In a groundbreaking achievement, Nigeria’s Bank of Industry (BOI) has raised €1.879 billion in 2024, marking the largest capital infusion ever secured by any African development financial institution (DFI). This substantial funding will significantly enhance BOI’s balance sheet, growing it by approximately N3.3 trillion, from N3.9 trillion in 2023 to an impressive N7.1 trillion.

This new capital is set to address the country’s pressing financing needs, particularly the annual funding gap of over $35 billion as outlined in BOI’s strategic plan for 2025-2027. With this increase, BOI aims to boost Nigeria’s developmental initiatives, particularly in critical infrastructure financing, a sector crucial to the country’s long-term economic growth.

Oversubscription and International Confidence

The capital raise was met with overwhelming interest, oversubscribed by 187.9%. This success can be attributed to an innovative dual-layer guarantee structure, which involved risk-sharing support from the Africa Finance Corporation (AFC) and Nigeria’s Central Bank (CBN). This structure helped secure favorable financing terms, with interest rates lower than typical Nigerian debt instruments, offering savings of about 3.6% per annum—equating to approximately N295.7 billion over the three-year term.

The syndication attracted international investors, particularly from the Middle East and Asia, signaling strong global confidence in BOI’s governance and its developmental mandate. This support is also seen as crucial for driving Nigeria’s economic diversification, especially by facilitating access to finance for key sectors such as agriculture, MSMEs, and sustainability-focused initiatives.

Strategic Focus on MSMEs and Infrastructure

A significant portion of the raised capital will be directed to financing Micro, Small, and Medium Enterprises (MSMEs), which play a pivotal role in Nigeria’s economy. BOI’s ongoing commitment to MSMEs is underscored by its participation in President Bola Ahmed Tinubu’s National Credit Guarantee Company (NCGC), which aims to provide more secure loans to the private sector by sharing risks associated with lending to MSMEs. The NCGC, expected to commence operations by mid-2025, represents a collaboration between government, private sector, and multilateral institutions to increase credit access and stimulate business growth.

Additionally, BOI’s strategic push to address Nigeria’s infrastructure challenges will play a central role in reducing operational costs for manufacturers, thereby improving the competitiveness of Nigeria’s real sector.

Supporting Gender Equality and Empowering Women Entrepreneurs

Another critical focus of BOI’s operations is the promotion of gender equality and empowerment of women entrepreneurs. The bank has made significant strides in supporting Women-owned Micro, Small, and Medium Enterprises (WMSMEs) through its dedicated Gender Desk. As of December 2023, BOI had disbursed N99 billion to 833 women-led businesses.

In alignment with Nigeria’s National Financial Inclusion Strategy, BOI has set a goal to allocate at least 15% of its risk assets to WMSMEs. This is part of a broader strategy to close the gender gap in access to finance, a key priority of the Nigerian government’s Renewed Hope Agenda under President Tinubu.

Looking Ahead

With the €1.879 billion capital infusion, BOI is better positioned to meet the ambitious targets set for Nigeria’s economic growth and stability. The funding will support key developmental projects, facilitate access to financing for underserved sectors, and help alleviate financial burdens on Nigeria’s government by leveraging private capital. BOI’s role in enhancing Nigeria’s energy security, increasing industrial production, and driving economic inclusion will be critical in the coming years, with a particular focus on alleviating food inflation and improving access to essential services.

This capital raise not only marks a significant milestone in Nigeria’s development finance journey but also reinforces BOI’s reputation as one of the best-managed government institutions in the country, with solid global recognition for its governance and strategic leadership.

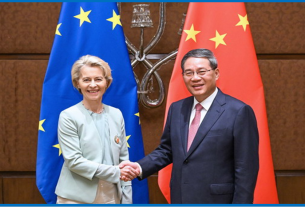

Picture by Bank of Industry on Wikipedia