|

Getting your Trinity Audio player ready...

|

- This weekly round-up brings you the latest stories from the world of economics and finance.

- Top economy stories: German economy posts zero growth; India sees strong second-quarter growth; French and Spanish inflation rises again.

1. German economy posts zero growth in second quarter

German gross domestic product (GDP) remained level between the first and second quarters of 2023, according to new data released last week.

Year-on-year, the economy contracted by 0.2% in the second quarter. It follows a technical recession last winter, as quarter-on-quarter growth had fallen by 0.4% in the fourth quarter of last year and 0.1% in the first quarter of this year.

Two consecutive quarters of economic contraction constitute a technical recession.

A Bundesbank report expects GDP to remain largely unchanged in the third quarter of this year, while a forecast from Pantheon Macroeconomics predicts a small contraction.

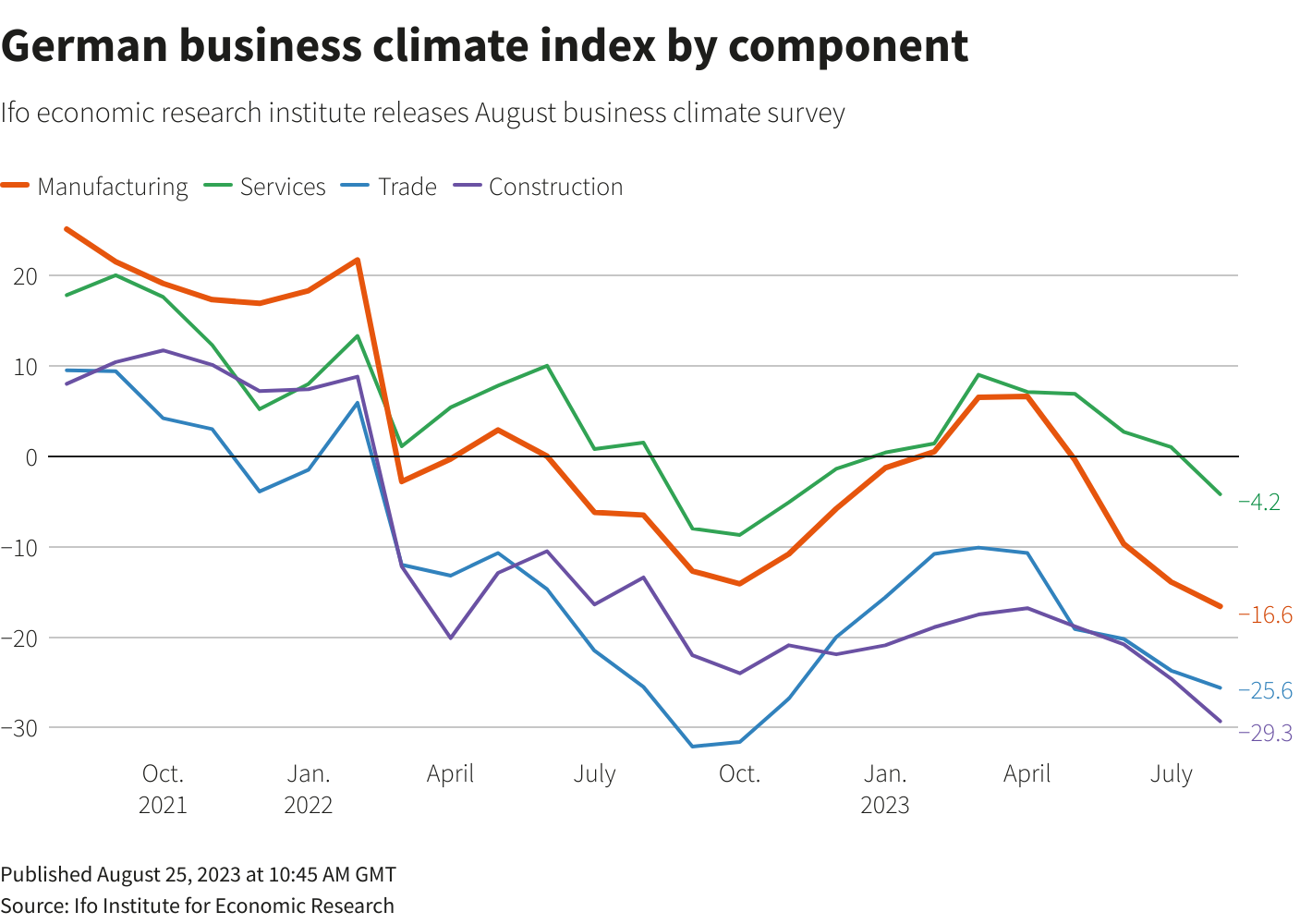

The mood among businesses also fell in August – the fourth month in a row where sentiment has fallen – according to data from the Ifo Institute. “The German economy is not out of the woods yet,” Ifo President Clemens Fuest said.

The government has responded with 32 billion euros ($34.63 billion) in corporate tax cuts over the next four years to boost the country’s economy.

2. Indian economy grows at quickest pace in a year

India’s GDP grew at 7.8% in the quarter running from April to June, according to new data.

It represents the quickest rate of growth for the country in a year, driven by services activity and strong demand.

The country’s chief economic advisor V. Anantha Nageswaran kept the 6.5% growth forecast for 2023. “Growth prospects appear bright, though external factors pose a downside risk,” he said.

Economists have warned about the impact of unusually dry weather following the driest August in India for more than a century. Lower reservoir levels could push up the price of commodities, and some predict the dry weather could constrain consumer spending.

The World Economic Forum’s Platform for Shaping the Future of Trade and Investment informs business and policy action on critical international trade and investment choices, driving inclusive growth and development by working with companies, governments, and civil society.

Contact us for more information on how to get involved.

3. News in brief: Stories on the economy from around the world

US economic growth was slightly slower in the second quarter of 2023 than expected, but still grew at a 2.1% annualized rate.

Argentina will offer benefits for workers and pensioners to counteract the impacts of rising inflation. Nearly 7.5 million pensioners will receive as much as 37,000 pesos (around $106), while there are additional packages for workers.

Australian inflation slowed to a 17-month low in July, boosting expectations that interest rates might not need to rise again. New data showed that the country’s consumer price index fell to 4.9% year-on-year in July. It comes as business investment in Australia hit its highest rate for nearly eight years in the second quarter of 2023.

Spanish inflation has risen, with consumer prices going up by 2.4% in August year-on-year, compared to 2.1% in July.

French inflation also rose in August, with prices rising 5.7% year-on-year.

UK home sales this year are set to hit their lowest mark in a decade, as high mortgage rates put buyers off.

Factory activity in China shrank for a fifth straight month in August, new data has shown.

4. More on finance and the economy on Agenda

What are CEOs thinking about the economy? From artificial intelligence, to M&A intentions, an EY survey gives some clues.

A new report from the United Nations looks at the potential role Africa can play in global supply chains for the green transition. Such moves to boost wages and prosperity across the continent, the report says.

The Multidimensional Poverty Index is an international measure that covers over 100 countries. What do the latest figures tell us about poverty globally, and what we need to do to tackle it?