ESG (Environmental, Social, and Governance) is a series of standards that are used to measure the impact that a business or organisation has on the environment and society. It also measures how accountable the business or organisation is for its actions, as well as how transparent it is.

Measuring ESG is becoming more and more essential for businesses and organisations that wish to maintain long-term sustainability goals. It is equally important to investors as well. According to Capital Group’s 2022 Global ESG Study, 89% of investors now consider ESG issues a part of their investment approach. This suggests that businesses that don’t consider ESG are at risk of attracting fewer investors. With ESG goals and investment now at the forefront of many businesses, it’s vital that businesses can confidently answer the question, ‘What exactly is ESG?’.

What is Environmental, Social, and Governance (ESG)?

As mentioned above, ESG refers to the standards used to measure the impact of a business or organisation on the environment and society. Governance (often referring to business transparency and accountability), is equally considered.

The main ESG regulations include the standards of The International Sustainability Standards Board (ISSB), the Task Force on Climate-related Financial Disclosures (TCFD), the EU Green Deal, the EU Taxonomy, The EU’s Corporate Sustainability Reporting Directive, and The EU Sustainable Finance Disclosures Regulation (SFDR) which are mandatory to comply for companies meeting the certain criteria. The international disclosures also include several voluntary frameworks and standards, such as Sustainable Finance Disclosures Regulation (GRI), Sustainable Finance Disclosures Regulation (PRI), and others widely adopted by companies.

Most commonly, businesses will utilise ESG Frameworks to understand how their business is performing overall and within their sector. Frameworks allow businesses and organisations to report on a variety of business operations, as well as spot opportunities and risks related to each of the ESG aspects.

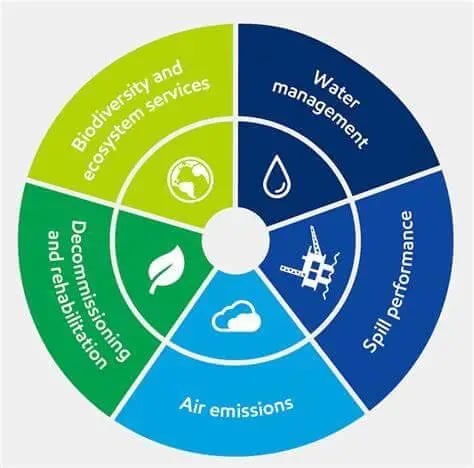

The Rio Impact Framework contains 20 high-level sustainability themes and their underlying factors are used to measure and monitor the impact of an organisation across the Environmental, Social and Governance (ESG) pillars. We additionally look at Economic factors.

But what do each of the elements of ESG specifically refer to?

Environmental (E)

This focuses on assessing how a company or investment impacts the natural environment. It includes factors such as a company’s carbon footprint, greenhouse gas emissions, energy efficiency, water usage, waste management, biodiversity, and other environmental practices. Environmental considerations are essential for evaluating a company’s efforts to mitigate climate change, reduce pollution, conserve resources, and operate in an environmentally responsible manner.

Rio Impact Framework

Responsible Resource Management

The way an organisation manages resources is a key illustrator of efficiency and process control. Every organisation consumes energy and water and produces waste. These factors are therefore a core illustration of sustainability performance.

Climate Change (Climate Risk, Carbon & GHG Accounting)

GHG emissions are the primary driver of rising global temperatures and therefore a key focus for policy, regulatory, market and technology responses to limit climate change. As a result, business models associated with significant emissions are likely to be more impacted by risks in the transition to a low-carbon economy.

Pollution Prevention & Control

Pollution prevention and control refers to the practices, strategies, and regulations aimed at reducing, mitigating, or eliminating the release of pollutants into the environment to protect human health and the planet’s ecosystems. It involves identifying and implementing measures to prevent pollution from occurring in the first place and controlling it if it does occur.

Biodiversity, Nature, Land Use & Conservation

Biodiversity and nature conservation are crucial for the well-being of the planet and all life forms that inhabit it. Biodiversity refers to the variety of species, ecosystems, and genetic diversity within and between them. It provides numerous benefits, such as ecosystem services like clean air and water, nutrient cycling, pollination, and climate regulation. Preserving biodiversity is essential for maintaining the stability and resilience of ecosystems, which in turn supports human livelihoods, food security, and economic development.

