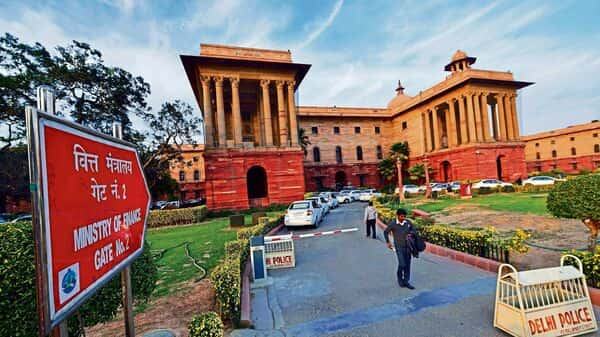

NEW DELHI : To review the progress of emergency credit line guarantee scheme to help businesses affected by COVID-19, the finance ministry is likely to meet the heads of public sector banks and top four private lenders on Wednesday.

The meeting will be chaired by Financial Services Secretary Vivek Joshi. The heads of HDFC Bank, ICICI Bank, Axis Bank and Kotak Mahindra Bank are also expected to attend the meeting, news agency PTI reported.

Extension of emergency credit line guarantee scheme (ECLGS) and Loan Guarantee Scheme for COVID-Affected Sectors (LGSCAS) beyond March 31 will be on agenda. The meeting will review progress ECLGS for Ministry of Micro, Small and Medium Enterprises (MSMEs) and also discuss on the challenges related to these.

The Union Budget 2022-23 announced the extension validity of the scheme up to March 2023 and an increase in the limit of guaranteed cover of ECLGS by ₹50,000 crore to a total cover of ₹5 lakh crore, with the additional amount being earmarked exclusively for the enterprises in hospitality and related sectors.

Finance Minister Nirmala Sitharaman in the latest Budget said, “Last year, I proposed revamping scheme will take effect from 1st April 2023 through the infusion of ₹9,000 cr in the corpus. This will enable additional collateral-free guaranteed credit of ₹2 lakh crore. Further, the cost of the credit will be reduced by about 1%.”

The ECLGS was announced as part of the Atmanirbhar Bharat Package in May 2020 with the objective to help businesses including MSMEs to meet there to help businesses including MSMEs to meet their operational liabilities and resume business in view of the distress caused by the COVID-19 crisis, suffered by them due to non-repayment of the funding by borrowers.

The overall ceiling initially announced for ECLGS was ₹3 lakh crore which was subsequently enhanced to ₹4.5 lakh crore.

The ECLGS has helped save at least 14.6 lakh MSMEs which benefited from ₹2.2 trillion in additional credit. This additional credit flow has saved around 12% of the outstanding MSMEs credit from slipping into NPAs, the report said.

Download The Mint News App to get Daily Market Updates.