Why Comparing Deepseek, Nvidia, and Intel is a Misguided Investment Strategy

In the fast-evolving technology sector, investors often make the mistake of comparing companies from different verticals under the same industry umbrella. A common example of this error is the tendency to analyze Deepseek, a software platform, alongside Nvidia and Intel—two hardware giants. While all three companies operate within the broader technology sector, their business models, revenue drivers, and innovation strategies are fundamentally distinct.

Distinct Business Models: Software vs. Hardware

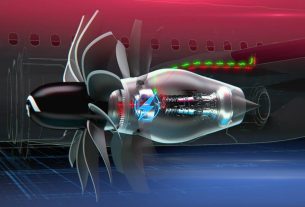

Deepseek is primarily a software platform that leverages underlying hardware. Its focus is on reducing development costs through software efficiencies and innovations. In contrast, Nvidia is a hardware-centric company, best known for its graphics processing units (GPUs), which power everything from gaming to artificial intelligence (AI). Similarly, Intel, like Nvidia, is a leading hardware manufacturer, specializing in semiconductors, microprocessors, and integrated circuits that are essential for computing systems.

While all three companies play a role in the broader tech ecosystem, the comparison between them based on cost-effectiveness or profitability metrics is misguided. Software companies like Deepseek face different challenges, cost structures, and growth factors than hardware companies like Nvidia and Intel, which focus on research, development, and manufacturing of high-performance chips.

Why This Comparison Doesn’t Hold Up

Basing investment decisions on direct comparisons between Deepseek, Nvidia, and Intel overlooks the fundamental differences in their operations and market dynamics. For instance, Deepseek’s ability to innovate and reduce development costs is centered around software optimization, scaling the platform, and attracting users. Its success hinges on leveraging data and software improvements, not on the physical infrastructure required by hardware companies.

On the other hand, both Nvidia and Intel’s primary revenue drivers come from manufacturing and selling cutting-edge hardware. Nvidia’s GPUs are crucial for sectors like gaming, data centers, and AI, while Intel continues to be a dominant player in semiconductors, powering everything from personal computers to enterprise servers. The nature of hardware innovation, from production costs to supply chain logistics, places these companies in a different investment category compared to software-based firms like Deepseek.

The Core of Their Success: Different Drivers for Each

While the technology sector is intertwined, each company has its own unique growth engine:

- Deepseek: Success for a software platform like Deepseek is driven by platform adoption, user growth, and scalable software solutions. Reduced development costs improve margins, but the core focus is on enhancing the software product and user experience.

- Nvidia: Nvidia’s strength lies in hardware innovation, technological breakthroughs in GPU design, and its position as a market leader in high-performance computing for AI, graphics, and gaming. Nvidia’s growth is fueled by hardware sales and partnerships in sectors like AI research and cloud computing.

- Intel: Intel, similar to Nvidia, thrives on its hardware expertise—specifically in microprocessors and chips that power global computing infrastructure. Intel’s continued leadership in chip manufacturing and technological development drives its revenue growth and market position.

A More Nuanced Approach to Investment Analysis

Rather than making the error of directly comparing Deepseek with hardware giants like Nvidia and Intel, investors should focus on the specific dynamics at play for each company. Deepseek’s future will depend on software innovation, platform expansion, and customer acquisition, whereas Nvidia and Intel will be focused on technological advancements in hardware, supply chain management, and scaling manufacturing capabilities.

Understanding the differences in business models is key. Hardware companies face substantial R&D costs, long production cycles, and supply chain complexities. Software companies, by contrast, generally require less capital expenditure and can scale more rapidly, but are heavily dependent on user adoption and software improvements.

Conclusion

The practice of comparing a software platform like Deepseek with hardware-centric giants like Nvidia and Intel is a risky strategy for investors. Each of these companies operates in distinct verticals, with unique growth drivers, challenges, and opportunities. To make informed investment decisions, it’s essential to recognize and evaluate these differences rather than conflating software and hardware sectors under a single investment lens. By doing so, investors can develop a deeper understanding of each company’s potential and align their portfolios with the right opportunities for growth.