Preferred shares are complicated investments only suitable for knowledgeable investors

Article content

In an increasingly complex world, the Financial Post should be the first place you look for answers. Our FP Answers initiative puts readers in the driver’s seat: you submit questions and our reporters find answers not just for you, but for all our readers. Today, we answer a question from Elmar about preferred shares.

Advertisement 2

Article content

Article content

By Julie Cazzin with Allan Norman

Q: I am heavily invested in preferred shares. Is it right to stay there in today’s market? Or should I seek out different investments? — Elmar

FP Answers: Elmar, if you are an experienced preferred-share investor, then you know you’ve given me a difficult question to answer with the limited information you’ve provided. What type of preferred shares are you holding: retractable, rate reset, perpetual, fixed floating or floating rate?

Probably the best way for me to answer your question is to explain why I think people invest in preferred shares, give a brief description, provide an example of what I think you’re seeing on your investment statement, and then discuss your options based on the example.

Advertisement 3

Article content

I suspect most people invest in preferred shares for the tax-efficient dividend income. It’s generally higher than guaranteed investment certificate (GIC) or bond income, and there is a perceived safety in owning preferred over common shares.

Preferred shares are equity investments that pay a fixed dividend, but they don’t share in the growth of the issuing company like common shares do. If the issuing company goes bankrupt, bond holders will be paid out first, followed by preferred shareholders and then common shareholders. In reality, I doubt preferred shareholders will receive anything if the issuing company goes bankrupt.

The share value of a preferred share will rise and fall with changes in interest rates, similar to a bond. Share value goes down when interest rates go up, and share value goes up when interest rates go down. Unlike bonds, there is no maturity date, so the dividend payments in most cases never end, unless the issuing company calls to redeem the preferred share or goes bankrupt.

Advertisement 4

Article content

The issuing company will most likely redeem a preferred share when it is in their best interest to do so. This may happen when a new preferred share can be issued at a lower dividend rate than the current rate.

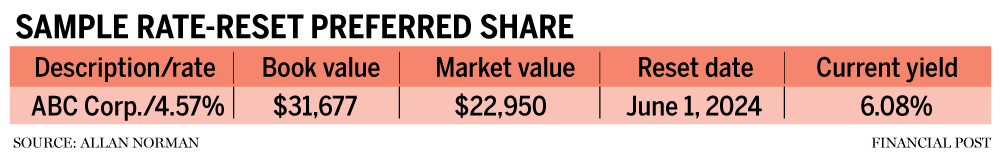

Rate-reset preferred shares are the most common type of preferred shares in Canada and the accompanying table shows a real example of what a rate-reset preferred share may look like on an investment statement right now:

The table tells you a few things: the dividend rate at issue, or at last reset, was 4.57 per cent; if sold today, the capital loss would be $8,727 (book value minus market value); and the current yield is 6.08 per cent, or annual dividend payments of $1,395 ($22,950 times 6.08 per cent).

Elmar, based on what’s presented in the table, should you hold or sell this preferred share? It depends on how you like to invest, your goals, when you need the money and other factors, coupled with some future unknowns such as changing interest rates.

Advertisement 5

Article content

If you hold, you will continue to collect the dividends even though the share value is down. It isn’t too different from having a rental property drop in value while the rental income continues. In the case of a rental property, you likely wouldn’t sell the rental if your primary goal is income, or you would wait until the property went back up in value before selling.

If interest rates continue to go up, the value of the preferred share is likely to go down. However, there will be a rate reset in 2024 based on the five-year Bank of Canada bond yield plus a spread. Under that scenario, you will receive a higher dividend payment in 2024.

Ideally, once the new dividend rate has been set in 2024, interest rates will start to fall, causing your share price to rise. The catch is, if interest rates fall too much, the issuing company may redeem the shares at the issue price. This is why preferred shares have limited upside potential, but that may not be a concern to income-oriented investors.

Advertisement 6

Article content

-

FP Answers: The Bank of Canada lost $522 million in three months — here’s why

-

FP Answers: Should I commute my pension and take $1.1 million to retire now?

-

FP Answers: Is paying down my mortgage or investing in RESPs the better choice?

-

FP Answers: Where to find help to launch your business into emerging markets

Selling preferred shares in a non-registered, or cash, account, means creating a capital loss of $8,727 in our example, which can be indefinitely carried forward to offset future capital gains or those earned in the past three years, or it can be applied against income from a registered retirement savings plan or registered retirement income fund in the year of death.

If your intention is to sell and reinvest, then I’m going to assume your goal is to make back your capital loss faster than if you continue to hold the preferred share.

Advertisement 7

Article content

Is there an alternative investment opportunity right now that you’d be comfortable with? For example, do you see down markets as a buying opportunity with the potential for markets to recover faster than the preferred shares?

Alternatively, if dividend income is important to you, are there any dividend-paying stocks with a similar dividend rate to your preferred share?

There is no clear winning choice here, Elmar, and, as I hope you can see, it depends. Preferred shares are complicated investments and I think they are only suitable for knowledgeable investors.

Allan Norman, M.Sc., CFP, CIM, RWM, provides fee-only certified financial planning services through Atlantis Financial Inc., and is registered as an investment adviser with Aligned Capital Partners Inc. He can be reached at www.atlantisfinancial.ca or [email protected]. This commentary is provided as a general source of information and is not intended to be personalized investment advice.

_____________________________________________________________

If you liked this story, sign up for more in the FP Investor newsletter.

_____________________________________________________________