Saving for old age is challenging for most people, but recent data suggest women are less likely than men to consider their retirement savings on-track. Nearly half of women find making retirement savings decisions to be complicated and confusing and nearly six in 10 women feel they do not earn enough to save for retirement. It’s not surprising that women have these concerns, as they continue to provide more care for family members of all ages, earn less than men even when working full-time and year-round and live longer on average. Among women and men ages 50 and older, women report 77 cents in wealth ($165,691) for every dollar of wealth reported by men ($213,948). That’s one of many reasons why it’s so important for women to plan for their lifetime financial security, and for policymakers and employers to support their efforts.

Step 1: Increase women’s access to retirement plans

More than four in 10 working women have no access to an employer-based retirement plan. Some 37% work for an organization that doesn’t offer retirement plans to any employees and 7% work for organizations that offer retirement plans the women are not eligible for. Women may be ineligible because they work part-time or because they haven’t worked long enough at the organization, often as a result of family caregiving responsibilities, and this is despite typically shorter vesting periods in defined contribution plans than under traditional defined benefit plans.

It doesn’t have to be this way. Options for saving plans, such as 401(k)s and IRAs, exist even for those who are self-employed or running small businesses. Policymakers could also provide access through alternative plans, like federal or state-sponsored savings programs that automatically enroll individuals not covered by an employer-sponsored retirement plan or a state-facilitated retirement plan. Employers and policymakers should aim to increase the share of workers who are eligible for a retirement plan by expanding plan coverage and broadening eligibility.

Step 2: Encourage participation among the 15% of women who are eligible for a retirement account but did not participate in the past year

At least one in seven working women has the option to participate in an employer-based retirement plan but is not enrolled. Employers can encourage participation regularly, including during annual benefit enrollment periods, or by adding automatic enrollment to their plans. They can also offer to match at least some employee contributions to retirement savings to encourage increased participation. Employer-employee cooperation could lead to an increase in the participation rate and improved lifetime economic security for women. Saving even small amounts can help build future security – especially when women start earlier working lives.

Step 3: For the 42% who have a retirement plan… can they save even more?

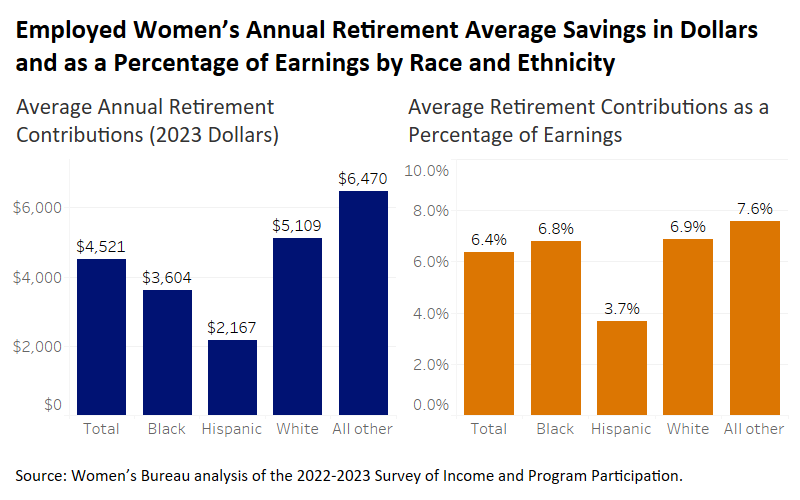

Women who work full-time and year-round are paid less than comparable men, so that they are drawing from a smaller ‘pot’ when they do save for retirement. On average, women who work at least part of a calendar year contribute 6.4% of their earnings to retirement savings, compared to 6.7% for employed men. But because women tend to be paid less, their average contribution amounts only total $4,521, compared to $6,103 for men (this includes their own savings as well as any employer matches).

Hispanic women’s annual contributions are lower (an average of $2,167), due to the fact that they are both paid less on average and contribute only 3.7% of their modest earnings. Black women have a similar rate of contributions as a percentage of earnings to white women (6.8% and 6.9%, respectively), but a $1,500 difference in the amount they contribute ($3,604 and $5,109, respectively), driven by the fact that Black women are paid substantially less on average.

These numbers illustrate the need for women, especially women of color, to ‘catch up’ in terms of saving for retirement. Women’s longer life expectancy can mean more years spent in retirement – yet another reason it’s critical to start saving early, especially for women who have lower average earnings.

What YOU can do to ensure retirement security

Policymakers have opted to shift responsibility for economic security to the individual employee despite persistent economic insecurity in retirement and inequality in wealth. To compound that, you are likely to have multiple employers over your career who may offer a range of retirement plan options. It is important to learn how the plans work in terms of portability and fees and to keep track of them. Many employers or retirement plan providers may be able to provide specific guidance, but there are tools to help individuals get a handle on planning their financial future. Additionally, numerous proposals exist to improve access, coverage and affordability of retirement saving for all.

Your future financial security depends on planning and saving as much as you can – and there’s no better time to start than today.

Jeff Hayes is a survey statistician at the Women’s Bureau.