On Friday, President Joe Biden intervened to block the $14 billion acquisition of U.S. Steel by Japan’s Nippon Steel, citing concerns over U.S. national security. In a statement, Biden emphasized that maintaining domestic steel production is crucial for the nation’s strength and security, particularly given the role that steel plays in military and infrastructure needs.

National Security Considerations

The Biden administration’s decision underscores the strategic importance of steel manufacturing in the United States. Steel is essential for various critical sectors, including defense, energy, and construction, and the administration has argued that allowing a foreign entity to control such a significant part of U.S. steel production could jeopardize the country’s ability to respond to national security challenges.

“Without domestic steel production and domestic steel workers, our nation is less strong and less secure,” Biden said, framing the move within a broader context of protecting U.S. industries vital for national defense. Steel is a foundational material used in military equipment, infrastructure projects, and energy systems, and having a secure, independent supply of it is seen as paramount in ensuring the country’s economic and strategic interests are protected.

Implications for U.S. Steel Industry

The proposed deal, which would have seen Nippon Steel acquire one of the largest U.S. steel producers, raised concerns about potential job losses and the shifting of key production assets abroad. U.S. Steel, a major player in the steel industry, employs thousands of workers across the country, and the potential transfer of control to a foreign company led to worries about the long-term sustainability of these jobs and the impact on the U.S. economy.

The Biden administration’s decision to block the acquisition is likely to have ripple effects on the U.S. steel industry. While the move is seen as a win for labor unions and domestic manufacturing advocates, it also signals increased scrutiny of foreign investments in critical U.S. industries. The government is expected to continue evaluating mergers and acquisitions in sectors deemed critical to national security, such as defense, energy, and technology.

Global Impact and Trade Relations

The decision also reflects broader tensions between the U.S. and foreign entities regarding the control of key industries. While the U.S. has long been a proponent of free-market trade, national security concerns are increasingly driving policy decisions, particularly in sectors vital to the country’s infrastructure and defense capabilities.

For Nippon Steel, this decision marks a setback in its attempts to expand its footprint in the global steel market. As one of the largest steel producers in the world, Nippon Steel had hoped to gain greater access to the U.S. market and benefit from synergies with U.S. Steel’s operations. However, the Biden administration’s action demonstrates a clear willingness to prioritize national security over international corporate interests.

Looking Forward: U.S. Industrial Policy

The Biden administration’s stance on this acquisition signals a broader trend toward rethinking U.S. industrial policy. With increasing competition from China and other countries in critical sectors, the U.S. is placing more emphasis on preserving domestic industries that are considered vital for national security.

This decision could pave the way for further regulatory scrutiny of foreign acquisitions in the U.S. and the implementation of policies aimed at strengthening domestic manufacturing capabilities. In particular, sectors such as steel, semiconductors, and rare earth minerals, which are vital to both the economy and national defense, are likely to receive heightened attention from policymakers.

Conclusion

President Biden’s decision to block the $14 billion acquisition of U.S. Steel by Nippon Steel is a significant move aimed at protecting U.S. national security and preserving domestic manufacturing capacity. The decision highlights the importance of strategic industries like steel and the role they play in ensuring the country’s defense readiness and economic resilience. As tensions over foreign investments in critical sectors continue to grow, this case sets a precedent for future government intervention in corporate mergers and acquisitions with national security implications.

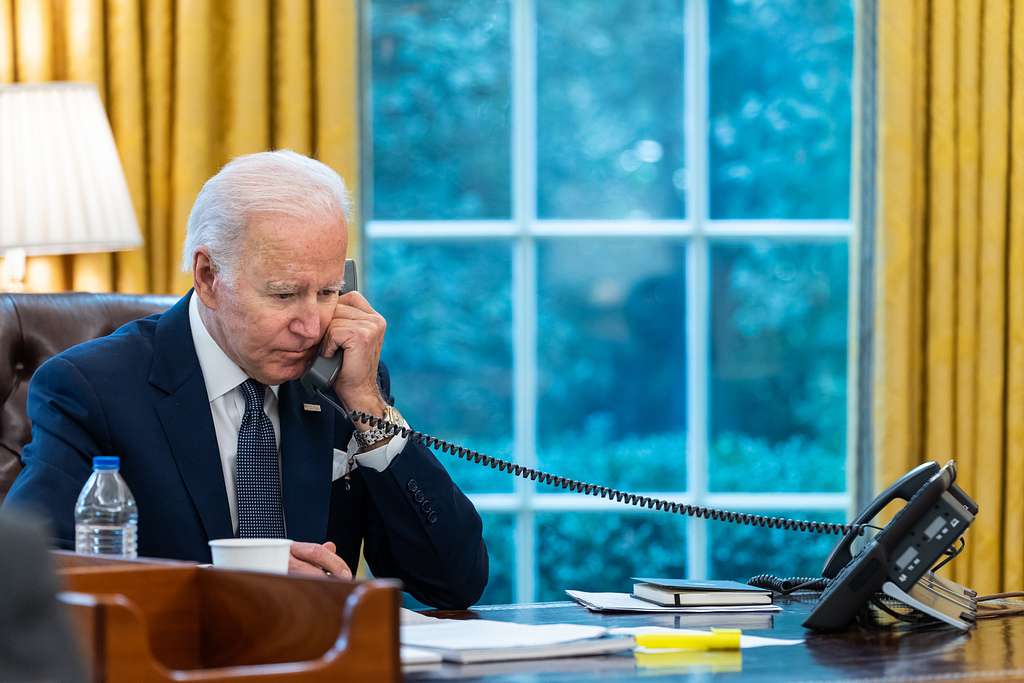

Picture by The White House on http://commons.wikimedia.org/