Thousands of Nigerians are reeling after the digital investment platform CBEX reportedly vanished with an estimated $847 million (approximately ₦1.3 trillion) from users’ accounts. The platform, which promised returns as high as 100% per month, locked users out of their accounts and halted withdrawals without prior warning.

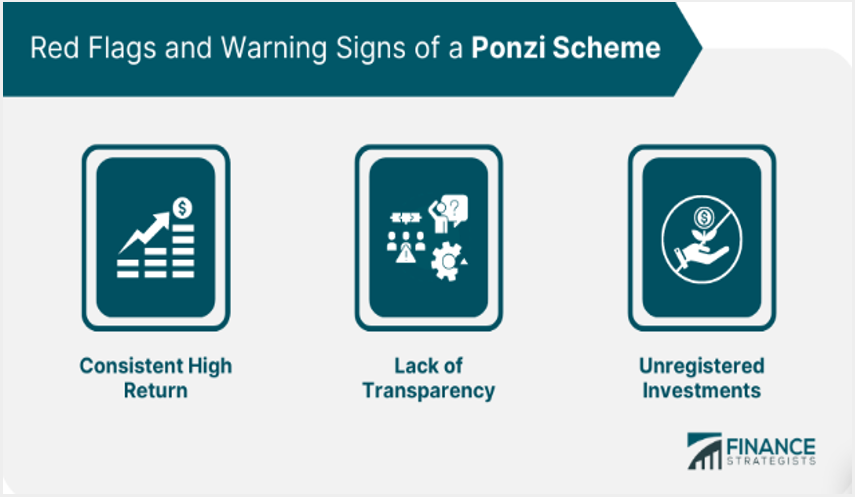

According to cryptocurrency expert Taiwo Owolabi, the total volume of stolen funds in USDT is $847 million and is likely to increase. Owolabi explained that CBEX operated by collecting funds into a TRX wallet, converting them to USDT, then to ETH, and displaying fake balances to users. When users attempted to withdraw, they were paid with another person’s money, a classic Ponzi scheme tactic.

The Securities and Exchange Commission (SEC) of Nigeria has previously warned citizens about the risks associated with unregulated digital platforms and potential Ponzi schemes. Despite these warnings, CBEX operated without legal approval from the SEC, leading to significant financial losses for its users.

This incident brings to mind the 2016 collapse of the MMM scheme, which promised high returns but left millions of Nigerians in financial ruin. The repeated occurrence of such scams highlights the need for stronger regulatory measures to protect investors.

In response to the increasing prevalence of Ponzi schemes, the SEC has proposed the Investments and Securities Bill (ISB) 2024, which includes penalties of up to N20 million or 10 years imprisonment for operators of illegal investment schemes. The bill also aims to enhance investor protection and promote market integrity.

Furthermore, experts argue that there should be safeguards in place for depositors, especially on platforms with a large number of users. Implementing mandatory insurance for investors’ funds could provide a safety net and deter fraudulent activities.

As Nigerians continue to demand accountability from CBEX and regulatory authorities, the need for comprehensive reforms in the digital investment sector becomes increasingly urgent.

References:

- BBC Pidgin report on CBEX platform users

- Nigeria’s Securities and Exchange Commission advisories

- Public records and investor testimonies related to MMM, MBA Forex, and Chinmark collapses

- Public commentary from social media platforms including X and Telegram