Reading Time: 7 minutes

Firstly, what is the CSRD?

The Non-Financial Reporting Directive (NFRD), which is currently in effect and affects roughly 12,000 organisations in the EU region, will be improved and replaced by the Corporate Sustainability Reporting Directive (also known as CSRD).

The new CSRD covers a much broader range of businesses – 50,000 more than under the NFRD – across all industries. Companies will be required to publicly disclose transparent and in-depth information about how sustainability issues are handled:

- The impacts on their own company (risks and opportunities – outside-in perspective).

- What effects they have on both the environment and people (inside-out perspective).

The abovementioned points are also known as “double materiality” under the CSRD. The double materiality is further covered by the European Sustainability Reporting Standards (ESRS), which are binding under the CSRD.

Your company may be coming under the scope of the CSRD if you meet the following conditions:

- Undertakings already subject to the NFRD, including EU subsidiaries of non-EU entities with more than 500 employees and either a balance sheet of more than EUR 17 million or a net turnover of more than EUR 34 million will need to start reporting in 2025 for FY 2024.

- ‘Large’ undertakings´, EU entities currently not subjected to the NFRD or EU subsidiaries of non-EU entities who are exceeding at two of the following criteria: 250 employees on average; a balance sheet total of 20 million euros; a net turnover of 40 million euros will need to start reporting in 2026 for FY 2025.

- Listed companies on an EU regulated market, including SMEs (Small and Medium sized Enterprises), but excluding micro-enterprises will start reporting in 2029 for FY 2028, but could start voluntary reporting from 2026.

- Small European credit institutions and insurance companies will start reporting in 2027 for FY 2026.

- Non-EU parent companies having a strong presence in the EU through branches or subsidiaries will need to start reporting in 2029 for FY 2028.

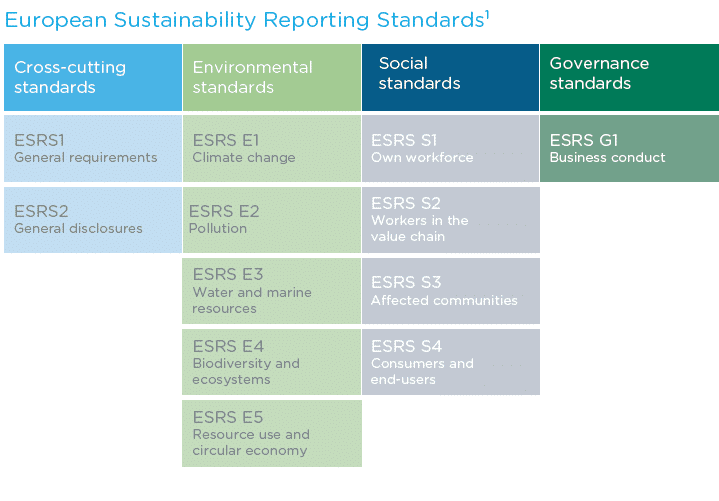

The European Sustainability Reporting Standards (ESRS), which comprehensively cover ESG (Environmental, Social, and Governance) sustainability topics, double materiality and require that the reported non-financial information be audited by external third parties. The ESRS will improve the comparability, reliability, and relevance of reported data and help investors and other stakeholders make informed decisions.

In short, the ESRS specifies the non-financial information that business entities will have to disclose under the CSRD.

The European Commission (EC) has commissioned the European Financial Reporting Advisory Group (EFRAG) with the development of ESRS. In November 2022 EFRAG has submitted draft ESRS to the EC. The EC will consult E.U. bodies and member states on the 12 approved ESRS drafts before final ESRS drafts are adopted as delegated acts by June 30, 2023 (see chart 1).

In the draft ESRS 12 sector agnostic standards (see graph 1).

