Iberdrola has become the first company worldwide to issue a €750 million green bond that complies with both the European Union Green Bond Standard (EU GBS) and the International Capital Market Association (ICMA) Green Bond Principles. This 10-year bond, offering a 3.5% coupon, underscores Iberdrola’s commitment to sustainable finance and positions it at the forefront of global green investment.

Key Highlights:

- Oversubscription: The bond attracted demand exceeding €4 billion, reflecting strong investor confidence in Iberdrola’s green initiatives.

- Investor Distribution: The issuance saw participation from over 220 investors, with significant interest from France (36%), Germany (16%), the UK (17%), Benelux (15%), and other European countries (16%).

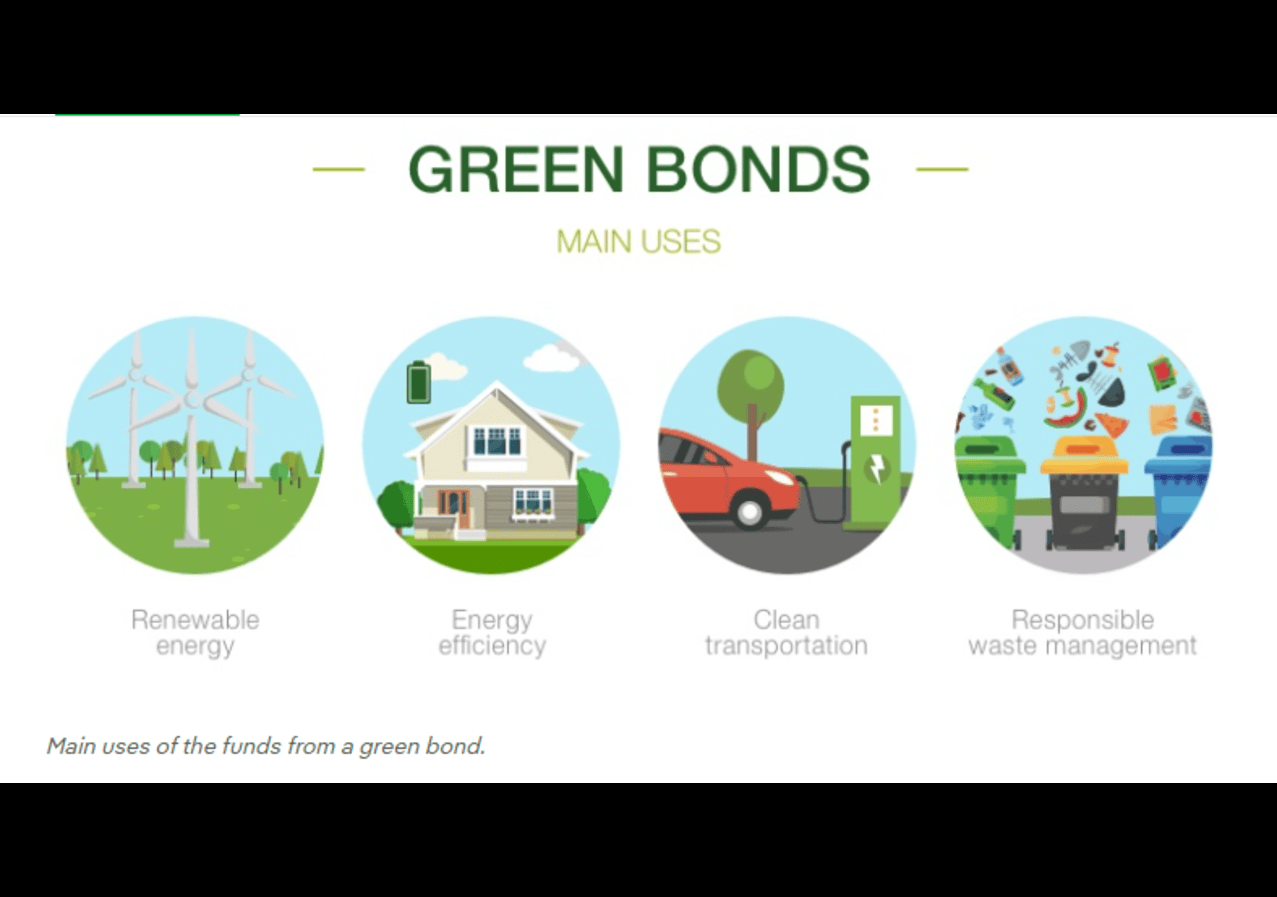

- Use of Proceeds: Funds raised will finance and refinance renewable energy projects, supporting Iberdrola’s sustainability goals.

Strategic Implications:

This issuance not only reinforces Iberdrola’s leadership in the renewable energy sector but also sets a benchmark for future green financing. By aligning with both EU and ICMA standards, Iberdrola demonstrates its commitment to transparency and accountability in sustainable investments.

For more information on Iberdrola’s green bond issuance, visit ESG News.

Green bonds usage Image by Iberdrola.