Additionally, nature conservation helps protect endangered species from extinction, preserves unique habitats, and promotes the sustainable use of natural resources. It also offers opportunities for scientific research, education, and recreation, fostering a deeper connection between humans and the natural world. Ultimately, biodiversity and nature conservation are fundamental for a healthy and sustainable planet, ensuring the survival and well-being of both current and future generations.

Sustainable travel & transport

Sustainable travel and transport are of paramount importance as they promote environmental conservation, reduce carbon emissions, and contribute to a more sustainable future. By adopting sustainable practices in travel and transport, such as using public transportation, cycling, or walking, and opting for fuel-efficient vehicles or alternative fuels, we can minimise the carbon footprint associated with transportation.

This helps mitigate climate change, improve air quality, and reduce congestion and noise pollution in urban areas. Sustainable travel and transport also support local economies, preserve cultural heritage, and encourage responsible tourism, ensuring that future generations can continue to enjoy the beauty and diversity of our world.

The importance of Environmental factors for investors

From an investment perspective, the environmental element of ESG is the largest consideration for the majority of ESG investors. According to a 2022 ESG Global Study from Harvard Law School, investors continued to primarily allocate their attention to the “E” component of ESG, which exhibited a slight increase in prominence compared to the previous year, with figures of 47% in 2022 versus 44% in 2021. This shift underscores the growing significance of the Environmental aspect within ESG for investors.

When considering Environment businesses and organisations need to look closely at everything from the products and services they provide to the effects of their operations and supply chains.

With these elements in mind, operations directors, managing directors and CEOs should consider looking into practices like:

- How to reduce energy usage in the workplace. This could be to simply remind teams to turn off electronics, or could be an entire switch to renewable energy sources. Vehicles should also be considered in these considerations, if company cars are used and deliveries are made by team members.

- Encouraging team members to recycle and reduce waste. If you create lots of waste as a part of your operations, this is a particularly important element to consider.

- Looking into sustainable, reusable or biodegradable packaging, both for internal use and for deliveries.

- Providing carpooling opportunities for staff, or offering hybrid or remote work to reduce carbon emissions by travel.

- Developing products that offer similar functionality, but are manufactured in more eco-friendly ways, and are in themselves better for the environment (recyclable, compostable, reusable etc.).

When you review environmental factors in your business or organisation, you must consider how your future actions reflect your commitment to sustainability. If you are not seen trying to make improvements to your long-term performance and risk management alongside being more sustainably-minded, it may affect your ESG rating.

Social (S)

The Social elements of ESG revolve around how businesses affect things like workplace culture and society as a whole.

According to the 2022 ESG Global Study from Harvard Law School, Social elements hold the smallest share of ESG investment interests, although 41% of investors also think that Social issues are largely overlooked, due to the climate change debate.

As climate change will be an ongoing topic for the foreseeable future, shifts towards social interests likely won’t change too dramatically. Nonetheless, it is vital to consider and can have a profound impact not only on investment opportunities but also on brand reputation and workplace efficiency.

Ultimately, when considering the Social aspects of ESG, businesses and organisations should look towards how they can make their workplaces more equitable. This includes understanding how their product impacts wider society, how they contribute to society as a business or organisation, and how local communities and others in their supply chain are affected.

Rio Impact Framework

Pay equality and fair wage

Pay equality and fair wages are of critical importance for creating a just and equitable society. Ensuring that all employees, regardless of their gender, race, ethnicity, or any other characteristic, receive equal pay for equal work helps combat discrimination and promotes diversity and inclusion in the workplace. Fair wages not only provide employees with the means to support themselves and their families but also enhance their job satisfaction and overall well-being, leading to increased productivity and employee loyalty. By valuing and compensating employees fairly, organisations can foster a positive work culture, attract top talent, and contribute to a more socially responsible and sustainable business environment. Additionally, pay equality and fair wages are fundamental to reducing income inequality and fostering economic growth and stability within communities and societies at large.

