Paris, 2 October 2025 — French utility EDF has successfully raised €1.25 billion (US$1.35 billion) through a green hybrid bond, with proceeds earmarked for extending the operating life of its domestic nuclear reactors. The issue, structured to comply with EU taxonomy rules, underscores France’s reliance on nuclear power as a cornerstone of its energy transition strategy.

Financing the Energy Transition

The perpetual subordinated notes were priced at a 4.375% coupon until 2031, with a first call date in 5.5 years. Settlement is scheduled for 6 October on Euronext Paris. Credit agencies are expected to assign provisional ratings of B+ (S&P), Ba1 (Moody’s), and BBB- (Fitch), with 50% equity content treatment.

EDF said the funds will be directed through its Green Financing Framework to projects extending the lifespan of France’s nuclear fleet, which generates around 70% of the country’s electricity. Nuclear power in France has a carbon intensity of just 4 gCO₂/kWh, making it one of the lowest-emission energy sources globally.

Strategic and Policy Implications

EDF framed the issuance as both a financial and strategic step. Claude Laruelle, Group Senior Executive Vice President for performance, investment, and finance, said the deal “demonstrates the confidence of the market in EDF’s strategy to promote energy sovereignty and energy transition.”

The move aligns with France’s national energy policy, which prioritises nuclear life extensions to ensure supply security and meet EU decarbonisation goals.

Hybrid Bond Market Dynamics

EDF has been one of Europe’s most active issuers of hybrid debt, which blends equity and bond features. Such instruments allow utilities to raise large sums while maintaining credit flexibility. For investors, hybrids offer higher yields in exchange for subordinated risk.

The issuance comes amid strong demand for green finance, with hybrid green bonds increasingly used by European utilities to balance energy security with capital-intensive transition investments.

Nuclear in the Green Debate

EDF’s decision to classify nuclear life extensions as “green” reflects the EU’s taxonomy, which recognises nuclear as sustainable under strict criteria. The move, however, continues to divide ESG investors. Critics argue it risks diverting capital from renewables, while supporters highlight nuclear’s role in providing stable, low-carbon baseload power.

Global Significance

The transaction not only secures EDF’s financing needs but also sets a template for other utilities navigating the dual imperatives of energy security and decarbonisation. As debates over nuclear’s place in sustainable finance intensify, EDF’s bond illustrates how capital markets are adapting to Europe’s evolving energy landscape.

Sources: ESG News, GlobeNewswire, EDF Press Release.

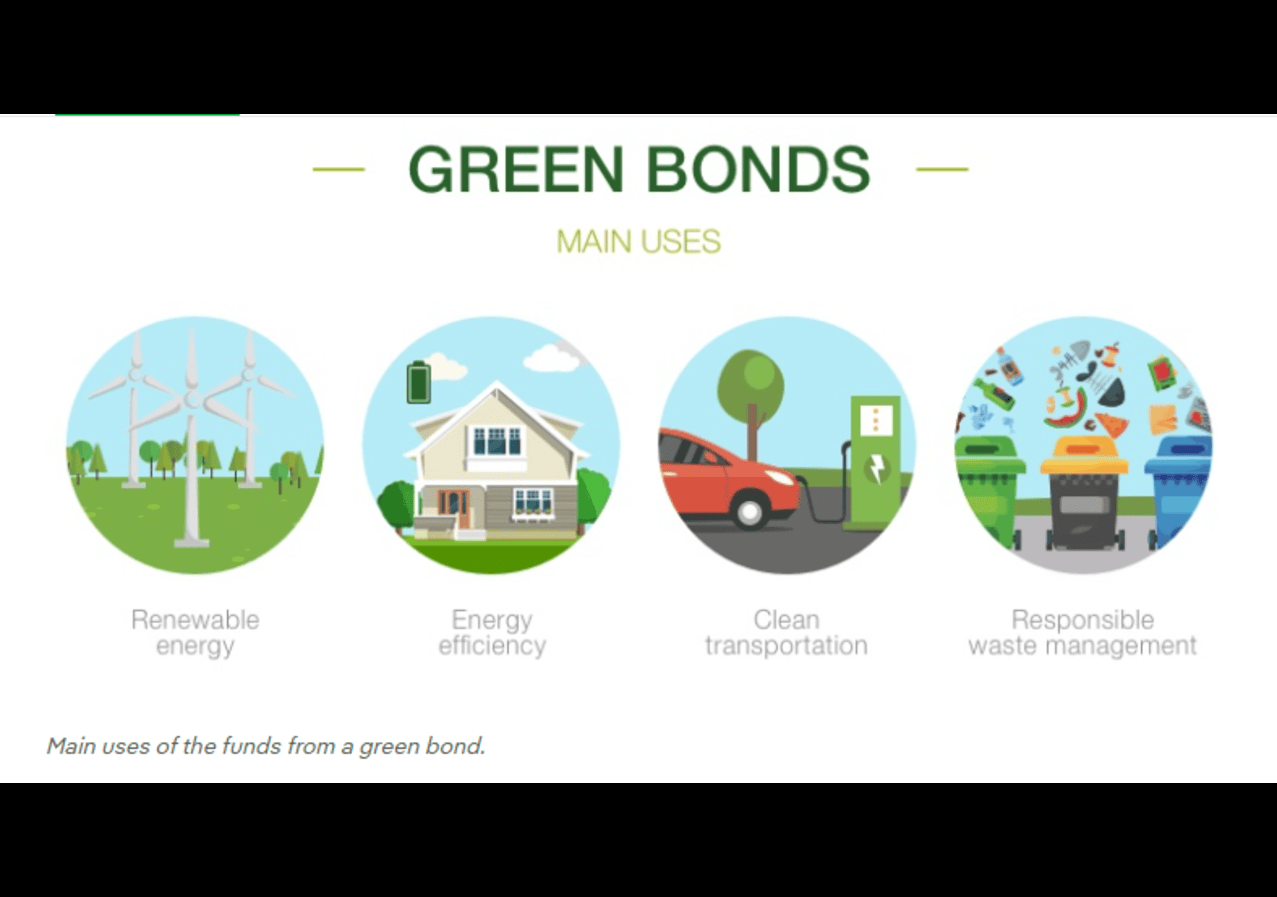

Green-bonds-usage-Image-by-Iberdrola