Graph 1. The ESRS Standards. Source: Rambøll Group A/S

Chart 1. Timeline in which the European Comission shall specify reporting specifications. Source: Deloitte Development LLC

Before gathering data or creating your first report, you should perform a “Materiality Assessment” to help you decide what your sustainability goals, targets, and priorities should be to stay compliant with and get ready for the CSRD.

Based on market research, stakeholder interviews, and surveys, a materiality assessment is a project that identifies and ranks the most important themes for your company.

For instance, a healthcare business might concentrate on supply chain efficiency, innovation, and healthcare access and affordability, while a retail would focus on percentage of products and life cycle stages where health and safety effects are evaluated, reductions in indirect energy consumption or products and packaging reclaimed percentages by product type.

A technology company could concentrate on data security, privacy, and accessibility to STEM education. Depending on the mission, industry, business model, and ESG maturity of your organisation, choose and rank the appropriate sustainability themes.

To know the scope of your research for the materiality assessment or what you need to create your report, you first need to understand what exactly you would need to report on. Article 19a from the EU Directive 2022/2464 (CSRD) describes how a sustainability report should look like, and it is quite straight-forward:

- First, explain the strategy and business model of your business. Everything you think of would fit under the cross-cutting standards of the ESRS. Then, explain how your business holds against sustainability matters, what you do that may impact the environment, what strategies have you developed or are developing to consider the interests of all your stakeholders, and how sustainability benefits you (this is where the concept of double materiality is practised).

- Report what is the carbon reduction target for at least 2030 and 2050, and how do you plan to achieve this.

- Describe how the administrative, managerial, and supervisory bodies have a role in achieving said sustainability targets.

- What are the company policies, procedures, and schemes regarding sustainability?

- Description of your risk assessments in relation to sustainability matters.

- Anything else relevant to the abovementioned points.

If you already have published reports against the Task Force on Climate Related Financial Disclosures (TCFD), then following the general guidelines of your already established TCFD report will give you a good basis on writing a compliant CSRD report. However, there are some additions in the CSRD that are not fully addressed in the TCFD to keep in consideration.

Regarding the ESRS governance standards, TCFD covers all the basic conditions that need to be met, such as disclosing the company’s governance tasks regarding climate-related risks. However, the ESRS goes further to implementing overall corporate sustainability standards, expanding from the climate-only disclosures from the TCFD. Furthermore, the ESRS demands:

- That impacts be considered in addition to Risks & Opportunities,

- Remuneration directly tied to greenhouse gasses (GHG) emissions reductions targets in ESRS E1 direct requirements related to ESRS 2 GOV-3,

- Integration of sustainability-related performance in incentive schemes, and classified under Governance in ESRS rather than Metrics in TCFD,

- List of sustainability matters addressed by the undertaking’s administrative, management and supervisory bodies, section 24 (c) – Statement on sustainability due diligence (Disclosure Requirements GOV-4).

When it comes to making a sustainability strategy the TCFD demands the disclosure of actual and potential impacts of climate-related risks and opportunities on the company’s businesses, strategy, and financial strategies where such information is material which is also demanded by the ESRS as well. The ESRS expands on these disclosures by:

- Demanding that in addition to risks and opportunities, an impact assessment on the environment and society be considered,

- Making more explicit reference to compliance with the 1.5°C global warming limit,

- A more developed understanding of “locked in emissions” and “stranded assets,”

- Effects of climate-related risks on future financial position and business activities separated between physical and transition risks,

- ESRS E1 is more specific about targets and forbids the use of carbon credits and offsets to meet GHG emission reduction targets,

- Future financial effects of climate-related risks covering gross risks instead of net risks (before mitigation and adaptation policies, targets, and actions),

- Ratios of taxonomy alignment, consistency of financial opportunities and resources with data from taxonomy regulation,

- Disclosures about energy efficient real estate assets by energy-efficiency classes, a list of assets subject to acute and long-term physical risks, exposure to fossil fuel activities,

- Provides examples of potential assets/liabilities such as those involving stranded assets or liabilities related to the EU-ETS (European Union Emissions Trading System),

- More details on potential financial effects and opportunities (business activities at risks, market size for low carbon solutions).

