Fortescue Metals Group has secured a landmark ¥14.2 billion (US$1.98 billion) syndicated loan to support its decarbonization initiatives and general corporate activities. The five-year facility, fixed at an annual interest rate of 3.8%, marks the first such financing for an Australian company with unrestricted use of proceeds.

Strategic Shift Toward China

The loan underscores Fortescue’s strategic realignment toward Chinese financial institutions, following its recent withdrawal from green hydrogen projects in Arizona (U.S.) and Queensland (Australia). The announcement closely follows Chairman Andrew Forrest’s visit to China alongside Australian Prime Minister Anthony Albanese, signaling a pivot in Fortescue’s clean energy strategy.

“As the United States steps back from investing in what will be the world’s greatest industry, China and Fortescue are advancing the green technology needed to lead the global green industrial revolution,” said Forrest.

Backing from Major Chinese Lenders

The facility is backed by leading Chinese banks, including the Bank of China and Industrial and Commercial Bank of China (ICBC). Fortescue emphasized that the financing strengthens its long-standing partnerships with Chinese institutions and opens new avenues for collaboration.

“This financing agreement strengthens Fortescue’s long-standing partnerships with Chinese institutions and opens new frontiers for collaboration,” Forrest added.

Funding Decarbonization and Corporate Growth

A Fortescue spokesperson confirmed that the loan will be allocated toward general corporate purposes and the company’s decarbonization agenda, reinforcing its commitment to clean energy development. The deal also highlights China’s expanding role in financing global energy transitions, particularly as Western investment in green technologies shows signs of retreat.

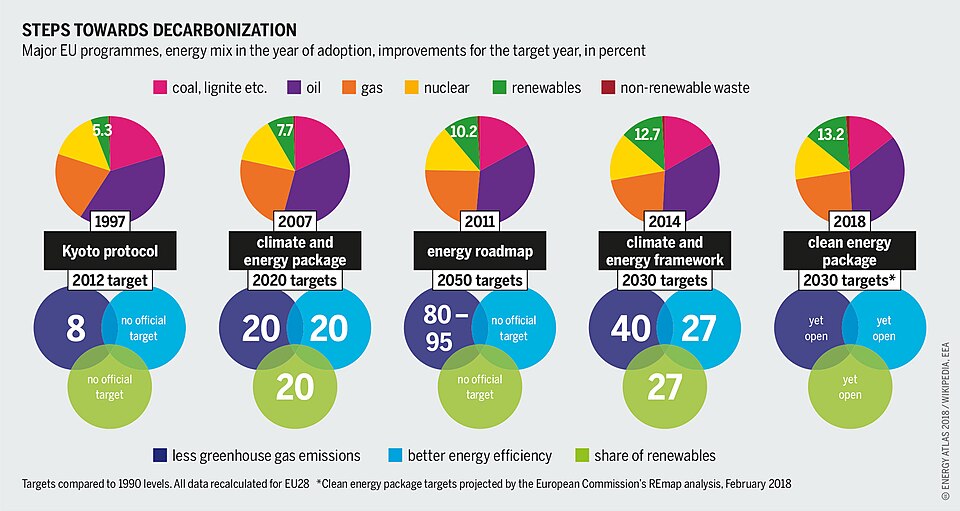

Steps towards decarbonization by Bartz/Stockmar