Canada is set to launch its third green bond this week, marking a significant milestone in the country’s ongoing efforts to fund sustainable projects and meet its ambitious climate goals. The bond issuance follows a highly successful $4 billion green bond launched in February 2024, which saw an additional $2 billion reopening in October. Investor demand for these bonds has been remarkable, with final order books surpassing $11 billion, demonstrating strong market interest in green investments backed by Canada’s AAA credit rating.

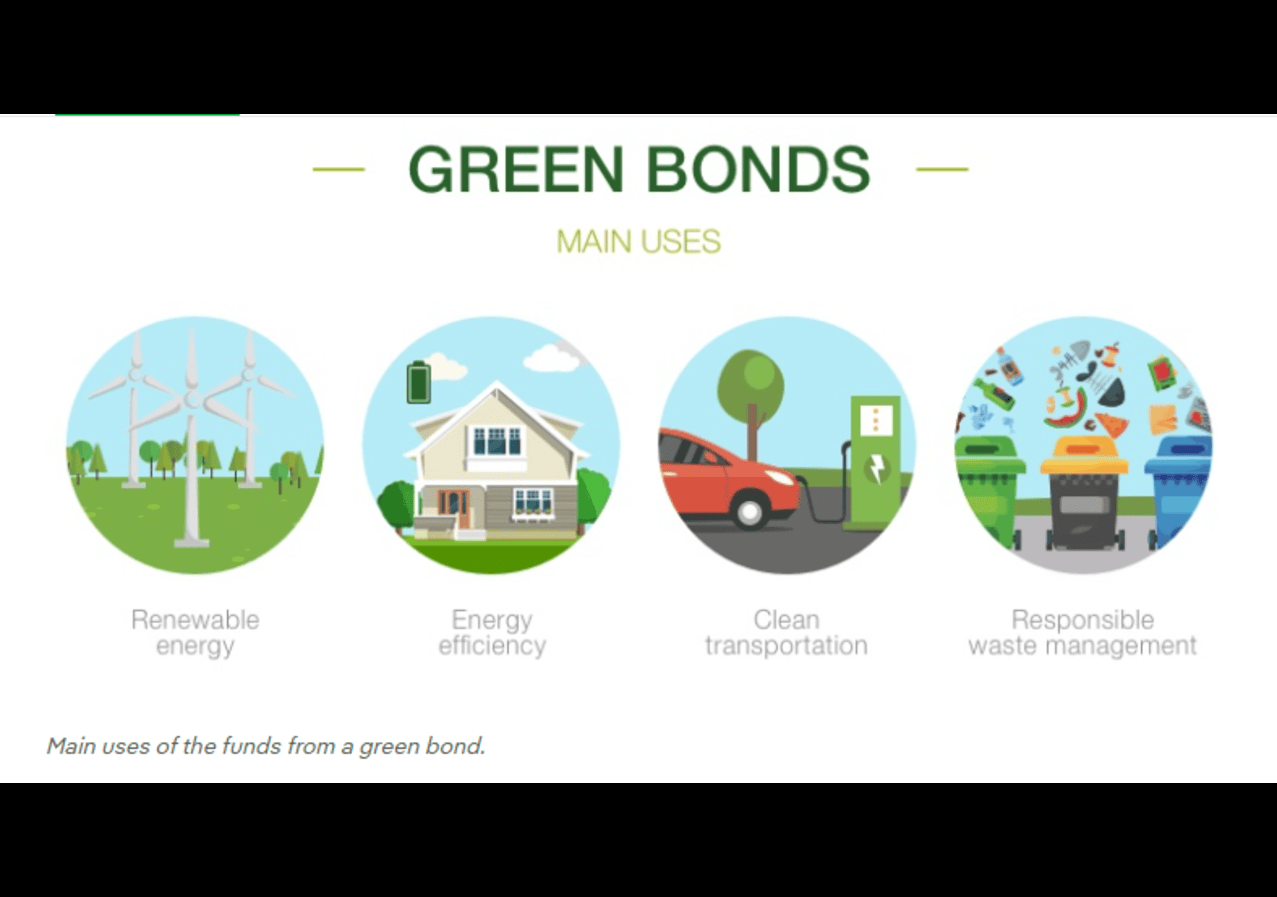

This green bond is part of Canada’s broader strategy to reduce emissions and transition to net-zero by 2050. The proceeds from the bond will be allocated to clean energy projects, infrastructure development, and nature conservation—all critical to achieving Canada’s 2030 emissions reduction targets. By tapping into private financing, Canada aims to bolster its sustainable finance market and contribute to global climate goals.

A First in Sovereign Green Bonds

Canada continues to lead in sustainable finance by becoming the first sovereign issuer to include nuclear expenditures in its green bond framework. This inclusion highlights Canada’s commitment to nuclear energy as a key component of its clean energy transition. In November 2023, Canada updated its Green Bond Framework, aligning it with international best practices and earning recognition from ESG research firm Sustainalytics for its credibility in delivering environmental benefits.

Global Impact and Investor Confidence

The green bond program also strengthens Canada’s position in the global market for sustainable finance, joining the ranks of countries like France, Germany, Sweden, Spain, Italy, and the UK, all of which have issued sovereign green bonds. With Canada’s bond market showing robust demand, the program offers investors an opportunity to participate in projects that are not only financially attractive but also contribute to global efforts against climate change.

What’s Next for Canada’s Green Bond Strategy

This upcoming green bond will be the second and final issuance planned for the 2024-25 fiscal year. As Canada accelerates its green finance initiatives, it continues to create new investment opportunities for those eager to support the transition to a low-carbon economy. With a proven track record of investor demand and a strategic focus on clean growth, Canada’s green bond program is positioning itself as a key tool in building a sustainable, low-emission future.

For more information on Canada’s green bond program and upcoming opportunities, keep an eye on developments as the government moves closer to its net-zero emission target by 2050.