Diversity, inclusion & equity

Diversity inclusion and equal opportunities are crucial for building a more inclusive, innovative, and thriving society. Embracing diversity means valuing and respecting individuals from different backgrounds, perspectives, and experiences, creating a rich tapestry of ideas and talents. Inclusive environments promote collaboration and creativity, leading to better problem-solving and decision-making processes. By providing equal opportunities for all, regardless of gender, race, ethnicity, sexual orientation, or other characteristics, we break down barriers and give everyone a fair chance to succeed, fostering social mobility and reducing systemic inequalities. Embracing diversity and ensuring equal opportunities not only enriches organisations and communities but also leads to a more just and harmonious world, where everyone can reach their full potential and contribute meaningfully to society’s progress.

Health, safety & well-being

Health, safety, and well-being are essential for a thriving society, as they promote personal fulfilment, increased productivity, and reduced healthcare costs. Prioritising these aspects creates a positive work environment, fosters social cohesion, and enhances an organisation’s reputation, leading to stronger communities and economic stability. Emphasising health, safety, and well-being aligns with sustainable development goals, ensuring a brighter future for individuals, businesses, and the overall well-being of society.

Skills & education

Skills and education are of paramount importance as they empower individuals with the knowledge, competencies, and abilities needed to succeed in their personal and professional lives. Education equips individuals with critical thinking, problem-solving, and communication skills, fostering personal growth and lifelong learning. It opens doors to better opportunities, higher earning potential, and improved socio-economic mobility. Moreover, a skilled and educated workforce drives innovation, economic growth, and societal progress, making investments in education crucial for building a prosperous and inclusive society.

Community engagement

Community engagement is of immense importance for a business as it fosters positive relationships, builds trust, and creates a strong support network within the local community. By actively involving and listening to community members, businesses can gain valuable insights, understand local needs, and tailor their products and services accordingly. Engaging with the community also demonstrates corporate social responsibility, enhancing the company’s reputation and attracting loyal customers. Additionally, community engagement promotes a collaborative approach to problem-solving and decision-making, leading to sustainable solutions that benefit both the business and the community it serves.

Governance (G)

The final factor to consider in ESG, Governance refers to how transparent you are as a business or organisation with your stakeholders about your activities. The ethical behaviour of the business or organisation is also considered, alongside the processes behind manufacturing, logistics and reporting.

Naturally, the Environmental and Social aspects of ESG are strongly linked to Governance, which requires businesses and organisations to effectively report on the transparency and decision-making processes behind each element of each aspect.

Interest in Governance has dipped slightly from 2021 to 2022, shifting from 31% interest to 27% interest. Considering how much interest is now placed in Environmental issues, it is no surprise that investors might have more of an interest in seeing environmental action over the governance of those actions.

Still, 27% of all interest is a good portion, and with that in mind, businesses and organisations should look into these elements to attract investors:

- Ethical business practices, for instance, ensuring that suitable bribery prevention is in place, and preventing trade secret misappropriation, unethical accounting, and more.

- Transparent salaries for teams, with emphasis on executives in particular.

- Ensuring that stakeholders are reported to in regards to operations, financial performance, carbon emission target tracking, and overall business strategy.

- Ensuring a diverse leadership team and the Board of Directors.

- Ensuring accountability among leadership teams and wider management.

Rio Impact Framework

Governance comprises the following aspects in the Rio impact framework:

Purpose

Defining a clear corporate purpose is essential for businesses as it provides a unifying vision and direction for all stakeholders. A well-defined purpose guides strategic decision-making, shapes company culture, and helps align business practices with societal and environmental goals. It drives innovation, attracts talent, and fosters long-term sustainability by creating a meaningful and positive impact on customers, employees, and the wider community.

Governing body quality

The composition of a governing body, such as a board of directors, significantly impacts a business’s performance and ethical behaviour. Having a diverse and skilled board with individuals from different backgrounds and expertise promotes effective governance, better decision-making, and a broader range of perspectives. A well-balanced governing body fosters accountability, transparency, and strategic oversight, leading to increased trust from stakeholders and better overall corporate performance.

