TDK Ventures Unveils Fund 3, Targeting Next-Gen Startups in Climate, AI, and Advanced Materials

TDK Ventures, the corporate venture arm of TDK Corporation, has launched its third flagship fund—a $150 million vehicle dedicated to early-stage startups working at the intersection of deeptech, sustainability, and digital transformation. With this latest addition, the firm’s total assets under management (AUM) now exceed $500 million, underscoring its growing role as a global impact investor.

Building on its previous investment vehicles—Funds I, II, and EX1—Fund 3 will focus on Seed to Series B startups operating in high-potential sectors such as artificial intelligence, next-gen materials, climate-tech, robotics, and clean mobility.

“With Fund 3, we doubled down on our commitment to uncover and support transformative startups poised to define new markets,” said Nicolas Sauvage, President of TDK Ventures, in a company press release. “We’re not just providing capital—we’re building true operational partnerships that generate equal-win outcomes for founders and TDK Group companies.”

Key Focus Areas of Fund 3

Fund 3 will invest across six strategic domains:

- AI, Compute, and Connectivity: Generative AI, data centers, photonics, edge computing.

- Advanced Materials: Nanofabrication, circular economy materials, and material science breakthroughs.

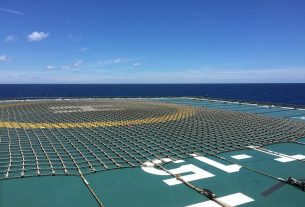

- Climate-Tech: Technologies addressing climate adaptation and decarbonization.

- Robotics & Manufacturing: Innovations spanning space, bio-manufacturing, and autonomous systems.

- Mobility & AgTech: Electric mobility, smart agriculture, and infrastructure for emerging markets.

- Digital Economy: Sustainable and scalable digital infrastructure.

TDK’s Broader Strategic Vision

According to Noboru Saito, CEO of TDK Corporation, Fund 3 aligns with the company’s dual transformation strategy—aimed at both contributing to societal progress and reshaping TDK’s own global operations.

“Fund 3 reflects our confidence in TDK Ventures’ ability to uncover what’s next and empower the innovators who will shape the world for generations to come,” said Saito.

TDK Ventures leverages the global R&D and manufacturing ecosystem of its parent company, offering startups not just capital but also deep technological support and go-to-market advantages. With core competencies in sensor tech, energy systems, and advanced components, the venture unit positions itself as a strategic co-builder, not just a financier.

Investor Confidence and Ecosystem Integration

Fund 3 also strengthens TDK Ventures’ position within the broader global innovation ecosystem. The firm maintains strategic relationships with research institutions, corporate partners, and VC networks. Its Net Promoter Score of 88% in 2025, sustained above 80% for five years, reflects strong founder satisfaction.

For institutional investors and corporate leaders, Fund 3 offers early access to disruptive technologies shaping the future of clean energy, intelligent infrastructure, and sustainable manufacturing.

More information about TDK Ventures and its investment approach can be found at tdk-ventures.com.

Let me know if you’d like this tailored for a particular platform (LinkedIn, Medium, investor deck, etc.) or audience (corporate, startup, policy-focused).