What is TCFD, and why is it important for your organisation? What are the TCFD recommendations and how are they used?

Here, we’ll cover everything you need to know about TCFD reporting.

What is TCFD?

TCFD, or the Task Force on Climate-related Financial Disclosures, was created by the Financial Stability Board, an international economic body.

The term “TCFD” is commonly used to refer to the set of recommendations provided by the task force, which is a popular ESG (environmental, social, and governance) disclosure framework focused on climate.

As Mark Carney and Micheal Bloomberg — who both played a large role in the development of TCFD — note in a Guardian article, climate change presents both risks and opportunities for organisations, and financial disclosure is necessary for progress:

“The challenge is that investors currently don’t have the information they need to respond to [climate change] developments … We believe that financial disclosure is essential to a market-based solution to climate change. A properly functioning market will price in the risks associated with climate change and reward firms that mitigate them.”

TCFD was designed to help organisations disclose climate-related risks and opportunities which are set to affect the resilience of their business. These disclosures enable investors, lenders, insurance underwriters, and other organisational stakeholders to make more informed decisions based on forecasted climate-related scenarios.

What are the TCFD recommendations?

The TCFD recommends that organisations make climate-related financial disclosures in four key areas:

- Governance

- Strategy

- Risk management

- Metrics and targets

By disclosing key information within these areas, organisations can communicate how they’re thinking about and assessing climate-related risks and opportunities as part of their resilience and risk assessment processes.

Read the full TCFD recommendations here.

Here’s an overview of these four key disclosure areas:

Governance: Your organisation’s management of climate-related risks and opportunities.

Example recommendation: Describe the board’s oversight of climate-related risks and opportunities.

Strategy: Your approach to both the actual and potential impacts of climate-related risks and opportunities on your business.

Example recommendation: Describe the climate-related risks and opportunities the organisation has identified over the short, medium, and long term.

Risk management: How your organisation identifies, assesses, and manages climate-related risks.

Example recommendation: Describe the organisation’s processes for identifying and assessing climate-related risks.

Metrics and targets: Disclose the metrics and targets used to assess and manage relevant climate-related risks and opportunities where such information is material.

Example recommendation: Disclose Scope 1, Scope 2, and, if appropriate, Scope 3 greenhouse gas (GHG) emissions, and the related risks.

There are both general TCFD recommendations and specific suggestions for individual sectors such as financial services, energy, and transportation.

Read the full TCFD recommendations here.

Who discloses using TCFD?

TCFD is one of the most popular ESG reporting frameworks. In fact, in 2019, nearly 60% of the world’s 100 largest public companies “supported the TCFD, reported in line with the TCFD recommendations, or both.”

Major brands across industries support TCFD, including Accenture, Shiseido, the Virgin Group, Toshiba, 3M, and Tesco.

The framework is so popular that some other ESG groups/frameworks — including the Sustainability Accounting Standards Board (SASB) and Climate Disclosure Standards Board (CDSB) — have incorporated TCFD’s recommendations as part of an effort to develop a “universal” framework using the best elements of previously developed frameworks.

Learn more: We compare some of the most common ESG reporting frameworks and make our recommendation in this guide.

Additionally, the UK government plans to make TCFD reporting mandatory. The UK Financial Conduct Authority (FCA) confirmed that in 2021, premium listed companies in the country will be required to make better disclosures about how climate change affects their business, consistent with TCFD recommendations.

TCFD disclosure examples

TCFD reporting is often combined with other ESG frameworks and is typically published in organisations’ annual sustainability or CSR reports, despite TCFD’s recommendation that “preparers of climate-related financial disclosures provide such disclosures in their mainstream (i.e., public) annual financial filings.”

Here are a few examples of sustainability reports that incorporate TCFD reporting:

Preparing for TCFD: software solutions

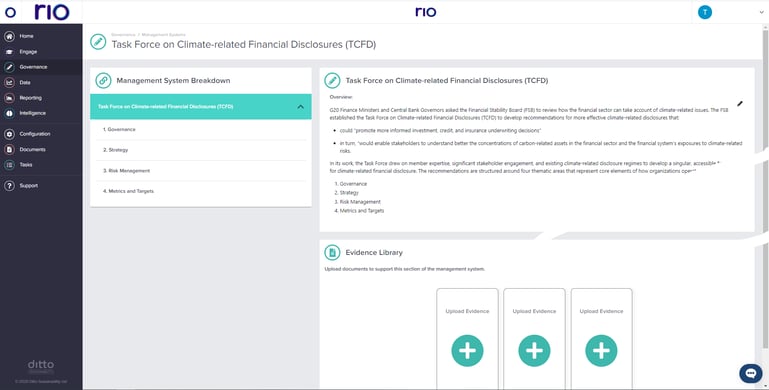

Rio is an example of TCFD governance software

ESG software typically allows organisations to keep track of information for sustainability reporting purposes, such as mandatory GHG emission reporting or governance documents, including policies and staff information. A software which helps organisations to report against common ESG frameworks such as TCFD is essential in accelerating progress against key targets, legislation and trajectories such as Net Zero Carbon.

Dedicated sustainability software like Rio can streamline the process of data collection, analysis and reporting based on TCFD and other popular frameworks.

Here are some features to look for in your TCFD software:

- Can it keep qualitative and quantitative data in one system?

- Can it automatically ingest data from other systems via API?

- Can it generate TCFD reports in a few clicks?

- Can it manage reporting tasks?

- Can it provide intelligent recommendations based on your ESG data?

TCFD alternatives

Though it’s one of the most popular, TCFD isn’t the only ESG reporting framework, and it’s often combined with other frameworks.

Use our in-depth ESG Framework Guide to find the best reporting framework for your organisation and talk to one of our team members to discuss how Rio can assist with your TCFD disclosure needs.