Stakeholder engagement

Engaging with stakeholders is crucial for businesses as it fosters open communication, builds relationships, and enhances trust. Understanding and responding to stakeholders’ needs, concerns, and expectations help companies make more informed decisions that align with societal and environmental interests. Meaningful stakeholder engagement also mitigates risks, identifies opportunities for innovation and collaboration, and supports a company’s social licence to operate.

Business ethics

Business ethics are integral to a company’s reputation, culture, and long-term success. Acting ethically fosters trust among customers, employees, investors, and partners, leading to stronger relationships and loyalty. Ethical practices also mitigate legal and reputational risks, ensure compliance with regulations, and safeguard the well-being of employees and stakeholders. Emphasising business ethics creates a positive work environment, strengthens the company’s brand, and contributes to a sustainable business model.

Compliance, risk and opportunity oversight

Effective oversight of compliance, risk management, and opportunities is essential for a business to operate responsibly and sustainably. A robust compliance framework ensures adherence to laws, regulations, and ethical standards, reducing legal and reputational risks. Active risk management identifies and addresses potential threats, leading to increased resilience and better decision-making. Moreover, seizing opportunities through thorough analysis and evaluation allows businesses to stay competitive, innovate, and capitalise on emerging trends and markets, leading to long-term growth and success.

The importance of Governance factors for investors

Effective Governance has multiple benefits alongside attracting investors. It also helps to improve the reputation of your business or organisation, which in turn improves its long-term viability.

By building on the above elements of Governance, businesses and organisations can continue working towards a sustainable business model. You will also find improvements to your ESG score while attracting responsible investors.

What does ESG mean for my business or organisation?

To put it short – ESG in your business or organisation means making both short and long-term goals to meet the standards for further investment opportunities.

ESG for your business or organisation also means:

- Reducing your carbon emissions, reducing waste, and dealing with pollution.

- Creating a diverse workplace that is inclusive and accountable.

- Working with communities to improve standards of living.

- Reporting openly and honestly about goals.

- Making realistic environmental goals, and keeping to them.

Meeting the standards laid out in your ESG strategy is very much a long-term goal, and there may be elements of it that are time-consuming or expensive. The potential for investment in ESG companies is very high though, and as such the initial transition will be worthwhile. Beyond investment, you will also be working towards a business or organisation that is robust and has long-term sustainability, which is vital in today’s climate.

What is an ESG Strategy?

An ESG strategy is the method you will use to meet your ESG goals. They often include these three elements:

- Regulatory compliances associated with ESG in your country

- Identifying your stakeholders and how you will engage with them

- The framework of your ESG, and the roadmap to meet long and short-term targets

Consider making your ESG strategy as detailed and structured as possible, so you can easily review progress made and update it to meet new compliances.

You should also consider utilising ESG tracking and reporting software for your ESG strategy. ESG platforms allow you to easily monitor your efforts, using AI to effectively report on utilities and other resources, alongside social impact and carbon footprinting.

ESG Answered

There are many aspects to ESG, both from a business perspective and an investor perspective, that need to be considered.

From a business standpoint, meeting ESG standards is a great way to improve your reputation, and enhance your prospects for long-term success.

Investors are also keen to see their investments go towards a business that is aligning itself with long-term success. From the perspective of many investors, ESG is a rapidly growing and shifting area of investment that offers great potential. It also provides the added benefit of allowing them to invest in line with their values to bring around positive change.

Both businesses and investors should practise due diligence with ESG, though. Thanks to the broad nature of this investment approach, businesses must ensure that they are creating achievable targets, to stem any claims of greenwashing. Investors must also ensure that research is undertaken into their investments, to ensure that they are not investing their money into a business that is not meeting their standards and values.

Speak to Rio

If you would like to learn more about ESG, consider taking one of our ESG eLearning courses today. These courses are designed to provide your business or organisation with the knowledge to approach ESG standards confidently and begin making those environmental and socially-minded decisions.

Rio also provides a powerful AI-driven ESG platform that aids businesses in tracking and reporting on their ESG efforts. Through Rio ESG, you can also align your business with the right ESG framework, ensure you are targeting the right ISO management systems, and accurately measure your social impact.

For more information, get in touch with a member of the Rio team today.