Italian utility company A2A has successfully issued the first-ever green bond in compliance with the European Green Bond Standard (EuGBS), a framework introduced in December 2023. The €500 million bond, with a 10-year maturity, is aligned with the European Union’s Taxonomy, which defines sustainable economic activities.

This issuance marks a significant milestone for both A2A and the green bond market, with the proceeds directed exclusively towards environmentally sustainable projects. Rated AA2A by Moody’s and BBB by Standard & Poor’s, the bond saw remarkable investor interest, being oversubscribed by more than four times. The order book for the bond exceeded €3.7 billion, a sign of strong market demand.

Johann Ple, Senior Portfolio Manager at AXA Investment Managers, commented on the issuance, noting that the strong demand and the bond’s pricing—set at ms+125 basis points, below the initial guidance of ms+165—bodes well for the future of the EU Green Bond Standard. He also pointed out that while most corporate green bonds have seen robust demand this year, the disappearance of new issue premiums may affect future pricing.

EU Green Bond Standard Sets New Benchmark for Sustainability

The introduction of the EuGBS marks a major shift in Europe’s green bond market. Until now, issuers have adhered to voluntary frameworks such as the Green Bond Principles or the Climate Bonds Initiative. With the establishment of its own standard, the EU aims to strengthen its position as a global leader in sustainable finance.

In line with its ambition, the European Commission has set a target to issue €250 billion in green bonds by 2026, further solidifying the EU’s commitment to funding the transition to a low-carbon economy. The strong demand for A2A’s green bond reflects growing investor confidence in the EU Green Bond Standard and its potential to drive future issuance.

Conclusion

A2A’s successful green bond issuance represents a key development in the ongoing evolution of sustainable finance in Europe. With the EU’s new green bond standard gaining traction, the issuance underscores investor appetite for sustainable investments and sets a precedent for future corporate issuances. As more issuers look to align with the EU Taxonomy, the green bond market is poised to expand further, contributing to the EU’s climate goals and sustainable finance targets.

References:

- https://netzeroinvestor.net | A2A. “A2A Green Bond Issuance.”

- European Commission. “Green Bond Standards and EU Taxonomy.”

- AXA Investment Managers, Market Commentary.

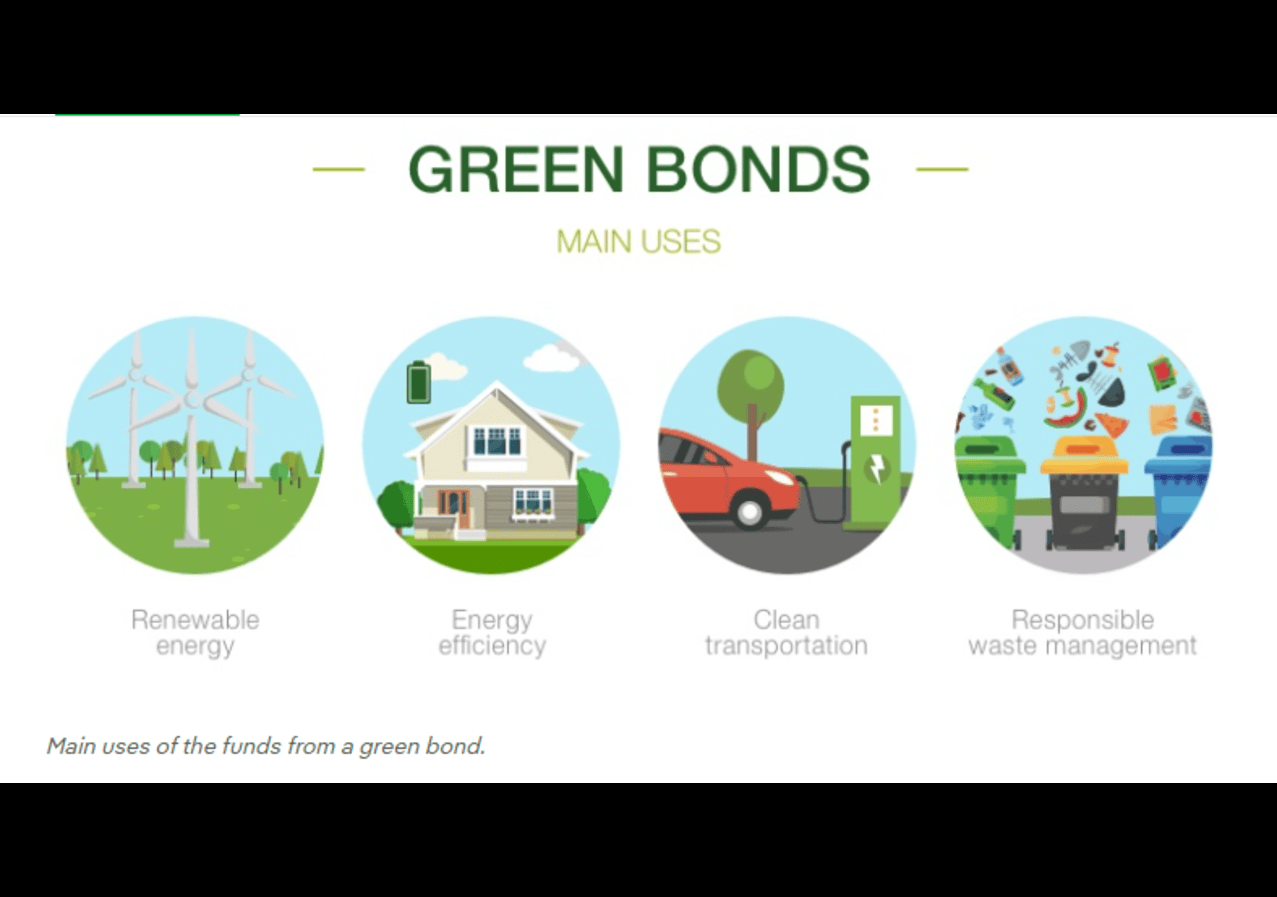

Green bonds usecase: Image from Iberdrola