But while rising GOP leaders tout efforts to derail sustainable investing, pushback from pension officials and banking associations is growing.

Article content

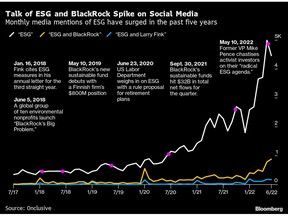

(Bloomberg) — The investing strategy known as ESG is under attack, and virtually no one expects the backlash to die down.

Advertisement 2

Article content

More than a dozen Republican state attorneys general have blasted ESG financial practices, while Republicans in Congress plan to increase their scrutiny of what they call “woke capitalism.” One of their main complaints is that environmental, social and governance investing is part of a broader Democratic effort to prioritize climate change and other societal issues to the detriment of the fossil-fuel industry.

Article content

The political assault by the right is backed by some of the party’s biggest names, including former Vice President Mike Pence and the governors of Florida and Texas, Ron DeSantis and Greg Abbott. Pence and DeSantis are widely seen as potential 2024 presidential candidates. Wealthy GOP supporters such as Peter Thiel, as well as billionaire Elon Musk, also have criticized ESG. And there’s a long list of right-wing activists such as Leonard Leo who have spoken out against BlackRock Inc. and other Wall Street giants they claim are catering to a Democratic agenda.

Advertisement 3

Article content

Such a coordinated political attack on the finance industry may be without precedent, said Jill Fisch, a professor of business law at University of Pennsylvania, who’s tracked corporate-governance issues for more than three decades. Fisch notes that there’s “big money behind the scenes,” what with Big Oil among the more generous backers of GOP candidates. “I don’t see it going away,” she said.

That’s particularly bad news for BlackRock, the world’s largest asset manager and a vocal backer of ESG. Florida and at least six other states have already announced plans to pull funds from the New York-based firm.

The acronym ESG was coined almost two decades ago with the idea that investors should take into account environmental, social and corporate governance risks in their financial calculations. Today, roughly $8.4 trillion is invested in ESG-related products. But according to Republican politicians like DeSantis, ESG “sacrifices returns at the altar of the select few, unelected corporate elites and their radical woke agendas.”

Advertisement 4

Article content

DeSantis has proposed a framework for anti-ESG bills that Florida lawmakers are expected to take up in their next session in March. The proposed legislation will prohibit state money managers from considering ESG factors when investing funds. Meanwhile Florida’s chief financial officer, Jimmy Patronis, is pulling $2 billion from BlackRock in the largest anti-ESG withdrawal announced by any state, and has advised the state’s investment arm to stop working with the firm, signaling that further withdrawals may happen.

In Texas, legislation is already being crafted to restrict the use of ESG criteria. House Bill 645 would prohibit financial institutions from using what it calls “value-based criteria” in their business practices. For example, it says that banks can’t discriminate or advocate for a person based on their social media activity, political affiliation or ESG standards. The legislation will likely be among a plethora of bills proposed in Texas, some arguably more political than practical, that target environmental or social policies.

Advertisement 5

Article content

Oklahoma lawmakers will consider a bill filed by state Senator Casey Murdock that would prohibit government entities from contracting with companies that have restrictive firearms policies, according to the state’s legislative website. The move follows a nearly identical 2021 Texas law, which temporarily halted a handful of banks from underwriting municipal bond deals in the state.

With the new Congress split between a Republican-controlled House and Democratic-controlled Senate, anti-ESG legislation is likely to go nowhere in Washington over the next two years. But that isn’t stopping GOP members from making proposals.

In the US Senate, five Republicans, including Tom Cotton of Arkansas and Marsha Blackburn of Tennessee, wrote a letter in November to dozens of law firms perceived as helping the ESG strategy that says Congress plans to use its oversight powers to see if antitrust violations are “being committed in the name of ESG.”

Advertisement 6

Article content

And US Representative Andy Barr of Kentucky, one of the top Republicans on the House Financial Services Committee, has said that he and his colleagues will be “exercising rigorous oversight of both regulators and private sector asset managers who have politicized capital allocation that damages American workers, retirees, and discriminates against US energy producers.”