On the matters of Risk Management, the TCFD warrants a disclosure for all sectors on how the company identifies, assesses, and manages climate-related risks. All these disclosures are covered in ESRS E1. However, the additions that the ESRS contribute are the following:

- Environmental impacts are considered in addition to opportunities and hazards,

- More detailed application requirements for identifying and evaluating physical and transitional hazards with the use of precise climatic scenarios in accordance with Application Requirements 10 to 13 in Section E1 of ESRS,

- In ESRS 1, the idea of the due diligence process is further developed,

- ESRS has a more developed concept of policies, actions, and resources to address both strategy and risk management procedures.

The metrics and targets disclosures in the TCFD are used when such information is relevant to assess and manage relevant climate-related risks and opportunities. The ESRS expands on the disclosures and demands the following:

- Energy consumption as well as energy intensity per revenue required,

- Additional information on GHG emissions included within Scope 1 emissions under the ETS, as well as Scope 2 emissions in market-based and location-based, calculation requirement on Scope 3. A clear distinction between removals, and carbon credits should be made,

- A definition on reporting boundaries is required (operational control approach required by ESRS E1),

- More information on potential financial impacts and opportunities (stranded assets, assets at physical risk, liabilities under the ETS, at-risk business activities, market size for low-carbon solutions)

- Revenue, CapEx, and OpEx resulting from the EU Taxonomy regulation,

- Specific target on GHG emission reduction and remuneration tied to this target,

- Distinction of the three levels of targets for general climate-related issues, reducing GHG emissions, achieving net zero and other claims of neutrality,

- Scope of the target specified,

- Target values aligned with 2030 and 2050 and preferably set over five-year intervals after 2030,

- Targets set forth by decarbonization levers,

- Use of carbon offsets excluded from GHG emission reduction targets (only included in net zero targets under specific conditions),

- Pathways to net zero presentation.

Despite all the overlaps, the TCFD does not cover much when it comes to calculating GHG emissions. The best way to approach calculations is to consult with the GRI (Global Reporting Institute) standards, more precisely GRI Topic Standard 301.

This topic standard further explains:

- The types of emissions,

- The methodology on how these emissions is being measured,

- Calculations based on site-specific data,

- Calculations based on published emission factors,

- Estimations,

- Reporting recommendations.

If you are familiar with the GRI then it is worth noting that the site-specific data calculations and calculations based on published emissions factors are both demanded in the requirements of ESRS E2 – Pollution Standard.

Once the report has been made and all the required information has been disclosed, it is time to publish your Report. The CSRD mandates that the only permissible reporting format for the sustainability information will be within the management report, in a separated section.

Additionally, the companies are required to prepare their management report in a digital open database in XHTML format in accordance with the ESEF regulations and the EU Sustainable Taxonomy. The format must be recognisable by a human. Then the reported sustainability information must be tagged in accordance with a digital categorisation system specified by the CSRD Regulation or use a compliant ESG software that can auto-tag and format the data.

For the corporate reporting ecosystem to improve the accuracy and reliability of sustainability data, the CSRD will play an essential role. It will offer the data necessary for financial players to fulfil their own transparency requirements under the SFDR and the EU Taxonomy Regulation.

The CSRD will play an essential role for the corporate reporting ecosystem to improve the accuracy and reliability of sustainability data. The CSRD would also offer the data necessary for financial players to fulfil their own transparency requirements under the SFDR and the EU Taxonomy Regulation.

This document serves as a consolidated step by step guide in developing a CSRD report. For further information on how to create a detailed CSRD report please contact our consulting team at ESG PRO via email [email protected] or call us on +44(0)331 630 0728

The post A Guide to EU CSRD Reporting and Compliance appeared first on ESG PRO Ltd..