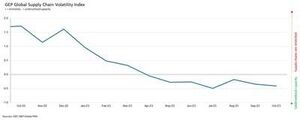

The GEP Global Supply Chain Volatility Index — the indicator tracking demand conditions, shortages, transportation costs, inventories and backlogs based on a monthly survey of 27,000 businesses — decreased again in October to -0.41, from -0.35 in September, indicating a 7th successive month of rising spare capacity across the world’s supply chains.

Additionally, the extent to which supplier capacity went underutilised was even greater than in September and August. Coupled with October’s downturn in demand for raw materials, components and commodities, this shows rising slack in global supply chains.

“While the shrinking of global suppliers’ order books is not worsening, there are no signs of improvement,” explained Jamie Ogilvie-Smals, vice president, consulting, GEP. “The notable increase in supplier capacity in Asia, which was driven by China, provides global manufacturers with greater leverage to drive down prices and inventories in 2024.”

A key finding from October’s report was the strongest rise in excess capacity across Asian supply chains since June 2020. Sustained weakness in demand, coupled with falling pressures on factories in Asia, indicates that the global manufacturing recession has further to run. With the exception of India, which continues to perform strongly, large economies in the region, such as Japan and China, are losing momentum.

Suppliers in Europe continue to report the largest level of spare capacity. In fact, the lower levels in GEP’s supply chain index for the continent have only been seen during the global financial crisis between 2008 and 2009. They highlight sustained weakness in economic conditions across the continent. Western Europe, particularly Germany’s manufacturing industry, is a key driver behind the region’s deterioration.

A relative bright spot is North America, where supply chains have excess capacity, but to a much lesser extent than elsewhere as the US economy continues to display its resilience, in stark contrast to Europe.

October 2023 Key findings

- Demand: Demand for raw materials, components and commodities remains depressed, although the downturn seems to have stabilised. There are still no signs of conditions improving, however, as global purchasing activity fell again in October at a pace similar to what we’ve seen since around mid-year.

- Inventories: With demand falling, our data shows another month of destocking by global businesses, signalling cashflow preservation efforts.

- Material shortages: Reports of item shortages remain at their lowest since January 2020.

- Labour shortages: Shortages of workers are not impacting global manufacturers’ capacity to produce, with reports of backlogs due to inadequate labour supply running at historically typical levels.

- Transportation: Global transportation costs held steady with September’s level, although oil prices have declined in recent weeks.

Regional supply chain volatility

-

North America: The index fell to -0.34, from -0.30. This remains much softer than the global average and continues to suggest the US. economy is poised for a soft landing.

- Europe: The index rose to -0.90, from -1.01, but still remains at a level that is indicative of considerable economic fragility.

- UK: The index edged slightly higher to -0.93, from -0.98. Still, the data point to a substantial rise in excess capacity at suppliers to UK markets.

- Asia: Notably, the index dropped to -0.38, from -0.20, highlighting the biggest rise in spare supplier capacity in Asia since June 2020 as the region’s resilience fades.