETFs include the Fidelity Total Bond ETF, the iShares 20+ Year Treasury Bond ETF, and the Vanguard Long-Term Corporate Bond ETF.

You can also consider Series I Savings Bonds right now, which are offering an excellent return of 9.62%. These bonds let you invest up to $10,000 (or $20,000 for a couple) per year, although you must keep your money invested for at least 12 months. You can access your investment after at least one year is up, but you’ll pay a penalty of three months of interest if you cash out your Series I Savings Bonds before five years have passed.

You can purchase bond ETFs through a range of online brokerage firms. If you want to invest in Series I Savings Bonds, you can do so through TreasuryDirect.gov.

#18: Alternative Investments

What makes an alternative investment attractive? They tend to have a low correlation with standard asset classes, like stocks or real estate, making them ideal for portfolio diversification.

One example, Yieldstreet, lets you invest in private markets through sectors like commercial real estate, marine projects, and even art. You can also invest in short-term notes.

The minimum investment with Yieldstreet starts at $500, and the company has shown average net annualized returns of 9.6% since its founding in 2014. They also say that more than 400,000 registered users have invested through their platform so far.

#19: Cryptocurrency

While crypto savings accounts that once offered excellent yields are mostly going the way of the dinosaur, you can still make money with cryptocurrencies like Cosmos and Ethereum. As an example, one popular strategy for earning somewhat passive income is called staking.

According to Coinbase, crypto-taking involves earning rewards for holding certain cryptocurrencies. Essentially, staking lets you put your crypto to work on the blockchain without selling it.

You can also earn money lending crypto to other investors via a crypto exchange. Just remember that crypto is highly volatile in nature and that you may not have any protection against losses if the value of your crypto sinks or the platform you use goes out of business.

#20: Online Brands

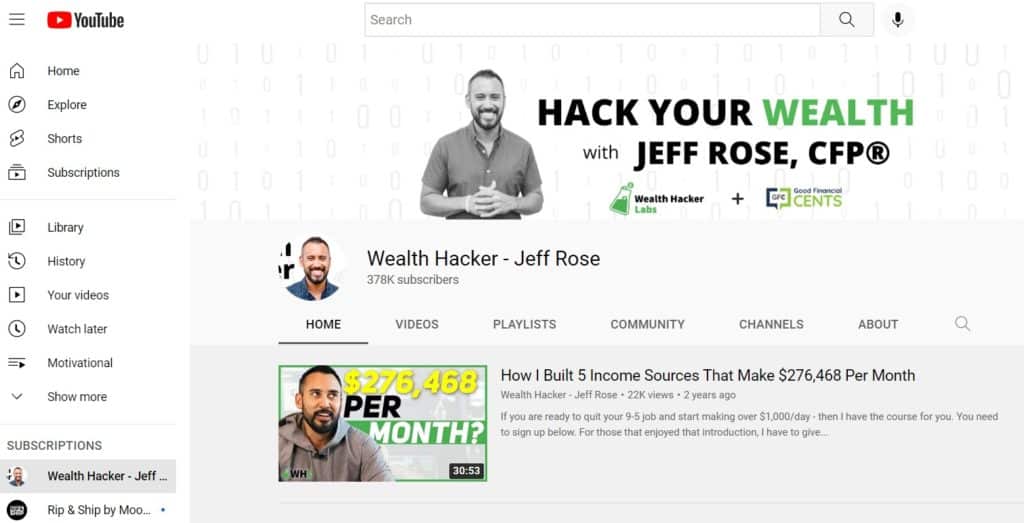

Another income producing asset to build is a social media account, but you don’t have to stick with just one. For example, you can build up a huge Twitter following, grow your Facebook page and start a money-making YouTube channel all at the same time.

If you’re wondering how to make money on YouTube, my Wealth Hacker channel is a good example:

I currently have almost 380,000 followers, and you shouldn’t be surprised that my YouTube channel is monetized to the hilt. Not only do I make money through sponsorships, but I bring in income through ads that run during my videos, too.

Another example is the 𝐓𝐡𝐞 𝐀𝐫𝐭 𝐨𝐟 𝐏𝐮𝐫𝐩𝐨𝐬𝐞 Twitter account, which reportedly makes six figures tweeting about art and self-improvement. The account also has a link to a masterclass you can sign up for in their bio, which helps the owner earn even more money over time.

#21: Royalties

Finally, consider how you could earn income over time through royalties. However, you’ll need an asset that brings in royalties to get a foothold here.

Writing a book is one of the best ways to earn royalties, and I know this firsthand. My book Soldier of Finance: Take Charge of Your Money and Invest in Your Future earns royalties each time someone buys it. I don’t earn much cash for each book sale, but I earn money through volume instead. For example, one book sold may only net me a few dollars in profits, but thousands of books sold net thousands of dollars in my bank account.

If you don’t want to write a book or create something that can earn royalties over time, you can also invest in assets that pay royalties through platforms like Royalty Exchange. This platform and others like it let you invest in movies, songs, and trademarks to earn passive income over time.

You could purchase the Doobie Brothers’ song “Black Water” for $160,000, then receive a yield of 15% for ten years. You could also purchase the 1983 Comedy Classic Trading Places for $140,300, then earn a yield of 6% for as long as the film is shown. Remember that these examples are offered by the platform itself, and past returns are not a guarantee of future results.

The Bottom Line on Adding Income Generating Assets

Income-producing assets can be nearly anything, from a business you build from the ground up to a book or a course you sell over and over again. Fortunately, you don’t have to pick just one of the options from my list. By creating multiple streams of income, you can diversify your finances and grow even more wealth over time.

With that in mind, you should remember that you need money to make money sometimes. While some of the options on this list let you invest with as little as $10, others require you to have $10,000, $100,000, or more just to get your foot in the door.

Either way, your best first step to building up income-generating assets is to get started, no matter where you’re at.