As the United States accelerates its push to secure critical minerals and reduce dependency on China, looming tariffs on Canadian minerals threaten to derail these efforts. Canada is the largest source of mineral imports to the U.S., providing essential materials such as uranium, aluminum, nickel, copper, and steel, all of which are critical for national security, defense, and energy production. In 2023 alone, U.S. imports from Canada amounted to $47 billion, far exceeding the $28.3 billion from China.

The High Stakes of Tariffs

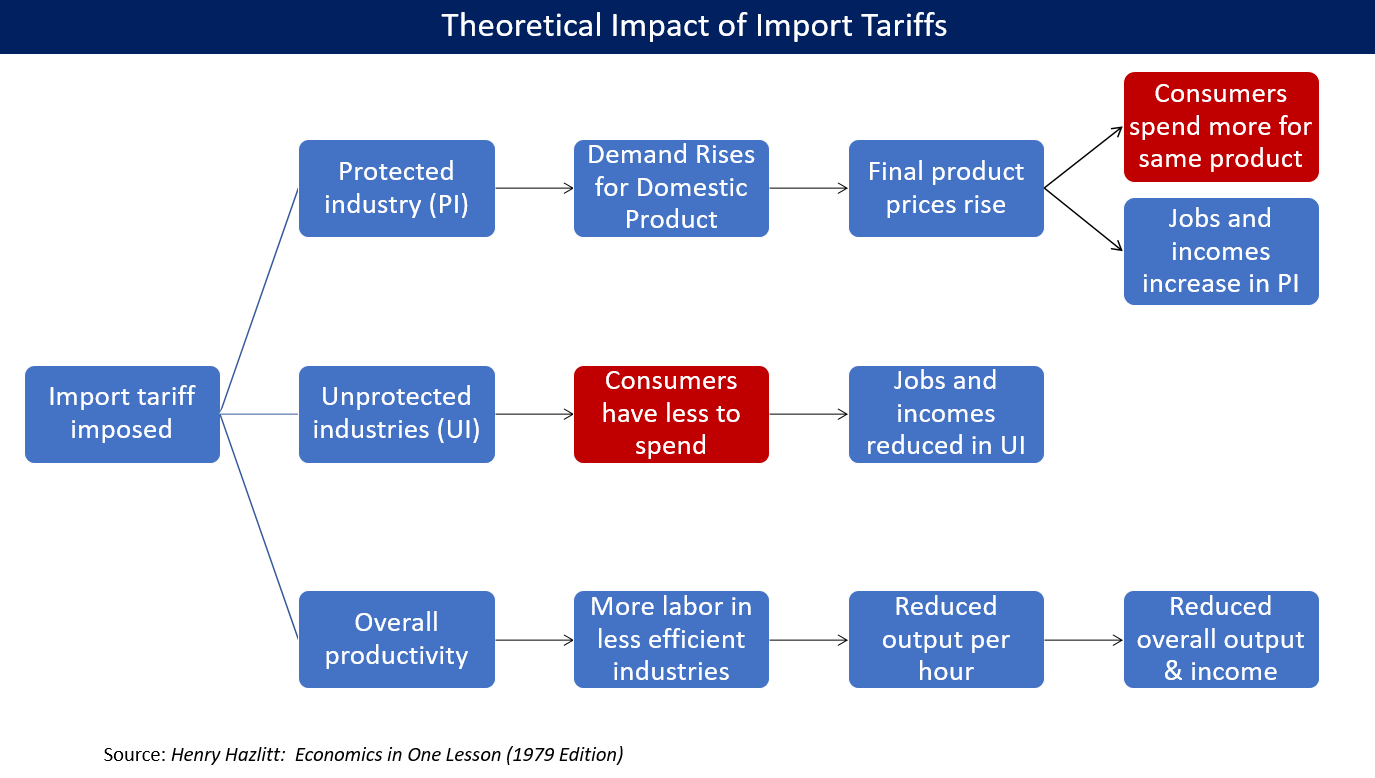

A 25% tariff on Canadian mineral imports would create significant cost increases for U.S. industries. The impact could add $11.75 billion in costs for U.S. consumers and defense contractors, a number that could rise as prices for uranium and base metals rebound. Furthermore, Canada’s likely retaliatory tariffs would also exacerbate the situation, potentially costing U.S. companies another $7.6 billion in added expenses. This economic strain could hinder U.S. defense manufacturing, nuclear energy projects, and heavy manufacturing industries, all of which rely on these minerals.

Critical Minerals at Risk

Uranium

Uranium is a fundamental input for nuclear energy, which is crucial for U.S. power generation and defense. While the U.S. leads the world in nuclear power production, its supply of uranium is vulnerable, as 50% of the global enrichment capacity is controlled by Russia and China. Canada, which holds the world’s largest high-grade uranium deposits, is the largest supplier to the U.S., meeting about 25% of domestic demand. Any tariff increase would exacerbate an already precarious supply situation, especially as the U.S. works to expand its nuclear capabilities.

Nickel

Nickel, essential for military applications and automotive manufacturing, is another mineral with potentially severe tariff consequences. Canada supplies roughly half of the nickel required by U.S. industries, with most of it processed in Canada before being sold back to the U.S. For military-grade uses, nickel is a key ingredient in alloys for armor, missile casings, and aircraft engines. A 25% tariff would add an estimated $260 million to the cost of U.S. nickel imports, potentially driving U.S. firms to source cheaper nickel from Indonesia, which is controlled by Chinese mining conglomerates, thus negating U.S. efforts to reduce reliance on China.

Aluminum

The aluminum industry, vital for defense and manufacturing, is another area at risk. In 2021, the U.S. imported $8.9 billion in aluminum from Canada, with Canadian smelters playing a key role due to their access to affordable hydroelectric power. A 25% tariff would not only increase costs but disrupt the highly integrated U.S.-Canada aluminum supply chain. This could hinder the production of military vehicles, aircraft, and other essential defense technologies that depend on high-quality aluminum.

A Complex and Integrated Supply Chain

The nature of North American mineral supply chains adds another layer of complexity. Minerals mined in the U.S. or Canada often cross the border multiple times during processing and manufacturing. The automotive sector alone sees parts cross borders up to eight times before assembly. Any disruption to this seamless flow—particularly from tariffs—would undermine U.S. industries, potentially leading to job losses and slowed production.

Conclusion

Tariffs on Canadian minerals could undermine U.S. efforts to reduce reliance on China and secure its critical mineral supply chains. Given Canada’s essential role in supplying uranium, nickel, and aluminum, these tariffs would pose a direct threat to U.S. national security, nuclear energy objectives, and defense capabilities. As the U.S. competes with China in areas like defense manufacturing and nuclear energy, it is clear that maintaining strong trade relations with Canada is paramount.

Gracelin Baskaran, Director of the Critical Minerals Security Program at the Center for Strategic and International Studies, highlights the urgency of these issues in a rapidly evolving global landscape.

Source: Gracelin Baskaran, CSIS