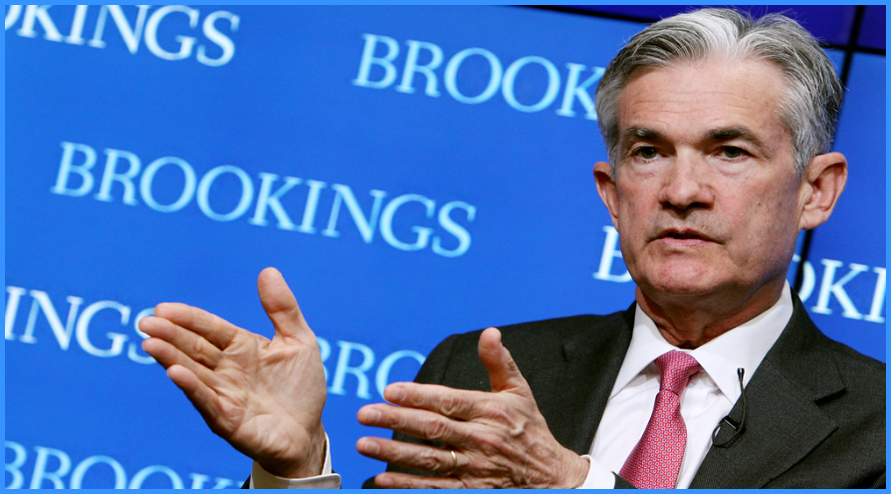

FRANKFURT — In a move without modern precedent, the world’s most powerful financial regulators issued a collective declaration of full solidarity with U.S. Federal Reserve Chair Jerome Powell on Tuesday, January 13, 2026.1 The intervention comes as Powell faces an escalating confrontation with the Trump administration, including a high-stakes Department of Justice (DOJ) investigation that critics label a pretext to dismantle the Fed’s historic independence.2

The joint statement, coordinated by the Bank for International Settlements (BIS) and spearheaded by European Central Bank (ECB) President Christine Lagarde, warns that political interference in monetary policy threatens the bedrock of global economic stability.3

A Defiant Front Against Political Pressure

The solidarity pact was signed by the heads of 10 major national central banks, representing the Eurozone, the United Kingdom, Canada, Australia, Brazil, South Korea, and several others.4 The group’s message was a stark reminder of the “iron laws” of central banking.

- Cornerstone of Stability: The governors asserted that central bank independence is a cornerstone of price, financial, and economic stability and must be preserved with full respect for the rule of law.5

- Personal Integrity: The statement took the rare step of defending Powell’s character, noting he has served with unwavering commitment to the public interest and is held in the highest regard by his international peers.6

- The DOJ Probe: The conflict stems from a DOJ inquiry into the costs of a $2.5 billion renovation of the Fed’s Washington headquarters—an investigation Powell has publicly decried as a politically motivated attempt to seize control of interest rate policy.7

The Economic Stakes: Inflation and Market Volatility

Economists warn that a politicized Fed could have catastrophic consequences for the U.S. dollar and global markets.8 If investors believe interest rates are being set by political whim rather than economic data, trust in the dollar as the world’s reserve currency could erode.

| Risk Factor | Potential Impact of Fed Politicization |

| Inflation | Market loss of confidence in inflation targets could lead to a permanent price spiral. |

| Borrowing Costs | Investors may demand higher yields on U.S. Treasuries to compensate for “political risk.” |

| Dollar Liquidity | Global “swap lines”—the dollar lifelines between central banks—could be weaponized. |

| Market Volatility | Unpredictable rate cuts could lead to asset bubbles and sudden financial shocks. |

Global Repercussions and “Emerging Market” Warnings

The rare nature of this collective action underscores the severity of the threat. Former Fed chairs Alan Greenspan, Ben Bernanke, and Janet Yellen have also joined the chorus of condemnation, warning that such intimidation tactics are more commonly seen in emerging markets with weak institutions.9

While the Bank of Japan and the Reserve Bank of India were notable absentees from the formal signature list, their leadership has separately emphasized the importance of maintaining a separation between monetary policy and government agendas.

The Bottom Line

As the world’s financial elite prepare for the Davos 2026 summit, the standoff between the White House and the Federal Reserve has become the defining tension of the new year. For the world’s central bankers, the defense of Jerome Powell is more than a professional courtesy—it is a defensive maneuver to protect the global financial order from a dangerous downward spiral of political interference.

Fed-Governor-Jerome-Powell-Picture-from-Flickr-by-The-Brookings-Institution