My book “Delay, Deny, Defend: Why Insurance Companies Don’t Pay Claims and What You Can Do About It” was thrust into the spotlight recently, after UnitedHealthcare CEO Brian Thompson was shot and killed in what authorities say was a targeted attack outside the company’s annual investors conference. Investigators at the scene found bullet casings inscribed with the words “delay,” “deny” and “depose.”

The unsettling echo of the book’s title struck me and many others.

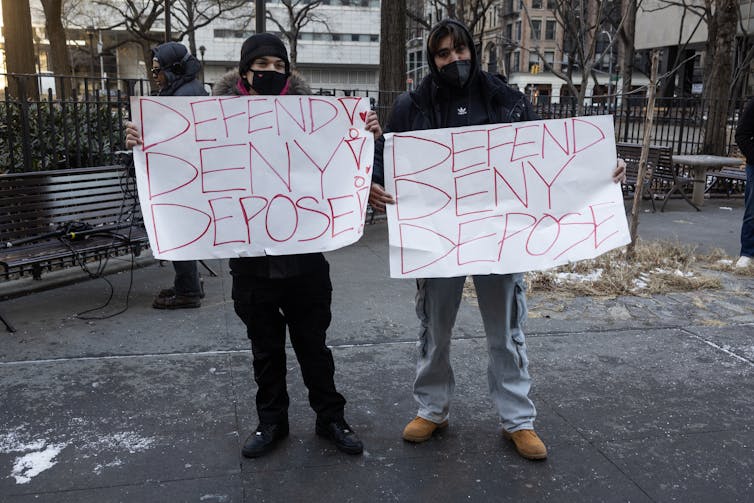

That killing – and the torrent of online outrage that followed – put Americans’ unhappiness with health insurers at the front of the national conversation. Many people responded not by mourning Thompson, but by blaming UnitedHealthcare and other insurers for failing to pay for essential medical treatments. Gleeful online trolls even celebrated the alleged killer as a heroic vigilante.

Speaking as an insurance scholar, I think few should be surprised by this ghoulish reaction. The killing revealed many Americans’ resentment and even rage about insurance companies. And while the focus has been on health insurance, these frustrations extend across the broader insurance landscape. Homeowners insurance, for example, is becoming harder to get in many states even as coverage is shrinking, and auto insurance rates are skyrocketing. These trends are fueling widespread discontent with insurers of all kinds.

Why policyholders feel betrayed

As many recent stories of health insurance denials in the news show, policyholders are most outraged when insurers fail to keep their promises to pay claims promptly and fairly.

And as I read people’s stories about their own experiences, I kept hearing echoes from my book. Too often, people say, insurance companies delay paying some claims, deny other valid claims altogether, and force policyholders to defend themselves in court – all to increase profits by cutting claim costs.

But problems often begin long before anyone files a claim. Insurance consumers generally don’t know much about what they are buying. For homeowners, auto and many other types of insurance, companies seldom provide copies of policy language or accessible summaries of policy terms to prospective policyholders.

GraphicaArtis/Hulton Archive via Getty Images

Even when consumers have access to policies, many don’t read or can’t understand the long, complex legal documents. Similarly, they can’t anticipate the many ways a loss could occur or the problems that could result if it does. As a result, they are only aware of a few key terms and otherwise believe that they will be “in good hands” with a “good neighbor,” to quote two of the iconic phrases of insurance advertising.

Then, when consumers need coverage, they discover that there are significant protection gaps. Health insurance can involve a tangle of limitations due to provider networks, medical necessity rules and preauthorization requirements. Homeowners reasonably expect that they will be fully covered for all major losses, but insurers have cut back coverage to account for rising costs due to inflation and climate change.

As a result, when disaster strikes, too many Americans feel like they haven’t gotten the security they already paid for.

An insurance industry Americans can trust

Rebuilding trust in insurance won’t be easy, but it’s essential. Insurance is the great protector of financial security for the American middle class, but only when it works. As the recent reaction demonstrates, it needs to work better. The insurance industry won’t change by itself; the financial pressures on insurers from increasing losses and fierce market competition are too great.

In order for insurance to serve its goals, lawmakers and regulators will need to take action. Based on my research, I see three big areas for improvement.

Andrew Lichtenstein/Corbis via Getty Images

First, the government can help make the market for insurance work better. Markets need information, and better information produces better results. Regulators should require that key information about coverage be available in an accessible format for all types of insurance.

Consumers also need information on the quality of companies offering policies, and whether a company pays claims promptly and fairly is a key measure of quality. Consumers don’t have access to much reliable information on that now, so disclosure should be mandated there as well.

Second, states would be wise to consider minimum coverage standards, especially for homeowners insurance, as insurers have been cutting back on coverage recently to reduce costs. New York addressed a similar problem in 1943, legislatively adopting a Standard Fire Policy, since copied in many states.

Some 70 years later, the Affordable Care Act did something similar by requiring that insurers cover 10 “Essential Health Benefits.” In both cases, lawmakers set minimum standards that every company must meet. States again need to consider whether insurance coverage is too important to be left purely to the vagaries of the market.

Third, policyholders need effective remedies when insurance companies are found to have acted unreasonably. Many insurance claims result in good-faith disputes about how much the insurance company should pay — for example, whether roof damage was caused by hail, which is usually covered by insurance, or just wear and tear, which isn’t. But other times, insurance companies deny claims after inadequate investigations or for spurious reasons.

For example, a 2023 Washington Post investigation concluded that in the wake of Hurricane Ian, some Florida insurance companies aggressively sought to limit payouts by altering the work of their adjusters who inspected damaged homes. Some policyholders and their families had their Hurricane Ian claims reduced by 45% to 97%. The American Policyholder Association, a nonprofit insurance industry watchdog group, claimed to find “compelling evidence of what appears to be multiple instances of systematic criminal fraud perpetrated to cheat policyholders out of fair insurance claims.”

Thomas Simonetti/Washington Post via Getty Images

When people find themselves in this sort of situation, they have to spend lots of time and effort fighting to get what they were owed in the first place. Even when an insurance company eventually relents, it still hasn’t fulfilled its original promise to the policyholder to settle claims promptly and fairly. In these cases, requiring additional compensation to policyholders and insurer disincentives for unreasonable conduct would level the playing field.

The deep resentment many Americans feel toward insurance companies became apparent after the killing of Brian Thompson. Reforms such as these would be a meaningful response to that resentment.