Last March, Barr and US Congressman Rick Allen of Georgia introduced the Ensuring Sound Guidance (ESG) Act to separate retail investors’ retirement and investment accounts from asset managers who put environmental and social goals ahead of returns. It’s likely the proposed bill will be pushed again next year.

Read More…

- BlackRock Struggles to Escape From the ESG Crossfire: Timeline

- Florida Escalates ESG War, Says Fink ‘Did It to Himself’

- Ex-Tabloid Reporter Who Coined ESG Label Says Backlash Is Good

Advertisement 7

Article content

As the anti-ESG campaign steams ahead, some pension officials and banking groups in Republican-dominated states have over the past year begun to question GOP claims that ESG is bad for investors. For example, the idea that BlackRock—one of the world’s biggest shareholders of fossil-fuel companies—puts sustainability above profits has been disputed by John Broussard, the assistant state treasurer and chief investment officer for Louisiana, a state with a massive fossil-fuel industry footprint.

After reading the 2022 letter sent by BlackRock Chief Executive Officer Larry Fink to corporate executives, Broussard concluded that what Fink is “really talking about is the investment opportunity this movement represents,” according to copies of emails gathered by the watchdog group Documented.

Advertisement 8

Article content

Broussard indicated that the public debate over ESG didn’t reflect Fink’s words.

In the letter, Fink said: “BlackRock doesn’t pursue divestment from oil and gas companies as a policy.” He added that “foresighted companies across a wide range of carbon-intensive sectors are transforming their businesses and their actions are a critical part of decarbonization. We believe the companies leading the transition present a vital investment opportunity for our clients and driving capital towards these phoenixes will be essential to achieving a net-zero world.”Broussard wrote in a Jan. 25 email to Louisiana’s state treasurer that “it’s kind of amazing how much the actual letter differs from so many news reports about the letter.” Through a spokeswoman, he declined to comment about the emails.

Advertisement 9

Article content

Broussard’s emails did little to slow a GOP intent on both vilifying ESG and making an example out of BlackRock. In October, Louisiana decided to remove almost $800 million in state funds from the asset manager, claiming the firm’s “blatantly anti-fossil policies would destroy Louisiana’s economy.” The action was taken despite the fact that BlackRock is among the world’s largest investors in oil giants including Exxon Mobil Corp. and Chevron Corp., largely through its index-tracking funds.

In Kansas, Alan Conroy, executive director of the state’s Public Employee Retirement System, raised doubts in March about a state bill that would ban the retirement plan from hiring firms that shun fossil fuels. He wrote in an email that passage of the law would cost the pension as much as $82 million a year, according to Documented, which gathered copies of the emails. The bill ended up being rejected. A spokeswoman for the Kansas Public Employees Retirement System, which manages about $20 billion, declined to comment on the emails.

Advertisement 10

Article content

And in one of the first legal actions taken against those criticizing ESG, a Kentucky banking group sued Daniel Cameron, the state’s attorney general, in October, accusing him of overstepping his authority when he launched an investigation into Wall Street banks’ use of ESG factors. The Kentucky Bankers Association said the attorney general was exceeding his powers, acting outside his jurisdiction and “wasting and improperly spending taxpayer funds in his improper efforts to do so.” The attorney general has filed a motion to dismiss the lawsuit.Joshua Lichtenstein, a partner at law firm Ropes & Gray LLP in New York, said such litigation may rein in some of the more dubious Republican legislative attacks on ESG. “Lawsuits like this will cause the red states to get smarter and more precise about what they try to restrict,” he said.

Advertisement 11

Article content

The reality is that roughly 20 of the 35 anti-ESG-related bills introduced during the past two years failed to become law, according to estimates from law firm Debevoise & Plimpton LLP in New York. Given the success rate, it will be interesting to see going forward whether Democrat-led states press asset managers to uphold their ESG commitments in the face of GOP criticism, said Ropes & Gray’s Lichtenstein. “In 2022, the pressure was more one sided, but that may not hold in 2023 and beyond,’’ he said.

Andy Puzder, an adviser to former President Donald Trump who helped shape some of the bills that are set to be introduced, has said he would be happy if five of the proposals he worked on became law in 2023.

—With assistance from Nic Querolo.